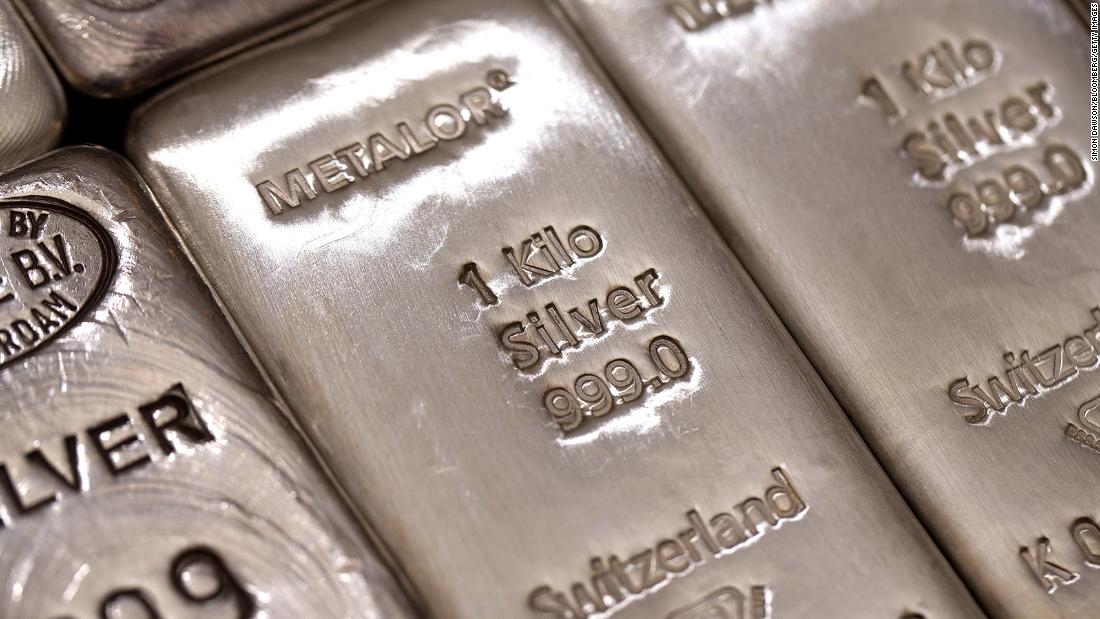

In more recent transactions, silver futures increased by 6.5%.

“SLV will destroy the largest banks, not just small hedge funds,” wrote a WallStreetBets user.

Another JPMorgan Chase claims that it “suppresses metals for a long time. This should be epic. LOADING”.

The Winklevoss twins, who sued Mark Zuckerberg on Facebook and were early supporters of bitcoin, both posted on Twitter support for pushing WallStreetBets into silver.

“If the silver market turns out to be fraudulent, you better think the gold market will be next,” Cameron Winklevoss wrote on Twitter.

Retail sites posted warnings over the weekend that they are facing high demand.

“Due to the unprecedented demand for physical silver products, we cannot accept additional orders for a large number of products until global markets open on Sunday night,” wrote APMEX, which is named the world’s largest online retailer of precious metals. . note on its website.

SD Bullion warned that “due to the unprecedented demand for silver”, it will also not be able to accept orders until Sunday evening. Similar ads were posted by Money Metals and other websites.

“It’s not surprising to see a sharp and sharp increase in consumer demand overwhelming the physical supply of silver coins held by short-term dealers,” Ryan Fitzmaurice, a stock strategist at Rabobank, told CNN Business in an email.

However, unlike GameStop and other popular stocks targeted by WallStreetBets, silver futures have been strong lately. Hedge funds and other institutional investors had been raised to the future of silver, and the precious metal was trading close to multi-year highs.

“It’s a dramatically different market configuration,” Fitzmaurice said. “I’m not sure how well this new Reddit trading strategy will work in futures markets and especially in the remarkably volatile commodity markets.”