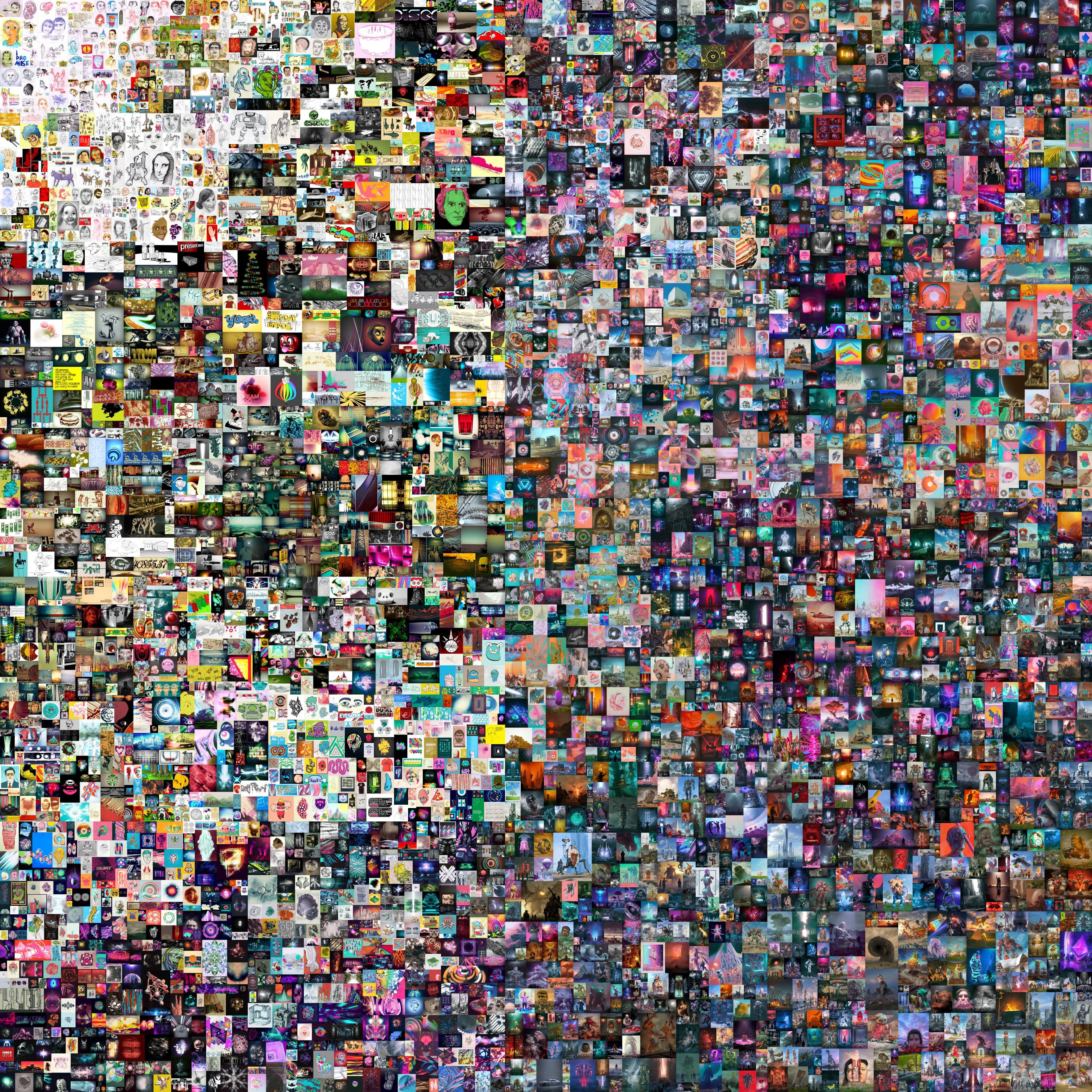

A piece of virtual art entitled “Every day: the first 5,000 days”. Created by digital artist Beeple, it is the first NFT-based work of art to be auctioned at Christie’s.

Christie’s

From art to sports trading books, people spend millions of dollars on digital collectibles.

These crypto collections, known as NFTs, have been exploding in popularity lately. A video created by digital artist Beeple, whose real name is Mike Winkelmann, was spun last week for a record $ 6.6 million. It was originally purchased for about $ 67,000.

