A modest recovery seems to be underway after Monday’s withdrawal, as hope springs eternally for a new stimulus from the administration of President-elect Joe Biden. And why should the market stop doing what it has been doing for a long time? Come back again and again.

But are there problems in paradise? “The ability of the capital market to rise decisively in the face of the tragic events of the Chapter to 1/6, the escalation of the virus, a weak employment ratio and rising returns confirm that a new phase, more speculative, more volatile of the bull market has begun, ”says BTIG chief strategist Julian Emanuel, equities and derivatives strategist, and equity strategy associate Michael Chu, in a note.

“Such a phase lasted over 6 months in 1999-2000, as the S&P 500 advanced another 25%, with multiple sales of 15% between them. The depth of such withdrawals in 2021 depends largely on yields, “they say. And if yields continue to rise, as they did on Monday, then high-growth names could have problems, they say.

They also give us call of the day, and zero in a sector, say investors may want to bypass the future.

Last month, they warned that communications and media stocks faced risks from higher rates, increased regulatory control and “a world tired of years of over-consumption of media”.

Emanuel and Chu update these thoughts on Tuesday: “Leaving President Trump’s office will naturally diminish the appetite for the media, as will the reopening of the economy and the possible return of travel and leisure activities” away from the screen. ” This and the recent moves to restrict access to content providers and platforms by Alphabet GOOGL,

Apple AAPL,

Facebook FB,

and Twitter TWTR,

it can only inspire politicians to seek more oversight.

Then there is the issue of investors moving towards value and moving away from growing stocks, which would be based on the communications sector.

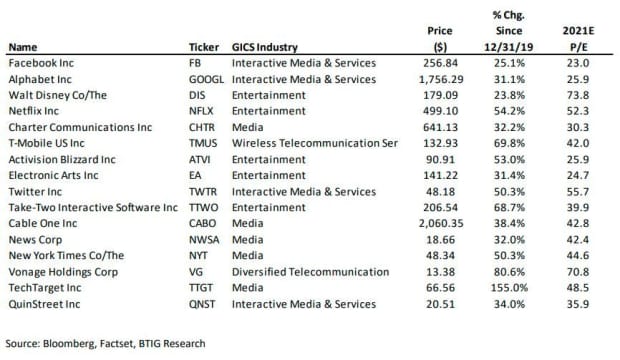

Here is the list of S&P 1500 communications service stocks that have surpassed their broader index by the end of 2019, but are set to move from “leaders to laggards as politicians pay more attention to the media, the rest of us pay less attention ”.

The actions listed above include Facebook, Disney DIS,

Netflix NFLX,

New York Times NYT,

and MarketWatch publisher, who produces this report, News Corp. NWSA,

NWS,

The final word goes to Howard Marks, co-founder and co-chair of Oaktree Capital Management. He explains in detail in his latest newsletter how investors may not look at that growth versus value strategy.

“Some of today’s high valuations are probably more than justified by future prospects, while others are ridiculous – just as some companies with low valuations may face an imminent loss, while others are only currently affected. “, he says. Read more here.

markets

US ES00 futures,

YM00,

NQ00,

are modestly larger, but European stocks SXXP,

are discontinued as concerns about COVID-19 infection increase. Asian stocks more completed 10-year Treasury yield TMUBMUSD10Y,

continues to slip higher after the biggest weekly rise in June last week.

Bitcoin BTCUSD,

volatility continues, with the cryptocurrency up 8% after falling between Sunday and Monday.

Buzz

US small business sentiment fell to a seven-month low in December. The results of the Employment Surveys and the Turnover Survey are also advanced.

German creditor Deutsche Bank DB,

he appears to have severed ties with President Donald Trump and New York Bank SBNY,

he is calling for his resignation, after saying he would no longer do business with him after last week’s riots on Capitol Hill. Trump tried to blame those attacks last week on “antifa people,” Axios reported, citing a tense phone call between him and the minority leader in the house, Kevin McCarthy, who said no, it was “MAGA.” Know. I was there.”

Zoom Video ZM Stock,

fell after the communications technology company said it was selling $ 1.5 billion in stock.

SolarWinds SWI Network Management Software Group,

says he has found the source of recent cyber attacks.

Some Democratic lawmakers say they tested positive for COVID-19 while sheltering from colleagues who refused to wear face masks during last week’s Capitol Hill riots.

Retailer Walmart WMT,

will launch its own financial technology company for clients and employees, with support for the Robinhood investment platform.

Chart

Here’s a look at how COVID-19 is progressing in the US, with deaths and cases off their peaks.

Random reading

I spy. Is Angelina Jolie more than an actress?