It’s another week full of gains, and the stocks seem to be starting well.

Earnings aside, waiting for a new stimulus to warm the US economy has sparked optimism. Treasury Secretary Janet Yellen said President Joe Biden’s $ 1.9 trillion aid plan could generate enough growth to restore full employment by next year.

In other signs of optimism regarding the recovery, the future gross Brent BRN00,

hit $ 60 a barrel on Monday for the first time in more than a year. 10-year US Treasury yield TMUBMUSD10Y,

increased to 1.20%.

GameStop GME powered by Reddit,

The frenzy seems to have cooled, after the short-term retailer’s shares fell 78% last week, after rising 1,737% in the past three weeks.

In ours call of the day, Deutsche Bank DB,

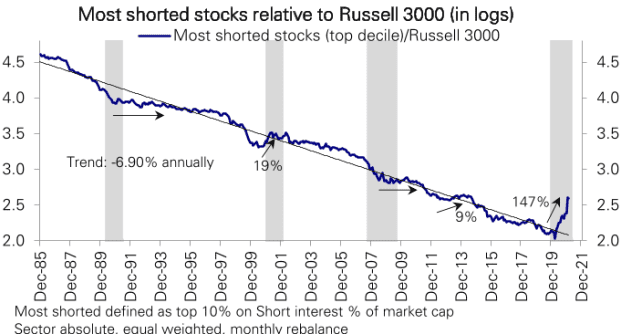

strategists said the shortest stocks actually surpassed in March last year, long before users of the RedSit WallStreetBets forum held their target.

They said that although short-term stocks usually do better during broad market rallies, the size of the current rally was “off-the-chart”.

Since the March market, the shortest shares – defined as the first 10% of short-term interest as a percentage of market capitalization – have increased by 245%, exceeding the Russell 3000 RUA index,

by 147 percentage points.

Compost, Haver, Deutsche Bank Asset Allocation

Led by chief strategist Binky Chadha, they noted that half of that performance came before the November US election and positive vaccine developments.

They said that the superior performance could not be explained by the extended market or “any rally”, nor attributed entirely to the retail buying trend, which accelerated the superior performance in November.

“We see it reflecting the fact that short exposure has remained strongly concentrated in stocks with low profitability and growth, especially in pandemic-affected industries, even though the ongoing economic recovery has improved the outlook for these companies,” they said.

Despite the recovery that has begun, shorts are still largely focused on the pandemic-affected industries, they said, adding that there was skepticism of a strong recovery. “Nine months after the shortest recession in our view, the consensus has persistently delayed the effective improvement of macro data.”

They also said that despite the third consecutive quarter of “huge” record gains for S&P 500 companies, the 2021 consensus has grown only slightly above and is well below its own forecasts.

The markets

US YM00 futures,

ES00,

NQ00,

showed above before opening at the beginning of another week full of gains. European equities also gained early trading gains, despite concerns about the spread of new variants of the coronavirus causing COVID-19. Asian markets were largely larger overnight due to growing optimism about the global economic recovery.

Buzz

Bitcoin BTCUSD price,

rose to $ 44,088, setting a new all-time high after the Tesla TSLA,

said it bought the $ 1.5 billion cryptocurrency in January, could accept the digital asset for payment in the future.

Hyundai Motor Co. 005380,

said on Sunday that it is not in talks with technology giant Apple AAPL,

to develop an autonomous electric car, contrary to several reports.

Twitter social media platform TWTR,

is set to post $ 1 billion in the second quarter when it reports earnings on Tuesday, according to analysts surveyed by FactSet.

The Biden administration is due to announce this week that it will resume with the United Nations Human Rights Council that former President Donald Trump retired almost three years ago, US officials said on Sunday.

Apple Dialog Semiconductor DLG Chip Supplier,

0OLN,

was concluded by the Japanese company Renesas Electronics in a business worth 4.9 billion euros ($ 5.9 billion).

The Tampa Bay Buccaneers dominated the Kansas City Chiefs, while Tom Brady secured his seventh Super Bowl title.

Random reading

Why some scientists believe that all life began on Mars.

The need to know starts early and updates up to the opening bell, but sign up here to deliver it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from Barron’s and MarketWatch.