Photographer: Chris J. Ratcliffe / Bloomberg

Photographer: Chris J. Ratcliffe / Bloomberg

Rishi Sunak can do self-control. After an addiction to drinking Coca-Cola with maximum power, resulted in seven fillings on the teeth, he was divided into one Cola per week.

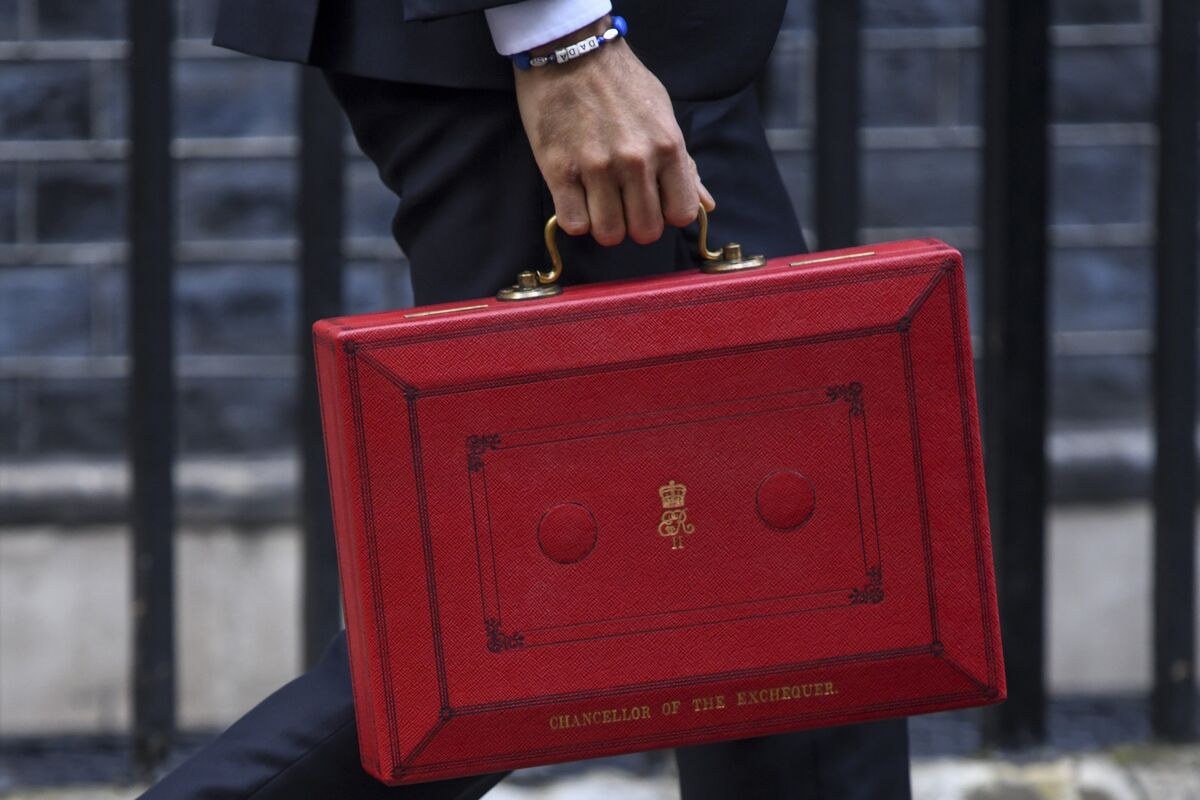

When it comes to delivering its budget on Wednesday, the tax chancellor is facing a fight to convince his colleagues of the need to reduce the flow of government spending and address the painful hole in public finances, approaching 400 billion pounds. ($ 558 billion).

The question he still faces is how to pay the bill. Will it raise taxes, hitting the rich and recouping profits from the few businesses that did them, as some suggest? Or will it prepare the ground for reducing public spending? Or will it signal instead that the pain of cuts and taxes will have to come, but not yet?

Sunak’s answers will shape his own fortunes, the political identity of the Conservative government and the chances of the British economy recovering completely from the deepest recession of 300 years.

“We went big, we went early, but there is still a lot to follow and there will be more to come in the budget. But there is a challenge, “with public finances, and” I want to work with people on this challenge, “Sunak said. Financial Times in an interview Friday.

Rishi Sunak.

Photographer: Chris J. Ratcliffe / Bloomberg

Together with finance ministers around the world, Sunak paid huge sums of taxpayer money to save jobs and businesses when the coronavirus forced the government to close shops and restaurants and lock people in their homes.

Now that Prime Minister Boris Johnson has presented his “roadmap” for a cautious four-month lifting of the blockade, Sunak is reconciled with maintaining this flow of support as long as the restrictions are in place.

What Bloomberg Economics says …

“Increasing bond yields in the last month, if maintained, would mean debt interest costs as a share of GDP averaging 1.2% over the five years, rather than 1%. Debt service costs have averaged 1.7% since 2000. ”

– Dan Hanson, senior economist. Click here for the full report.

This will mean extending the £ 54 billion wage support program, along with reductions in business rates and sales tax, at least until the end of June. This will not come as a surprise to Sunak’s colleagues and will thank many Conservative members of Parliament on Wednesday, but not all.

