Wall Street had Georgia in mind Tuesday night, with long-term securities and bonds for the most part, while investors watched double contests for key Senate seats that fell to thin margins at anticipated yields.

MarketWatch’s Victor Reklaitis reported that analysts describe the races in Georgia as “as close as you can get close” and there are expectations that the winners will not be declared until Wednesday morning.

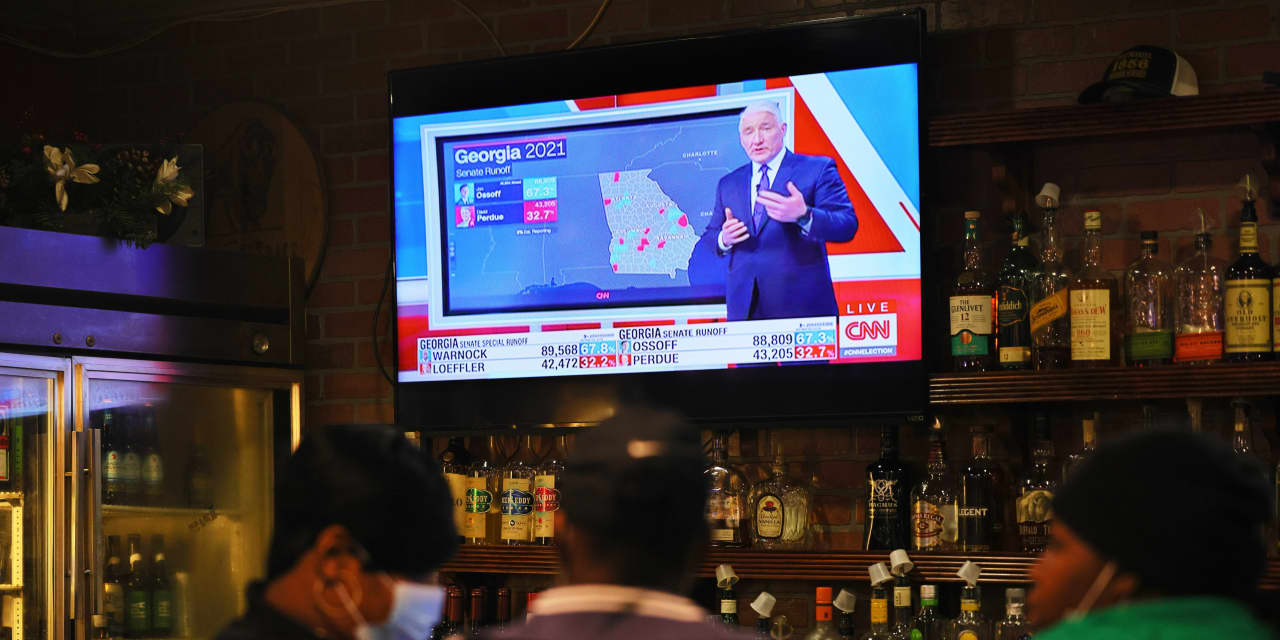

Democratic challenger Jon Ossoff followed incumbent Republican Sen. David Perdue with nearly 88 percent of the vote, after earlier enjoying an advantage, according to data from the Associated Press.

In the other elimination, Democrat Raphael Warnock was also almost level, but also behind, against current GOP Senator Kelly Loeffler.

The races in the Senate are the eliminators from the general elections in November, when none of the candidates reached the threshold of 50% necessary to be declared the winner.

At stake in markets is a prospect of a weak Democratic majority in the Senate, where candidates can claim GOP officials.

Senate Republicans, if Loeffler or Perdue wins Tuesday night, can be expected to block additional coronavirus bailout legislation and thwart Democratic plans for expansive spending after President-elect Joe Biden takes office, experts said.

However, a democratic sweep in Georgia would give that virtual party control of that chamber, as elected vice president Kamala Harris would cast unparalleled votes as chamber president.

Futures for the S&P 500 ESH21 index,

ES00,

decreased by 0.4%, while those for the Dow Jones YMH21 industrial average,

YM00,

were practically flat, but tilted down, and Nasdaq-100 futures NQH21,

NQ00,

were 1.2% late Tuesday.

In the regular session, the Dow DJIA,

S&P 500 index SPX,

and Nasdaq Composite Index COMP,

ended the session much earlier before political confrontations.

However, some of the biggest moves came from the bond market, with the 10-year Treasury yield TMUBMUSD10Y,

knocking on the door with 1%, around 0.985%, as prices fell after rates closed at 0.955%, marking the highest eastern close since 3pm on December 4, according to Dow data Jones Market. 30-year treasury obligation TMUBMUSD30Y,

It also rose by almost 4 basis points, gaining 1.744% from an afternoon close to 1.705%, also the highest rate in the last month.

For the bond market, democratic victories could add to the downward pressure on the Treasury, as analysts say inflation expectations have risen in response, as Congress may be more inclined to adopt additional fiscal spending measures with a majority, which would have a weight on bond prices, leading to higher yields.

It is almost impossible to assume the result that Wall Street considers most appropriate to further increase stocks in 2021. Last year, market participants bet that a presidential victory for Biden, along with Democrats who won a majority in the Senate, would provide the best-case scenario for additional financial assistance measures to support the recovery of the COVID-19 pandemic.

However, a blue wave failed to manifest and markets grew in the last weeks of 2020, regardless.