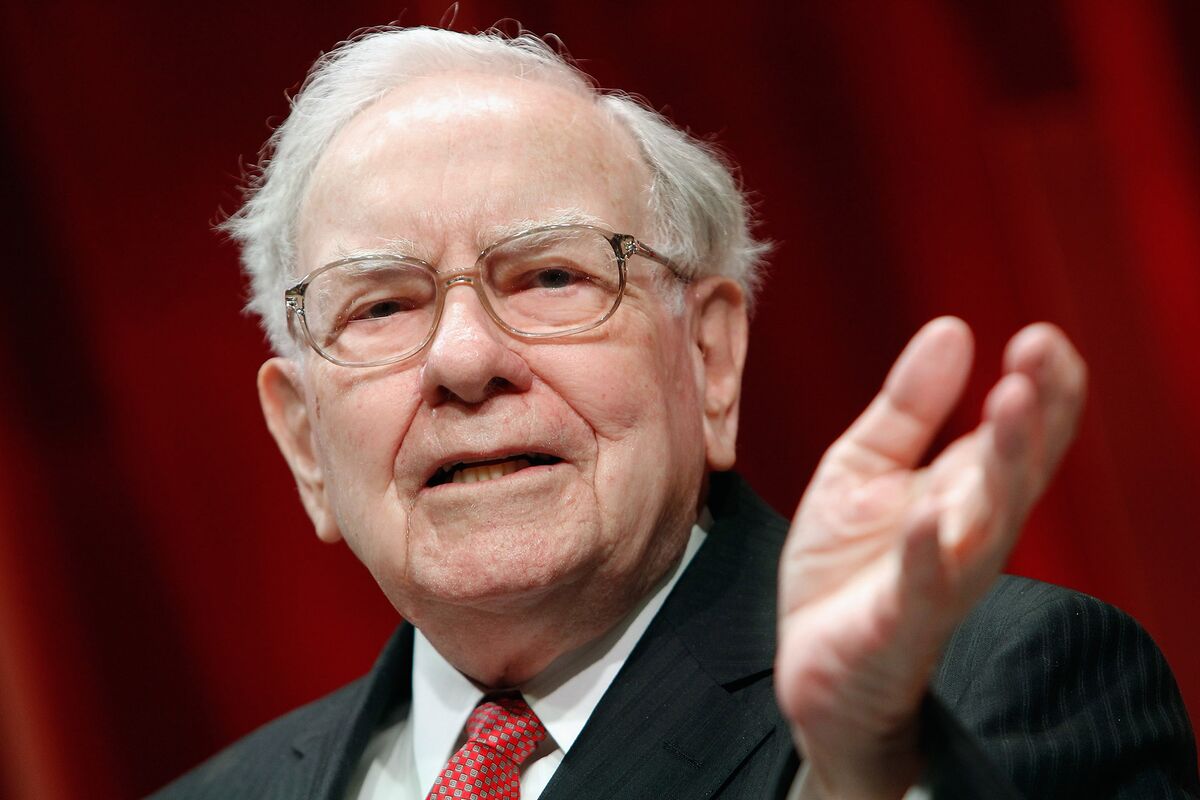

Warren Buffett

Photographer: Paul Morigi / Getty Images

Photographer: Paul Morigi / Getty Images

With U.S. stock indexes hitting record high again this week, one of Warren Buffett’s most famous slogans comes to mind: Investors should “be afraid when others are greedy.”

Any Buffett disciple who checks the market values preferred by the billionaire investor these days may have the desire to scream in fear.

The “Buffett Indicator” is a simple report: the total market capitalization of US stocks divided by the total dollar value of the nation’s gross domestic product. It first surpassed the previous peak of the dot-com era in 2019. However, it has evolved for more than a decade, and if there is one mantra that investors love even more than Buffett’s, “the trend is your friend.” .

However, in recent weeks, not even that long-term trend has been able to justify the foamy appearance of the metric. With us market capitalization more than double the level of GDP estimated for the current quarter, the report rose to the highest reading in its long-term trend, according to a blog review Assessment of the current market, suggesting a “highly overvalued” situation.

Source: CurrentMarketValuation.com

Of course, with federal reserves holding near-zero rates and buying bonds for the foreseeable future and an abundance of savings and fiscal incentives set to trigger a blockbuster growth in GDP and corporate earnings, it is fair to ask whether this is another one. among the many false alarms that have sounded in the last decade.

“It highlights the remarkable rage we are witnessing in the US capital market,” said Michael O’Rourke, chief market strategist at JonesTrading. “Even if these (Fed) policies were expected to be permanent, which they should not be, they would still not justify paying twice as much as the 25-year average for shares.”

This detachment of the Buffett indicator from its long-term trend joins a range of other valuations that have surpassed previous records in the pandemic-induced bear market return last year – if not years earlier. The earnings price, the sales price and the tangible book value are among the values well above the levels of the dot-com era, which many investors have considered peaks once in a lifetime.

Growing valuations are notoriously bad tools for synchronizing market tops. Indeed, all tools are. For now, many investors are confident to bet that the recovery from the pandemic will boost some denominators in such reports, so don’t let the ratings scare them. The S&P 500 gained 1.2% this week to a record high amid a surge in vaccine distribution and progress on a new package of tax incentives. Energy, the best performing sector this year, led the way, adding 4.3%.

Meanwhile, the yield on 10-year Treasuries reached 1.20% on Friday, the highest since the pandemic crash last year. Interest rates are unlikely to approach a level that would undermine the stock market, given that the S&P 500 earnings yield is 3.1%. Speaking to the New York Economic Club this week, Fed Chairman Jerome Powell reiterated that the central bank’s stimulus policies will not be resumed any time soon.

“When you compare it to fixed income markets and their rates, the return on earnings for equities is still positive,” he said. Anu Gaggar, senior global investment analyst for the Commonwealth Financial Network. “And now, with the Fed keeping rates at these low levels, this provides comfort to the market.”