Meanwhile, one of thousands of computer-generated avatars called CryptoPunks was recently sold for $ 2 million. And a crypto art version of the 2011 Nyan Cat meme sold for about $ 590,000 in an online auction.

At the same time, critics see the NFT madness as another potential speculative frenzy in crypto, which will surely escape in the end.

So what are NFTs? And why do they suddenly sell for millions? CNBC is going through what you need to know.

What are NFTs?

NFTs or non-fungible chips are a new type of digital asset. The ownership of these assets is recorded on a blockchain – a digital register similar to the networks that underlie bitcoin and other cryptocurrencies.

But unlike most virtual currencies, you would not be able to exchange one NFT for another in the same way you would for dollars or gold bars. Each NFT is unique and acts as a collector’s item that cannot be duplicated, making them rare in design.

You can think of them as a cryptographic alternative to Pokémon or rare baseball cards.

The rise of the internet has meant that anyone can view images, videos and songs online for free. People buy NFTs out of belief that they will be able to prove ownership of a virtual item through the blockchain.

NBA Top Shot, an NFT platform based on the US basketball league, allows users to buy and sell short videos that present the most important moments of the star players. The NBA licenses the roles to Dapper Labs, a start-up that digitizes footage, making a limited amount to create rarity. The NBA Top Shot has so far facilitated sales of over $ 277 million, according to the CryptoSlam website. Dapper Labs earns a discount on every transaction while the NBA receives royalties.

Basketball is not the only sport that enters the crypto. The French start-up Sorare allows users to collect and play officially licensed football cards in fantasy games. According to the NFT NonFungible data tracker, the Sorare market has generated sales worth over $ 21 million so far. Sorare announced last week that it had raised $ 50 million from investors, including Benchmark, Accel and Reddit co-founder Alexis Ohanion.

“It’s an obvious industry case for NFTs,” said Lars Rensing, CEO of the blockchain company Protokol. “Trading books and collections have always been a profitable revenue stream for clubs.”

Meanwhile, art dealers are also taking part in the action, with Christie auction house holding an auction for a virtual piece of art from Beeple. The auction has not yet been completed, but the work has already been auctioned up to $ 3 million.

NFTs are not a new phenomenon. CryptoKitties, one of the first examples, were once so popular that they clogged the digital ether network. To date, CryptoKitties has generated sales of over $ 40 million, according to NonFungible.

Why are they so popular?

The coronavirus pandemic played an important role in the NFT boom. Last year, the total value of NFT transactions quadrupled to $ 250 million, according to a study by NonFungible and BNP Paribas, L’Atelier.

This is not at all small, due to the restrictions on staying at home which have led to people spending much more time on the internet and saving money due to lack of travel. It’s similar to the rise of retailers betting on GameStop on other historically unfriendly stocks promoted on the Reddit WallStreetBets board.

Meanwhile, it comes at a time when bitcoin, ether and other digital currencies have risen in value, with bitcoin briefly exceeding $ 1 trillion in market value last month.

“Right now we live in a part of the world where the majority of the population spends 50% of their time online and a significant amount of their time on a computer,” says Whale Shark, a pseudonymous NFT collector who claims to have amassed a collection. worth more than $ 2.7 million, he told CNBC.

Skepticism

Many investors buy NFTs as a speculative investment in the hope that they will be able to return them at a much higher price than what they initially paid. But a growing number of people also own them in the long run as collectibles.

“Like any cycle of technological hype, we start with speculative activity, and this usually gives way to a more fundamental value,” Nadya Ivanova, L’Atelier’s chief operating officer, told CNBC.

“NFTs started in 2017. Much of it was about speculation. What we saw in 2020 is that the market is maturing.”

NFTs have attracted celebrities such as Mark Cuban, Lindsay Lohan and Gary Vaynerchuk, while major brands are also getting involved. And people find other use cases for NFTs, such as virtual real estate and games.

However, the NFT space has been greeted with skepticism by some artists and investors. Critics view it as another cryptographic way similar to the initial 2017 coin offerings that will eventually become irrelevant. Surprisingly, the companies behind these chips disagree.

“I think 99% of the projects in space today may not exist two or three years later, very similar to the ICO boom,” WhaleShark said.

Many NFTs have prices in the air, the digital symbol of the Ethereum blockchain. The digital asset briefly hit a record high of more than $ 2,000 last month, before plummeting about $ 600 in a matter of days, reminding investors of the wild volatility of cryptocurrencies.