As they say, the market may remain irrational more than it may remain solvent. And what’s happening now is that big players are being pushed – if David wants to intimidate Goliath, the legions of day traders, using services, including the Robinhood investment app, to increase stocks.

This is the theory proposed by Michael Batnick, research director at Ritholtz Wealth Management and author of the blog Irrelevant Investors. “These traders are moving from stock to stock. I squeeze all the juice until there’s nothing left and then move on to the next one, ”says Batnick.

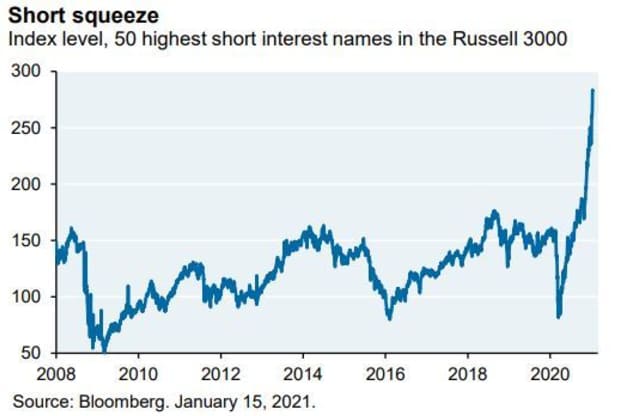

It shows this graph from JPMorgan which shows the shortest companies in Russell 300 RUA,

growing higher. “I can’t prove that digital marketers are to blame, but I don’t think it takes a titanic leap of faith to make the connection,” he said.

Batnick included this viral video of a young couple sharing their investment strategy on TikTok. (If you don’t click on the link, the person says he buys shares when they start to grow and sells when they stop doing so. In other words, impulse trading)

What is different this time? Network effect. “This is a huge community now, and if we’ve learned anything in the last decade, we should be careful about short-circuiting networks. There are non-monetary considerations here, such as membership. And fun. Did I mention he’s having fun? Says Batnick. “I don’t think these people can continue to make money forever, but this idea of ending their departure is not something I see coming.”

Buzz

Supreme Court Chief Justice John Roberts will swear in Joe Biden as the 46th president of the United States. The inauguration will be a core business, thanks to the COVID-19 pandemic, with approximately 200,000 flags replacing people in the National Mall. Vice President Mike Pence will represent the outgoing administration. Biden also announced a series of executive actions he will take on the first day, including the reunification of the Paris climate agreement and the World Health Organization and the halting of the construction of the US-Mexico border wall.

In one of his last acts in office, President Donald Trump pardoned 73 and commuted 70-year sentences, including former councilor Stephen Bannon, Republican fundraiser Elliott Broidy and rappers Lil Wayne and Kodak Black. In the business world, Anthony Levandowski was pardoned after stealing trade secrets from technology giant GOOG Google,

autonomous programs, as well as Gregory Reyes, former chief executive of Brocade Communications, who was the first convicted of illegally withdrawing stock options.

Any member of his family was especially absent from Trump’s list. Joe Exotic, the star of the Netflix series Tiger King, was also not pardoned after he hired a limousine awaiting release from prison.

Netflix NFLX,

shares rose 14% in premarket trading after the streaming service reported 8.5 million new subscribers in the fourth quarter and said it would no longer have to fund debt programming. Consumer Products Giant Procter & Gamble PG,

exceeded earnings estimates, as did Morgan Stanley MS,

ended the earnings season for Wall Street banks, surpassing estimates on both the top and bottom lines.

Alibaba Internet giant BABA,

9988,

grew in Hong Kong trade after founder Jack Ma made his first public appearance at a charity event since meeting with Chinese authorities over the cancellation of Ant Financial’s initial public offering.

Tesla TSLA,

rose as Oppenheimer raised its price target for the electric car maker to $ 1,036.

Short-selling research firm Citron Research is hosting a presentation of GameStop GME video game retailer,

which doubled in price in 2021. In a tweet, Citron said GameStop buyers at this level “are suckers at this poker game.”

markets

US ES00 futures,

indicated a stronger start, with Nasdaq-100 NQ00 technology,

leading contract.

10-year Treasury yield TMUBMUSD10Y,

was 1.10%.

Chart

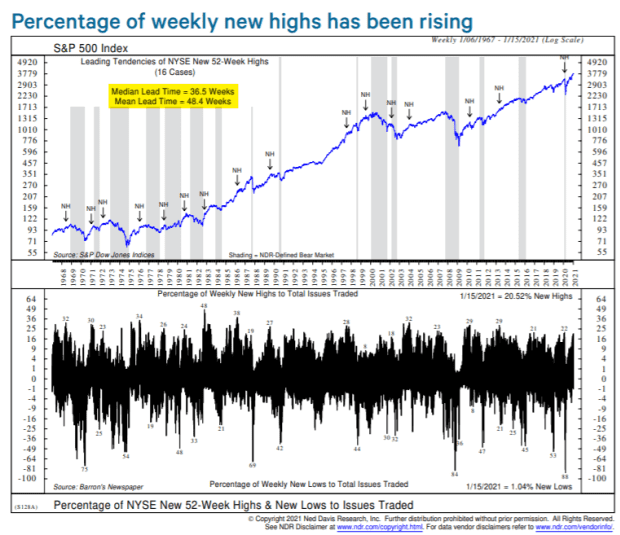

Ned Davis, the chief investment strategist of his namesake Ned Davis, says the market looks full of air, but that the road ahead will continue. The percentage of stocks that record new weekly highs has risen, while the percentage of stocks that make new lows has remained low, he said. Historically, the new highs reached 36.5 weeks before the market hit. He agrees that the market appears to be expanding relative to its long-term trend. But it is not as extensive as 1929 or 2000, he says.

Random readings

The pink swings on the US-Mexico border have won a design award.

A 500-year-old stolen painting, which could have been created by Leonardo da Vinci, was returned to a museum, which did not know that the artwork was missing in the first place.

The need to know starts early and updates up to the opening bell, but sign up here to deliver it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron’s and MarketWatch.