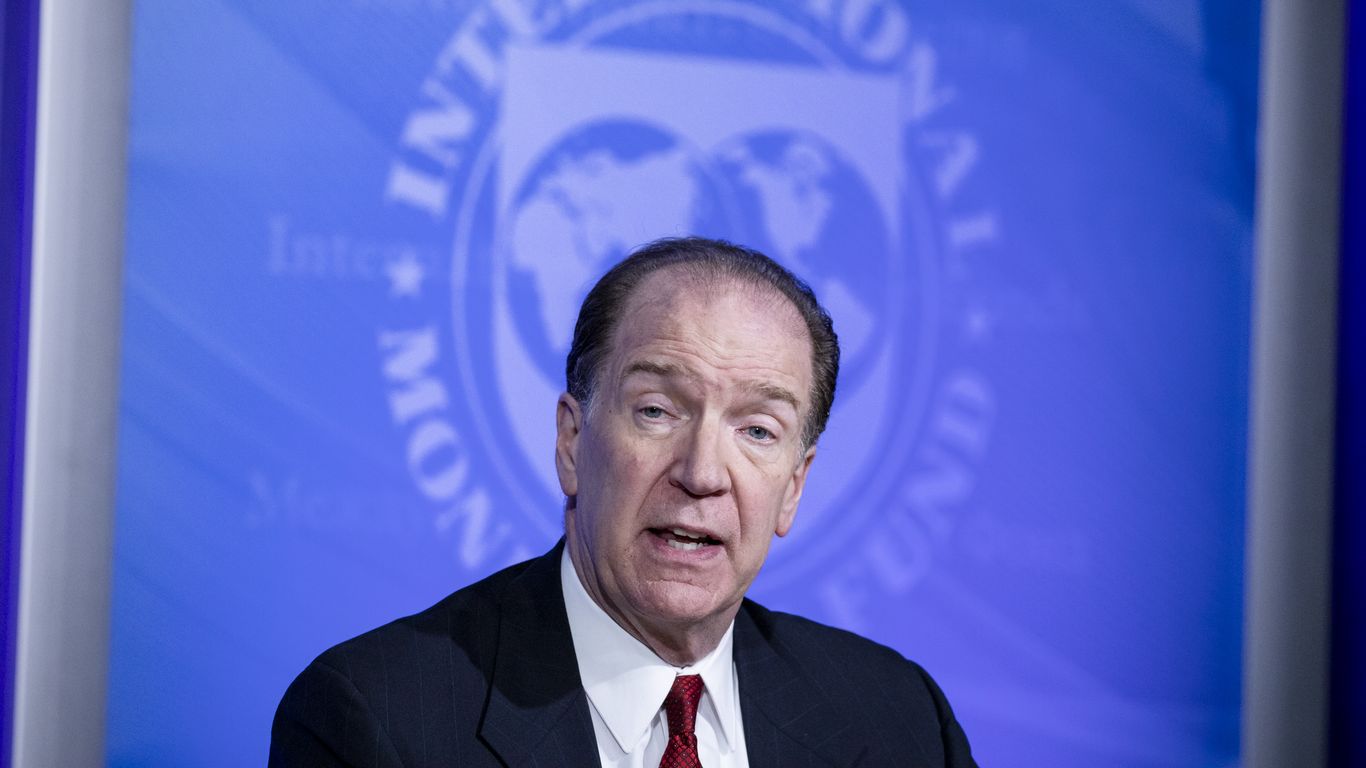

More countries will soon face serious debt problems and are likely to default this year if prompt action is not taken, World Bank President David Malpass said on Tuesday, calling for debt restructuring and a focus on inequality. and investments in the “post-COVID economy”.

Why does it matter: Malpass is the latest to issue a stern warning about the state of the global economy, urging creditors such as China and the Paris Club’s wealthy group of nations to share the burden.

Where is it: Malpass, a former Treasury Department official under President Reagan and President Trump economist Bear Sterns, described current debt levels in many countries as “unsustainable” and said a growing number are currently on “Red alert” for non-compliance.

- “Given the sharp decline in short- and long-term interest rates, we need to find ways to adjust the debt burden process so that the debt burden on people in poorer countries can be dramatically reduced.”

What we hear: In addition to the risk of rising defaults and rising poverty in developing economies, the World Bank’s goal of increasing average incomes in countries “is not being met in the current context,” Malpass said.

- This is partly because “the incentive mechanisms that are there are working on concentrating wealth rather than adding wealth from the bottom up,” Malpass told Axios during a question and answer session with reporters.

- “One thing I think is important is that we recognize that creative destruction is important, that is, small businesses that fail because of the severity of the recession. But even more important is the creation of new small businesses, innovation.”

He continued: “And so, that will mean that countries actually allow that process and not just work through their large structures to provide funding to large companies.”

A deeper level: “The risk is that people at the bottom of the income scale will spend years seeing a sustained improvement in their situation.”