The almost non-stop rise of Bitcoin to the new records has attracted Wall Street attention as well as several other titles in recent memory.

The world’s No. 1 digital asset was recently trading at about $ 32,000 in action on Tuesday, at the last check, but the JPMorgan Chase JPM team,

argue that the blockchain-backed cryptocurrency could be valued at $ 146,000 in the not-so-distant future if it can continue to attract demand from gold buyers, as the bank’s researchers believe is already happening.

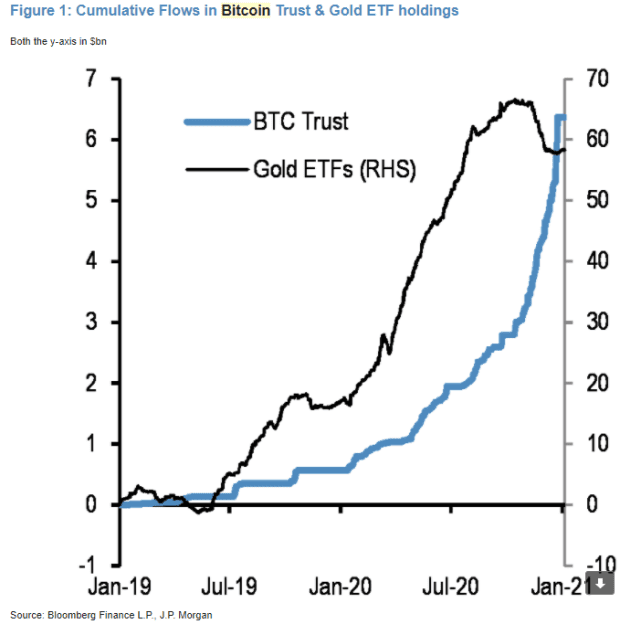

Analysts point to the exit from exchange traded funds, or ETFs, and enter into a digital currency-based trust, sponsored by Grayscale, for example, as part of evidence indicating the increased use of bitcoin as a gold-like guarantee, which would help increase its price in the stratosphere.

“Bitcoin’s competition with gold has already begun in our minds, as evidenced by the over $ 3 [billion] of entries in the Grayscale Bitcoin Trust and the over $ 7 billion in gold ETF exits since mid-October ”(see attached chart):

through JPMorgan

JPMorgan says that, as a single measure, bitcoin currently consumes 3.4 times more venture capital than gold and more than 5 times more when comparing Grayscale Bitcoin Trust with GBTC,

SPDR Gold Shares GLD,

the largest gold ETF by assets.

Bitcoin BTCUSD,

should currently increase by 4.6 times its current market capitalization of about $ 575 billion – outstanding coins multiplied by the unit price – to involve a bitcoin price of $ 146,000 “to match total private sector investment in gold through ETFs or bars and currencies, ”wrote JPMorgan’s strategic team, including Nikolaos Panigirtzoglou, Mika Inkinen and Nishant Poddar.

The researchers also said that interest in bitcoin is expected to come largely from younger investors.

Read: Opinion: Bitcoin is heading for a shortage of supply – and that will continue to drive up prices

“There is no doubt that this competition with gold as an ‘alternative’ currency will continue in the coming years, as millennials will become a more important component of the investor universe over time and given their preference for ‘digital gold’ over of traditional gold, ”the research team wrote in the research report dated Monday.

The only major impediment to the rise in the price of bitcoin and one that will likely make its prices fragile is volatility.

“But this long-term growth based on an equalization of the bitcoin market ceiling with that of gold for investment purposes is conditioned by the volatility of bitcoin that converges to that of long-term gold,” the researchers write.

Investors have been drawn to the story that bitcoin could act as a wealth deposit against the backdrop of central bank money printing in the last year to support an economic recovery from the coronavirus pandemic.

PayPal PYPL,

recently allowed users on its platform to purchase bitcoin, as well as other sister cryptocurrencies, such as Ethereum Ethereum ETHUSD,

Bitcoin Cash BCHUSD,

and Litecoin LTCUSD,

SQ square,

The popular Cash application allows users to buy and sell bitcoins.

Bitcoins have enjoyed a remarkable evolution in 2020 compared to other assets. Bitcoins have already grown by 12% so far in 2021, compared to a 3% increase for the price of GC00 gold,

GOLD,

based on the most active gold futures contract for January. Meanwhile, the Dow Jones Industrial Average DJIA,

the S&P 500 SPX index,

and Nasdaq Composite COMP,

are smaller at this time of year.