But he opposes his conservative small-state instinct, and many of his colleagues are also deeply concerned about the economic policy their Conservative government is pursuing. The prospect of hiking taxes – potentially including a sharp rise in business taxes – to pay the bill is particularly hard for most conservatives to swallow.

In recent weeks, the chancellor has worked diligently to analyze the views of his colleagues in an effort to understand what they are facing and to adapt their messages. Some MPs say they were invited to four or five Zoom calls with Sunak before his budget.

“Rishi was very open, very obedient, he really cared about what I was saying,” said Alexander Stafford, one of the new Conservative MPs elected in December 2019. “We all know there will be tax cuts or increases. My hope is that none of this will fall too hard at this time. I haven’t left the forest yet. ”

Others say it more directly. “If it increased taxes, it would undermine everything we did to get the business going,” said Andrew Bridgen. “No society can ever impose its path to prosperity.”

Among the details of the plan, Sunak will pledge £ 22 billion for an infrastructure bank previously proposed to boost the country’s green economy, the Treasury said in a statement on Saturday. The bank will provide a wide range of products, including equity, loans and guarantees, to support projects in sectors such as renewable energy, carbon capture and storage and transport. It is also expected to announce the launch of a fund that will channel up to £ 375 million to fast-growing start-ups.

What else will be in Sunak’s budget?

- A new state-backed loan program to help companies recover from the pandemic

- Extensions to major virus support measures, including the furlough program, a reduction in VAT and business tariffs

- More details on how a proposed infrastructure bank will work

- An extension of the £ 20 increase in universal credit, a social payment

- 126 million pounds of new funding for 40,000 internships

- A signal that the profit tax should rise, possibly to 25% by the end of parliament, according to the Sunday Times

- A freeze on lifetime pension benefits and when people start paying the basic income tax rate, according to the Times

- A £ 5 billion fund for non-essential pubs, restaurants and shops, according to the Sunday Telegraph

- A possible fee for each online delivery, according to the Telegraph

- A fourth round of 3-month subsidies for the self-employed, with up to 80% of their pre-pandemic income

Steve Baker, a Conservative who is part of the Treasury committee and will question Sunak about his election, said the government’s priority must be to create better-paying jobs for people in the coming months. “I just don’t see how raising taxes promotes more, better-paying jobs for the public,” he said.

The pandemic fundamentally provoked the Conservative Party’s sentiment about what it represents. In the past, conservatives have flirted with the privatization of state health care, reduced social payments and reduced taxes for high-income people.

What Bloomberg Economics says …

“The rise in bond yields in the last month, if it remains, would mean debt interest costs as a share of GDP averaging 1.2% over the five years, rather than 1%. Debt service costs have been in average of 1.7% since 2000.

– Dan Hanson, senior economist. Click here for the full report

However, Johnson’s team now presents itself as the champions of the National Health Service, while pumping out social security and weighing options to raise taxes on capital gains.

The influx of more than 100 new Conservative MPs in 2019, many of them representing northern seats appreciated by the Left Labor Party for the first time in decades, has changed the structure of the Westminster party.

There is less demand for fiscal prudence than in previous years, and there is certainly no appetite for a return to the austerity policies pursued for much of the last decade by Conservative-led administrations.

Historically low interest rates mean that there is also no pressure from bond markets on the Chancellor to control his spending immediately. While the country’s debt increased during the crisis, the cost of services decreased.

However, Sunak sees great risks in doing nothing to address the British public finances devastated by the pandemic. Even if he delays most difficult decisions until the next budget in the fall or even next year, many of his colleagues expect that he will not be able to postpone the pain.

Bond markets signal that Sunak’s borrowing costs may only increase. Exemption interest rates on financial markets have risen by half a percentage point in the last month for securities maturing in six years and over. The 10-year Treasury yield on gold reached 0.836% on Friday, the highest since March 2020, when the pandemic began to spread widely in Europe. Each 1 percentage point increase in interest rates adds £ 25 billion to the service cost of UK debt, Sunak told FT.

“We all know that markets can return very, very quickly,” said Harriet Baldwin, a conservative who traded bonds during a market route in 1994. “Although the situation is very favorable at the moment, it will not always be the case. It has a difficult rope to walk on. ”

Observers praise Sunak for his work ethic and attention to detail, and the chancellor himself said he likes to start his day with a workout, either on a treadmill, in the gym or on a stationary bike. to arrive at his office at 7:45 in the morning

The truth is that no amount of sweat or training can guarantee that Sunak’s policies will succeed. The biggest factor in determining whether the UK economy is permanently scarred or recovering quickly is beyond the chancellor’s control: the pandemic itself.

If, despite a quick and seemingly effective vaccination program, the Johnson administration cannot maintain control of the coronavirus, Britain’s plan to reopen the economy on a cautious schedule in the next four months will be in jeopardy. So is the unity of the party.

“The hell will go away if the data is challenged or leaked back,” said Indiana-born Joy Morrissey, who was elected under Johnson’s leadership in 2019. “This data is the last possible data that everyone will have. accept”.

– With the assistance of Kitty Donaldson, Emily Ashton, Lizzy Burden and Reed Landberg

(Add comments from Bloomberg Economics.)