A cruel reality for the euphoric stock market? Next week could be the closest thing to an estimate for rising investors by 2021.

It is the busiest week of the fourth quarter earnings season, highlighted by the highly anticipated results of heavy companies such as AT&T T,

Apple Inc. AAPL,

Facebook FB,

and Tesla TSLA,

In total, about 118 companies are scheduled to report quarterly results in the last trading week of January, including 13 components of the DIA Jones Industrial Average DJIA blue-chip,

John Butters, senior analyst at FactSet research, told MarketWatch.

And over 60% of the weekly attack will take place between January 27 and January 28.

The hectic period could turn into a pivotal period for a market that could seek the next spark, as the new administration of President Joe Biden’s administration takes its political initiatives and intends to address the COVID-19 pandemic.

To date, optimism is highest among equity investors, with opinion data from Ned Davis Research at 74.4%, a level it has reached only 7.4% since 1994.

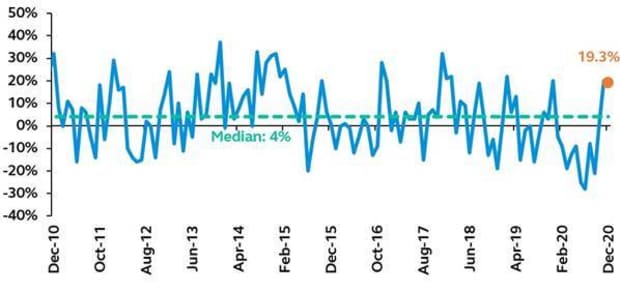

Similarly, the difference between bulls is 19.3% compared to an average of 4% on December 31, according to the survey of the American Association of Individual Investors.

Source: American Association of Individual Investors, the leading global investors

Ned Davis Research says that the buying situation has apparently crushed the appetite for betting, rising that stock prices will face a significant correction in the short term. “One thing investors have done less is selling short,” analysts Ed Clissold and Thanh Nguyen wrote in a Jan. 19 research report.

According to NDR data, the short selling ratio, the number of shares sold short divided by the total number of issues traded, reached its lowest level since 2011, in November.

You don’t have to search long to find evidence of the treacherous path that short sellers face these days.

Example, GameStop GME stock,

is on track for the best monthly growth in its history, up 245%, while retail investing fanatics have promoted stocks and urged users on finance-oriented social platforms such as Reddit to buy shares for squeeze the activist investor and noted the Lemon Andrew Left Research.

The actions of fanatical investor groups overcame attempts at hacking and hacking and included what the Left described as “serious crimes such as harassment of minor children”Wrote the sister publication MarketWatch, Barron’s.

For some, this is the ability of the market to peak. Falling sellers and retail investment agencies trying to prove their new strength

Is that how the precursor of a bubble feels? Are we in one? When will it appear, if so?

EDF

These are all questions that can be asked of the Federal Reserve when it provides the background for the next major event for next week: the most recent monetary policy update.

Fed Chairman Jerome Powell has often been blamed for helping to prevent a financial market disaster during the coronavirus pandemic in March last year and for encouraging too much risk.

The Powell-led Federal Open Market Committee quickly cut interest rates to nearly 0% and pumped billions of dollars of liquidity into the financial market that was shaken by COVID-19.

But the Fed’s policies have favored some of the risk-taking on the screen, some critics say. The Bears also claim that the endless printing of money will have consequences for the US dollar, the economy and, ultimately, the long-term financial markets.

Biden is proposing an additional $ 1.9 trillion in federal government spending to help pull the US economy out of recession as coronavirus cases and deaths hit a new high this month.

All of this may give additional significance to next week’s Fed meeting.

“All eyes will be on President Powell at next week’s FOMC meeting. We expect it to be more optimistic, but still cautious, “wrote economists Lydia Boussour and Gregory Daco of Oxford Economics in a research note Friday.

In recent speeches, Powell has already indicated that the Fed is unwilling to give up monetary policy accommodation soon, including raising interest rates from historic lows or reducing its asset purchases, a source of support for financial markets.

The Fed meeting begins on Tuesday, with Powell & Company providing its policy update on Wednesday at 2:00 p.m., followed by a press conference hosted by the president.

US economic growth?

On Thursday, a day after the Fed’s decision, market participants will wait for the official bulletin on the health of the US economy.

According to consensus estimates among American economists surveyed by MarketWatch, the US economy could have grown by about 4% annually in the last three months of 2020, which would normally be phenomenal, but comes after growth of 33.4%. the third trimester.

However, if the reading of GDP continues to show upward progress, it can be pointed out that the economy is moving in the right direction even as the coronavirus pandemic continues to erupt.

After all said and done if Dow, S&P 500 index SPX,

and Nasdaq Composite COMP,

they are still far from spitting records, the bulls can be found even more daring.