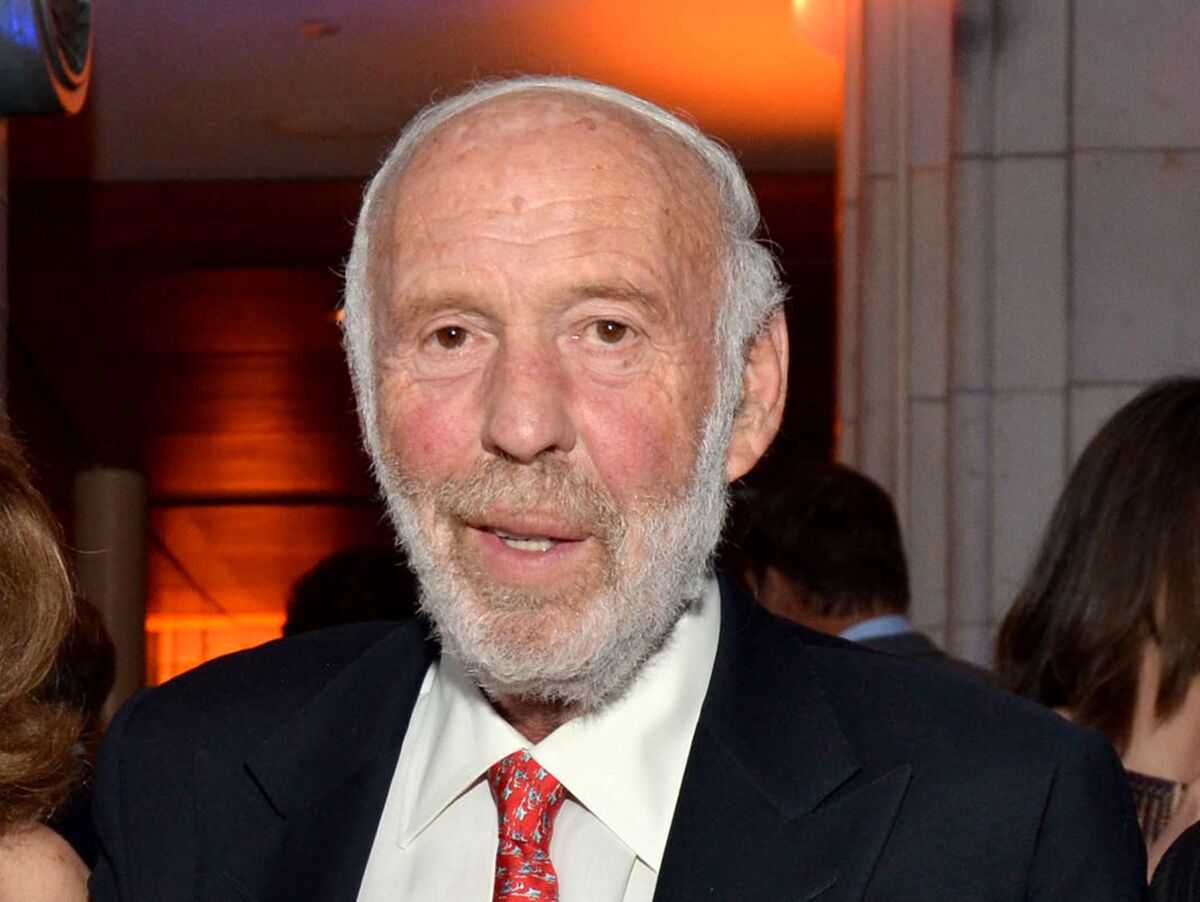

Jim Simons

Photographer: Amanda Gordon / Bloomberg

Photographer: Amanda Gordon / Bloomberg

Renaissance Technologies, the giant investor that has just had the lowest returns on its public funds, has been hit with redemptions of at least $ 5 billion.

In December, customers earned $ 1.85 billion net of the three hedge funds and asked for $ 1.9 billion back in January, according to investor letters seen by Bloomberg. Investors are ready to raise another $ 1.65 billion this month, the letters show.

These figures could be offset if there are flows in February or if investors decide to withdraw any of their redemption claims.

The company of billionaire Jim Simons, a pioneer who invests in quantities, comes from a hard year. Its three public hedging funds recorded double-digit losses in 2020, as their algorithms were thrown out of market hits that computers had never seen before. At the same time, its fund for employees and insiders increased by 76% last year, the institutional investor reported.

Read more: Human hedge funds are being beaten How much in the Pandemic-Driven Year

The Renaissance institutional fund, the largest of its external vehicles, lost 19% in 2020, the letters show. This fund received most of the redemptions. The Alpha Diversified Institutional Fund decreased by 32% and the Global Equities Institutional Diversified Fund decreased by 31%.

A spokesman for the company in East Setauket, New York, declined to comment.

Renaissance told customers in a September letter that his losses were due to the fact that they are under-covered during the March collapse and then over-covered in the return from April to June. This was because its trading patterns were “overcompensated” for the initial problems.

The renaissance once again addressed its sad numbers in a December letter.

“Although recent performance has been terrible and worse than it would have been suggested, previous performance would have been likely by 2020,” the firm said, adding that its model anticipates that, for as long as ours, there are risk reports. profitability as bad as the ones we now see are not shocking. The broader lesson is that “we should expect really good investments to work terribly from time to time.”

Renaissance is the largest quantitative fund firm in the world. It was founded in 1982 by Simons, a former code breaker for the National Security Agency. Last month, he announced that he was stepping down as president of the company, which at the time was managing about $ 60 billion. He will remain a member of the board.