Technology stocks are back under pressure as bond yields continue to rise – investors are spinning off assets perceived as having broad valuations. 10-year Treasury yield TMUBMUSD10Y,

up 64 basis points this year through Friday, up 2 basis points to 1.589% Monday.

After the biggest comeback of the day in a year, at the end of last week, the technologically strong Nasdaq Composite was due to fall at the opening, with the future NQ00,

lasts down 1%.

In ours call of the day, Miller Tabak & Co’s chief market strategist Matt Maley said investors should be “very careful” when buying the decline when it comes to the technology-laden index and should sell the rebounds instead.

Maley said that despite a “nice rebound” on Friday, the index closed the week below 13,000 and said that any other disadvantage in the near future will be “very technically negative.” Miller Tabak stressed that he did not call for a repeat of the Nasdaq recession in 2000, but said it was clear that the trend had changed after last week’s losses.

Maley therefore advised investors to sell for any jumps for the time being and look for “some capitulation before they become more aggressive about buying things.”

The trend may have been reversed for the Nasdaq Composite, but there is still some hope for the broader technology sector, Miller Tabak said.

“The reason is that the biotechnology group also weighed the Nasdaq and the additional negative shake that this group gave Nasdaq was a catalyst for a more significant breakdown in this index than we have seen in some of the ETF technologies.” said Maley. Funds and indices traded on the key technology exchange have not yet exceeded key support levels, he added, which should be closely monitored in the coming days.

For example, the FAANG index – which includes Facebook FB,

Amazon AMZN,

Apple AAPL,

Netflix NFLX,

and Google parent Alphabet GOOGL,

– it is only a 6% discount to the February highs and is still above the 100-day moving average. “A break below this moving average would generate a large warning signal on the group,” he said.

The same can be said for the XLK Tech XLK ETF,

which fell by 7% and also remained above the 100-day moving average. Finally, the SMH semiconductor ETF SMH,

which fell on correction territory, was the key, especially at level 220. “If it closes next week below that level, it will give it a ‘bottom-up’ key,” he said.

Despite the technological downturn, not everything was dangerous and gloomy for the wider market, with the S&P 500 SPX,

with only a 2.3% discount from its all-time highs in February. “Even if things like the Tesla TSLA,

and ARK ETF ARKK,

they have fallen by 30% and 25%, respectively, from their all-time highs in January, the broad market will be fine if these hard-hit areas are able to stabilize even more after returning on Friday, “he said.

markets

Price of crude brent BRNK21,

briefly exceeded $ 70 a barrel for the first time in a year after rebels in Saudi Arabia and Yemen traded airstrikes. US ES00 futures,

YM00,

showed below before opening after Friday’s strong gains as recent volatile transactions appeared to continue. European stock markets have risen, and companies that fought during the COVID-19 pandemic are leading the way.

Chart

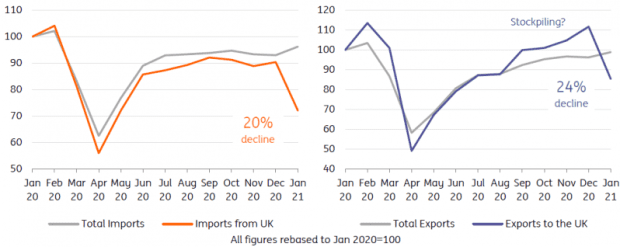

French trade data show a clear “Brexit effect” in January, ING analysts said, noting a 20% drop in UK imports, while imports from the rest of the world rose.

Source: Macrobond, ING

Buzz

US public health officials have warned that another wave of coronavirus could be around the corner and that now is not the time to relax the restrictions.

President Joe Biden said he anticipates checks and aid deposits for Americans that will be sent out this month after the Senate passes the COVID-19 stimulus bill. He added that the bill will speed up the availability of vaccinations.

MacKenzie Scott, the philanthropist previously married to Jeff Bezos, married a Seattle teacher following her 2019 divorce from Amazon.com founder, according to a person familiar with the matter.

Prince Harry and his wife Meghan opened up to Oprah Winfrey in an explosive interview late Sunday.

General Electric GE,

is approaching a $ 30 billion deal to combine its aircraft leasing business with AerCap Holdings in Ireland, according to people familiar with the matter.

Random readings

Meghan Markle revealed that she worked for Humphrey Yogart. The internet is above the spoon

Shoe Zone shoe store chain replaces Peter Foot with Terry Boot as CFO. It’s not a joke.

The need to know starts early and updates up to the opening bell, but sign up here to deliver it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron’s and MarketWatch.