The numbers: The US regained a low of 49,000 jobs in January, and the unemployment rate fell again, but the economy is still struggling to recover after a record rise in coronavirus caused more layoffs late last year .

The weak employment report added fuel to democratic demands for another large dose of federal aid to help the economy. The Biden administration is seeking nearly $ 2 trillion from Congress, including $ 1,400 in payments to most families.

The United States lost jobs again in December, for the first time since the onset of the pandemic after coronavirus cases rose again. Many states reintroduced trade restrictions to combat the pandemic, and restaurants and hotels had to lay off workers, some for the second or third time.

Read: Unemployment benefits are reduced to 9 weeks

The US economy, struggling with a record crisis of coronavirus cases, gained just 49,000 new jobs in January.

Spencer Platt / Getty Images

But with the decline in Covid-19 cases again in January, restrictions are high and more people are returning to work or finding new jobs. However, the increase in the winter coronavirus case has affected the economy of the momentum and left millions on the unemployment lists. About 10 million jobs that disappeared in the early stages of the pandemic have not yet returned.

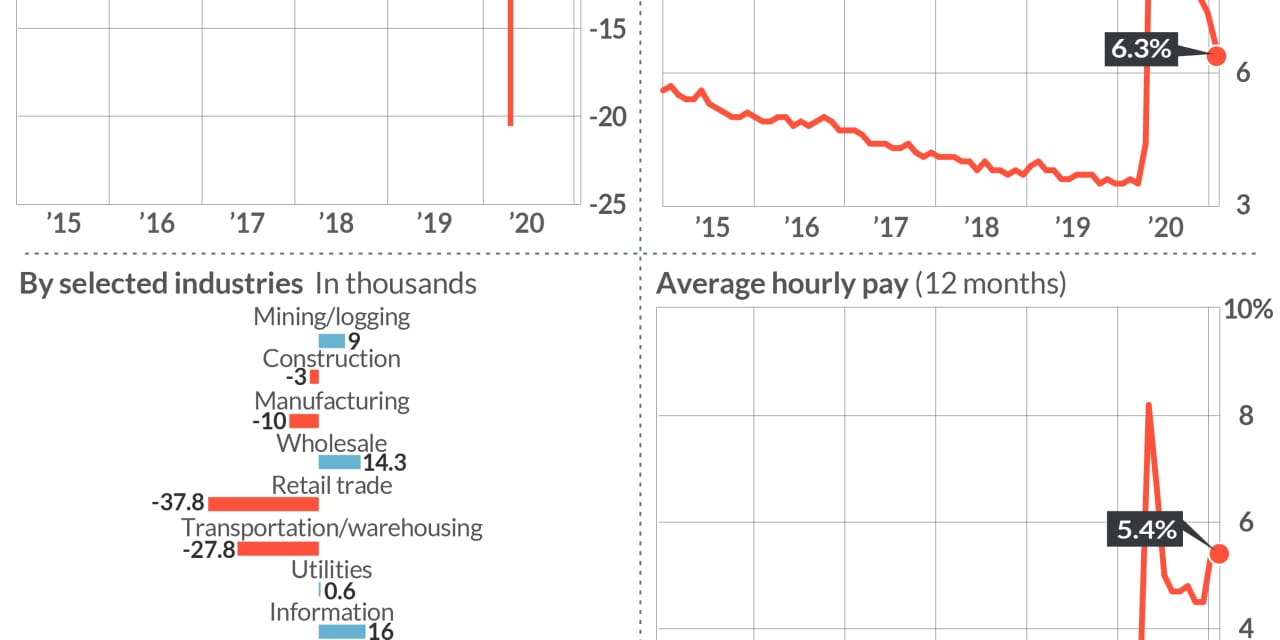

Meanwhile, the US unemployment rate fell to 6.3% in January from 6.7% and reached a new low pandemic, but the decline was largely caused by job losses and, through hence the abandonment of the workforce.

“In particular, we should not be reassured that the unemployment rate has dropped dramatically, given that more Americans have given up their jobs,” said Robert Frick, a corporate economist at the Navy Federal Credit Union.

Economists say the real level of unemployment is a few points higher. One important reason is that several million people who quit their jobs because they could not find a job are not included in the main unemployment rate.

Employment growth last month was in line with Wall Street forecasts. Economists surveyed by the Dow Jones and The Wall Street Journal expected a gain of 55,000. At the beginning of Friday’s trading, shares rose.

What happened: The small increase in jobs in January was exaggerated by the reported increase in employment in K-12 schools and public colleges. Government jobs increased by 43,000, but it was largely a statistical mirage of seasonal adjustments that were distorted by the pandemic.

The private sector has created just 6,000 new jobs overall.

Professional firms in technology, science and others added 93,000 employees last month to lead the way. Wholesalers and energy producers also held more jobs.

But employment has fallen in almost every other part of the economy.

Jobs in leisure and hospitality – restaurants, hotels, casinos, theaters and the like – fell by 61,000 in January, after a massive decline of 536,000 in December.

States began lifting business restrictions last month as coronavirus cases began to recede again, but not enough to give a big boost to employment.

Retailers lost 38,000 jobs, health care providers cut 30,000 positions, and warehousing and transportation companies cut wages by 28,000.

Employment has fallen slightly in both construction and manufacturing.

Meanwhile, the number of jobs lost in December rose to 227,000 from the initial 140,000.

The whole picture: The economy will certainly grow faster this year and add millions of jobs lost if coronavirus vaccines prove effective and Washington approves more engagement. This would give a boost to an already frothy stock market.

However, progress will be slow in the next few months, with the majority of the population still waiting to be vaccinated. The longer the recovery, economists warn, the greater the risk that many jobs will never return.

What are they saying? “There is still a long way to go to complete employment, and the argument for fiscal stimulus has become a little stronger,” said Curt Long, chief economist at the National Association of Federal-Insured Credit Unions.

“The US labor market hit the ball earlier this year, but the vaccine launch promises to push the team into the final zone by the summer,” said chief economist Sal Guatieri of BMO Capital Markets.

Market reaction: Dow Jones Industrial Average DJIA,

and S&P 500 SPX,

grew in trades on Friday. Stocks have risen in anticipation of a greater stimulus and a faster release of vaccines.