The coronavirus pandemic dealt a severe blow to the Tax Agency’s collection capacity during 2020. Despite this, the public revenue disaster was partly covered by the various tax settlement program. This is the case of the personal income tax, in which the Revenue Campaign last spring showed an increase in yields with a result that must be paid to the treasury three times higher than the return advance, corresponding to 2019, before the Covid crisis.

This is derived from the data provided yesterday by the Tax Agency, which practically ended last year’s Revenue Campaign on the previous year’s tax data. The campaign ends with the return of 10.4 billion euros to about 14 million taxpayers in a year marked by an increase in telematic declarations in the framework of the coronavirus pandemic.

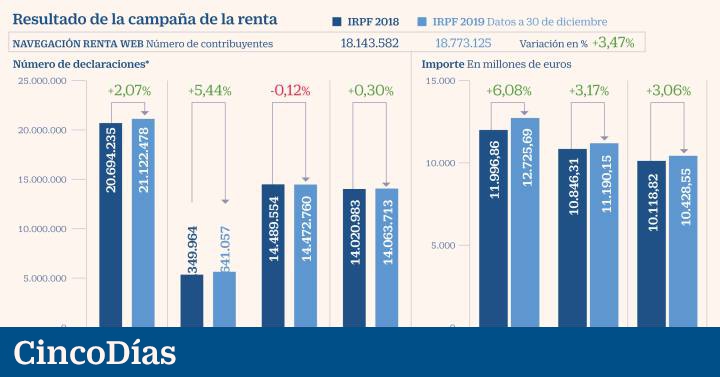

To begin with, the number of declarations submitted increased by 2% to reach a new historical record, exceeding 21.12 million. Of these, 68.5% included a request for repayment (14.47 million), while the remaining 31.5% (5.64 million) went to a loan to the treasury.

However, the campaign ends with a higher increase in taxpayers obliged to pay, as well as the amounts to be paid by the Treasury, than among those who had results in their favor and received from the Tax Agency. . To understand this phenomenon, it must be taken into account that the campaign ends a fiscal year, 2019, in which the economy slowed down, but still grew by 2%, as it has not yet been affected by the Covid-19 pandemic. However, its liquidation takes place in a year in which the economy suffered an ecological disaster of 11.2%, according to official government forecasts.

Thus, the number of declarations to be increased increased by 5.44% compared to the previous year, to 5.64 million, and the amounts to be received by the treasury increased by 6.08%, to 12,725 million euros.

In turn, the returns to be returned decreased by 0.12% to 14.47 million, while the amount returned was 11,190 million euros, an advance of 3.17% compared to the result of the previous campaign, correspondingly starting from 2018.

From there, the Treasury has already returned 93% of the requested amounts (10,428 million) to 97% of stakeholders (14.06 million taxpayers).

Incidence in the box

This development, with a higher increase in balances to be paid in the public treasury than in those that had to be returned to taxpayers, partly explains why the Ministry of Finance aspires to close a two-year GDP decline with a collection reduction of only 7.6%.

Thus, at the end of November, the public coffers had suffered a decrease in tax collection by 9%, from 197,853 million in the first 11 months of 2019 to 179,996 million on the same date in 2020. However, in the case of personal income tax , the comparison showed a year-on-year increase of 1% to 82,358 million. Even a comparison in homogeneous terms for calendar purposes limits the decrease in personal income tax revenue during 2020 to 0.3% at the end of November. A limited impact, given the severity of the economic crisis triggered by the pandemic and the fact that, the Tax Agency acknowledges, by activating ERTE as a safety net, “they went from having wages subject to withholding to benefits with little or no retention” .

Remote statements

The 2019 revenue campaign was characterized, in turn, by the increase in electronic yields. It should be recalled that the process began during the closure of the offices of the Tax Agency, during the state of alarm last spring. Although, the Treasury ruled out delaying the campaign. Thus, the statements presented through the “We call you” telephone service multiplied by six to 1,155 million.

In turn, the declarations made through the website of the Tax Agency (19.28 million, by 6.9% more) and those made through the mobile application (another 365,000, by 25.8% more) reached 93 % of the total of all those presented, compared to 88% represented by these electronic declarations in the previous year.

New requirement for Sicav to pay 1% tax

The PSOE has tabled several amendments to the anti-tax fraud law being processed by the Congress of Deputies, which include a tightening of requirements for collective investment companies, Sicav, to pay taxes at 1% in companies. Although a minimum of 100 partners is already needed to ensure that this tax advantage does not benefit all types of vehicles, the Socialists propose a minimum participation of 2,500 euros per shareholder (12,500 euros in the case of Sicav on compartments) to avoid the existence of such -the so-called “mariachi” participants, which only seem to allow the main investor to pay less taxes. The PSOE proposes that the change be accompanied by a six-month transition regime, a gateway in which the dissolution and liquidation of a Sicav for this reason is exempt from the Tax on property transfers and documented legal acts. In turn, the partners will not have to integrate the income from liquidation based on income tax, Income Tax or Non-resident income, provided that the money is reinvested before seven months. Its use for the purchase of securities will be exempt from the new Tobin tax.