Santa may not be coming to town because of the pandemic, but he will pay a social distance visit to Wall Street capital traders if history is a guide.

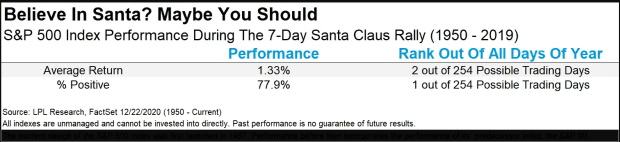

The shares performed extremely well in a seasonal period that includes the last five trading days of the year and the first two sessions of the new year, in what became known as the “Santa Claus” rally.

This period, which begins on Thursday this year, is considered one of the best seven-day periods for shares at any time of a year, with an average return of 1.3%, the second best performance of any seven-year period. days in a year. The duration also ended positively in almost 78% of the approximately 250 trading sessions, according to Ryan Detrick, chief market strategist for LPL Financial, in a research note on Wednesday (table below).

Source: LPL Financial

Detrick says it’s unclear why this December is proving to be such a good time on average, but some speculate that institutions will keep their books at the end of the year, with holiday consumer spending boosting corporate sales, with thin trading volumes of many Investors on leave and optimism over the next year could all be factors in the growth that is spreading in the financial markets.

“The bottom line is that bulls tend to believe in Santa Claus,” he writes.

It can be hard to believe that stocks will gain a second bit of gains after a huge rebound from the lows seen in March, when the coronavirus pandemic hit a new rally so far in December.

Dow Jones Industrial Average DJIA,

the S&P 500 SPX index has already risen about 2% so far this month,

increased by 2.4% during the period and the Nasdaq COMP Composite Index,

increased by 5.2% so far in December.

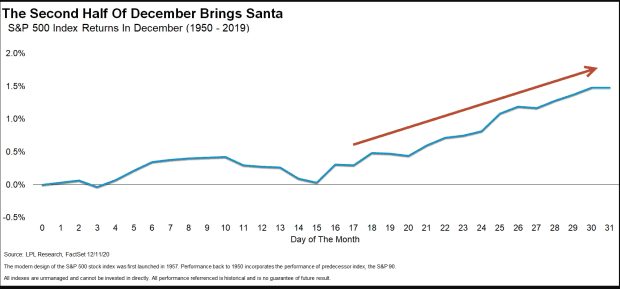

Detrick said there is reason to believe there is another stage in the rally, as December tends to start relatively slowly and gain steam by the end of the calendar year.

Source: LPL Financial

Investors are concerned about the market’s ability to support the almost uninterrupted growth of high registrations and assessments amid a resurgence of the COVID-19 pandemic in parts of the world and signs that new strains of the virus are emerging, even while vaccines are in course from Pfizer PFE,

and partner BioNTech BNTX,

22UA,

and Modern MRNA,

Earlier this month, Ed Yardeni Research of Yardeni Research said it anticipates strong performance in December, favored by investors and fund managers, who will turn in a few pandemic winners and become value-oriented stocks. who have not yet enjoyed the fruits of an improved economy.

The December gains also followed a strong rally in November, which William Watts of MarketWatch said was unlikely to “steal” from the December gains.

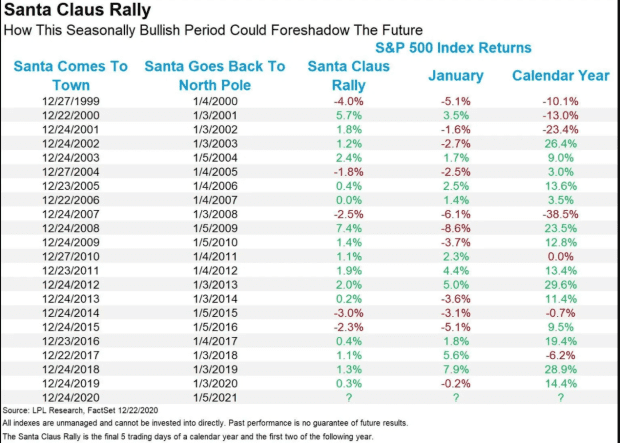

Detrick said the effect of the Santa rally could shape trade next year.

The analyst said that, going back to the mid-1990s, “there were only six times Santa failed to show up in December,” and in these cases, January brought a movement of less than five times, and the entire year had only a solid gain once – in 2016, but a mini-bear market at the beginning of that year.

“Considering the ugly markets of 2000 and 2008, both took place after one of the rare cases that Santa Claus failed to show makes believers leave us. If this strong seasonal period misses the mark, it could be a warning sign “, wrote Detrick.

Source: LPL Financial

That being said, MarketWatch’s Mark Hulbert argues that a failed Santa’s rally doesn’t always predict poor performance, although market researcher Yale Hirsch, the creator of the Stock Exchange Almanac, noted: “If Santa couldn’t make it, bears on Broad and Wall, “referring to the intersection of Wall Street and Broad Street, where the New York Stock Exchange is located.

Analyzing the correlation between the performance of the Dow in the second half of December and its profitability for the following year and we made a finding of interest: The stock market on average does not better after the losses at the end of December and not worse.

Hulbert warns readers not to extrapolate too much from his findings and notes that 2021 can be distinguished from other years and seasonal trends, given the global pandemic and its impact on economies.