A massive disruption is heading on the highway to a $ 1.5 trillion global truck market as old and new entrants battle for pole position in a race to dominate zero-emission trucks.

Electric vehicles have come to the attention of investors in the last year, as shares such as Tesla TSLA,

Nikola NKLA,

NIO NIO,

XPeng XPEV,

Li Auto LI,

and WORLD 1211,

he shouted above. And this is for a good reason: electric vehicles will have penetrated 100% of the global car market by 2040, according to UBS UBS,

By 2025, the Swiss bank is waiting for two players – Tesla and Volkswagen VOW,

– have already emerged as the world’s largest sellers of electric vehicles, delivering around 1.2 million cars each, next year.

But vehicle emissions are more than just cars. There are bigger things that move.

Amid changing regulations and technological innovation, both alternatives to electric batteries and hydrogen fuel cells in internal combustion engines are emerging to disrupt the global truck market, estimated by UBS worth $ 1.5 trillion.

Essential reading: Buy these 3 battery stocks to play at the electric vehicle party, but stay away from this company, says UBS

The Swiss bank expects zero-emission or ZEV vehicles to finally move trucks powered by internal combustion engines, with the pace of change accelerating rapidly compared to three years ago as new entrants join.

In a report released on Wednesday with the contribution of 21 analysts, UBS said it expects most of the truck market to be distributed to battery-powered electric vehicles and fuel-cell electric vehicles, which are powered by hydrogen. Renewable natural gas could also play a smaller role in the market, analysts said.

The main driving force is global emissions regulations, but the economy of battery and fuel cell ZEVs is also highly competitive. UBS expects heavy trucks powered by batteries or fuel cells to be more cost-effective than diesel by 2030, including the cost of infrastructure. However, the input supply remains a challenge, with global battery shortages expected by 2025, according to UBS, and the green hydrogen industry is still young.

UBS predicts that 30% of heavy truck sales in North America, Europe and China will come from ZEV by 2030, with ZEV trucks accounting for 40% to 60% of heavy truck sales in these regions.

Read this: Forget about Nio and XPeng. This company and Tesla will be the first two parts of electric vehicles by 2025, says UBS.

If Tesla’s goals are taken at face value, then its semi-electric truck with electric batteries will be a “superior alternative” to internal combustion engines by 2025, UBS said.

In fact, insofar as Tesla can take an advantage in battery innovation, the Swiss bank’s analysts believe that the American company “can have a built-in advantage” over the old manufacturers of heavy trucks that rely on third parties to supply batteries.

Manufacturers of conventional trucks and engines are struggling to maintain control, including through new offerings and partnerships, but UBS expects them to “lose at least a share” of the market. Incumbent producers are facing the “biggest wind” in this changing space, the bank said.

In medium-haul trucks, new entrants such as Rivian, Lion and Chanje are establishing their presence and will be key challengers. These companies are currently private, but could become public through an initial public offering or through a merger with a special purpose procurement company, with an incomplete check.

Addition: Tesla faces race with Volkswagen, as German car giant targets battery costs and new factories

For heavy trucks and engines, expect Tesla, Nikola and Hyliion HYLN,

dominate if they are able to perform in their respective visions, UBS said, although officials like Toyota 7203,

and Hyundai 005380,

they are also expanding globally. Analysts noted that both new battery and fuel cell offerings from new entrants are still under development and may not meet the targets for both weight and range.

In the UBS model, all conventional truck and engine manufacturers are expected to lose market share by 2030: Cummins CMI,

Daimler DAI,

Volvo VOLV.B,

– which owns Mack Trucks – and Traton 8TRA,

which is majority owned by Volkswagen and is expected to complete its acquisition of Navistar NAV,

in the middle of 2021.

In this battle between truck manufacturers, UBS expects infrastructure, batteries and power companies to rise above the level and enjoy the highest tailwind. These stock groups make up their preferred choices. The Swiss bank is pursuing the electricity infrastructure company Quanta Services PWR,

and chemicals and battery packs such as Albemarle ALB,

LG Chem 051910,

and Contemporary Amperex Technology Co. Limited (CATL) 300750,

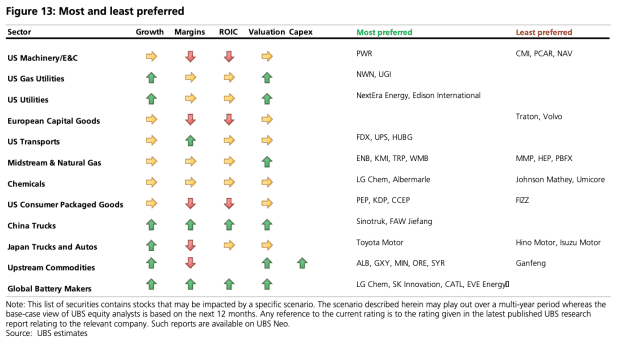

Several of the most preferred and least preferred UBS shares in the report are shown in the chart below: