“

“It reminded us so much of 1998 – the late 1990s

“

This is Chris Harvey, head of stock strategy at Wells Fargo Securities WFC,

talking to CNBC about how TSLA Tesla,

recent inclusion in the S&P 500 SPX,

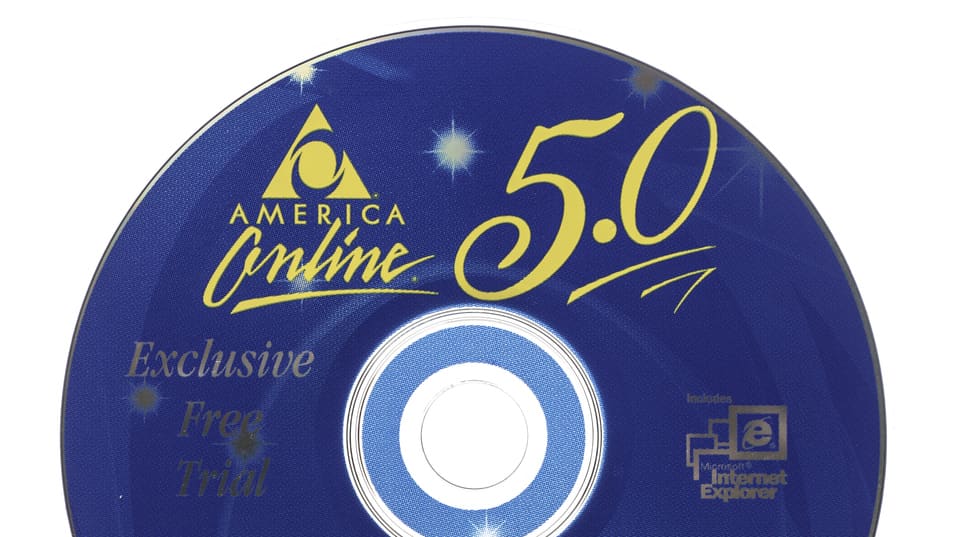

reminds me of the last days of the dot-com balloon. Specifically, Harvey, highlighting Well Fargo’s first 10 predictions for 2021, made a comparison between Elon Musk’s electric car company and AOL, a poster of the internet frenzy decades ago.

“AOL, similar to Tesla, had game-changing technology, incredible performance … it hit the index at the end of December, after an amazing run,” Harvey said. “But it was a fundamental event.”

After its relentless rally in the late 1990s, AOL, like many causalities of the dot-com bubble, failed to keep up with the times, which is a risk for which Tesla, with nearly 700% this year, faces and the following year explained. “After ’99, many technology and growth companies lost between 50% and 100% [of value]Harvey said. “We think in 2020, everything happens much faster. So, if it took 12 months for the end to begin, now it will take six months. “

For Harvey, the best places investors can look for include cyclical names, “COVID-beta.” “The old economy, not the new economy,” he predicted. Here is the CNBC summary of the full list:

For more on Harvey’s thoughts on Tesla and 2021, watch the interview:

Tesla shares were heading lower ahead of Monday’s opening bell, while the future on the Dow Jones Industrial Average YM00,

Technically powerful Nasdaq Composite NQ00,

and S&P 500 ES00,

all indicated a positive start to the week.