JMP Securities analyst Joe Osha is now more optimistic about Tesla Inc.’s shares. than ever and its reasons relate to the potential electric vehicle manufacturer in the next few years and not to the inclusion of the stock in the S&P 500 index.

Osha raised its stock price target by 53% to $ 788, the highest price it has ever had at Tesla, at $ 516. Its new target is 21.3% above Monday’s closing price of $ 649.86. Osha has reiterated its market performance rating, which it has held on the stock exchange since October 22, after Tesla reported third-quarter results.

TSLA stock,

returned 0.8% to premarket trading on Tuesday. Monday, the first day as the S&P 500 SPX,

member, the stock fell 6.5% after rising 11.6%, two days before being included in a record on Friday, in trading shares often referred to on Wall Street as “buy the rumor, sell the reality”.

Osha said he based his investment position on Tesla on the idea that he should look “a few years out” by 2025 to have a reasonable idea of what Tesla could become.

“As we tracked the company’s performance over the past six months, our goal of delivering 2.5 million units by 2025 seemed more and more plausible,” Osha wrote in a note to customers. “Now, when we go out of the year and analyze [Tesla’s] competitive position, both market opportunity and [Tesla’s] the potential shipments look bigger than I thought. “

Therefore, it has raised its delivery target in 2025 to 3.05 million vehicles. And this new vision is what determined him to increase his stock price target.

Nowhere in Osha’s note, which was sent to customers on Monday, did he mention the inclusion of the S&P 500.

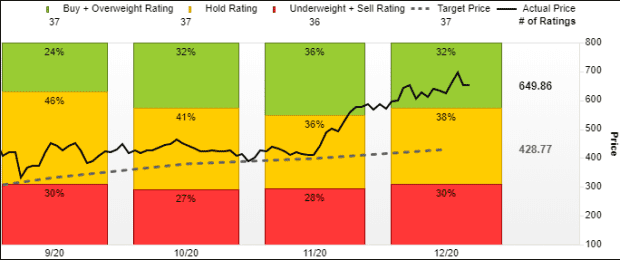

Osha’s opinion makes him a minority on Wall Street. Of the 37 analysts surveyed by FactSet covering Tesla, 32% have the equivalent of a buy rating, 38% have the equivalent of a hold and 30% have a sell rating.

Read also: Tesla’s share price target gets a 28% increase on Wedbush, but not enough to recommend buying.

Its $ 788 price is 83.8% above the average analyst target of $ 428.77, which is 34.0% below Monday’s close.

FactSet

Osha’s more optimistic view of Tesla is not just company-specific. It now projects total electric vehicle battery (BEV) shipments in 2025 to account for 15.7% of global vehicle sales, up from its previous estimate of 14.0%.

He believes that Tesla will capture about 45% of the addressable BEV market in 2025, which is actually lower than its current estimate of 54%.

“Given the pace at which politics is evolving, we could imagine reviewing the number of the BEV industry in the coming years,” Osha wrote.

Tesla shares rose 676.7% this year to Monday, while the S&P 500 gained 14.4%.