Like no president before him, Donald Trump used the stock market as a scorecard, arguing that strong gains were a justification for his economic administration.

Trump leaves the mandate with major landmarks in the USA close to the historical maximums. But how did his performance accumulate with his predecessors?

Not too bad, according to major indices. Based on annualized returns for S&P 500 SPX,

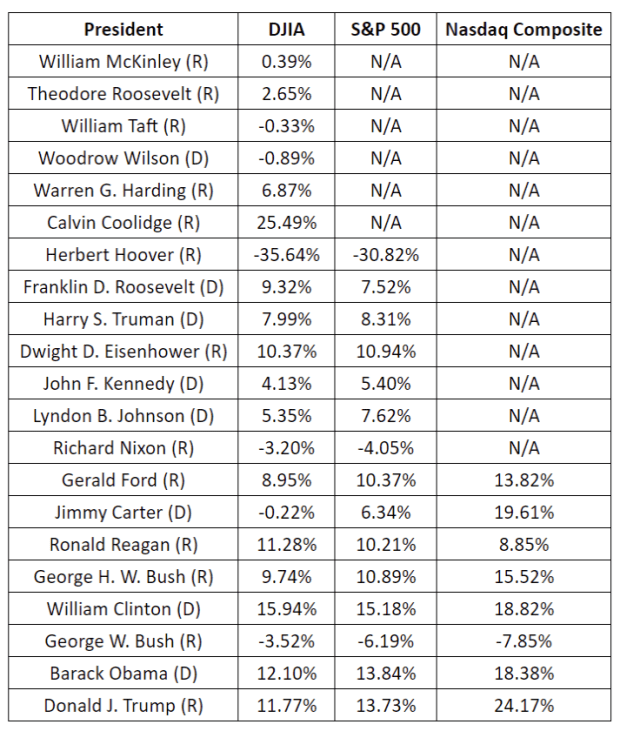

The US benchmark, Trump (+ 13.7%) recorded the third best performance of the 15 presidents who have served since 1929, according to Dow Jones Market Data. However, Trump easily followed his immediate predecessor, Barack Obama (+ 13.8%). Bill Clinton (+ 15.2%) ranks first.

Dow Jones market data

Dow Jones Industrial Average DJIA,

the most famous blue-chip track, recorded an annualized return of almost 11.8% under Trump, compared to 12.1% for Obama and 15.9% for Clinton. Calvin Coolidge, with the Roaring ’20 advantage, surpassed them all with an annualized increase of 25.5%, based on data dating back to the late 1890s.

Trump can claim some boasting rights when it comes to Nasdaq Composite technology, which debuted in the early 1970s. An annualized increase of 24.2% is at the top of the list, with Jimmy Carter in second place with an increase of 19.6. %.

Of course, there are reasons why previous presidents avoided linking their success too closely to the stock market. For one, the market is volatile. If you take credit for its growth, you will probably get more to blame if it falls.

The stock market is also far from perfectly assessing the economy or how individual households feel about their own circumstances.

So what should investors read in historical records? After all, many analysts have noted that no democratic president has seen a drop in total yields during his tenure.

Opinion: The economy – and the stock market – tends to do better under Democrats

Jim Reid, a strategist at Deutsche Bank, said he might not offer much guidance in any case when it comes to the Biden presidency.

The question is whether the performance during the democratic administrations was determined by the skills in managing the economy or simply by bad luck when it came to synchronization for some Republicans.

“For example, the US had a Republican administration when the pandemic hit last year, the period between the peak of the dot-com bubble and the minimum GFC (Great Financial Crisis) (George W. Bush.), When the 1973 oil shock occurred. Nixon) and during the depression (Hoover) “, wrote Reid.

Meanwhile, Biden is inheriting an economy that is still struggling to recover from the COVID-19 pandemic and a stock market that many investors consider at exorbitant prices, if not in the bubble territory. Stocks have gathered, however, since Biden’s November election victory, partly due to expectations, will promote aggressive stimulus measures.

And the new presidential term began with an explosion, as the Dow, S&P 500 and Nasdaq finished with all records and recorded the best performance on Inauguration Day since Ronald Reagan took the oath to begin his second term in 1985.