Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

China’s producer prices rose the most in March since July 2018 due to rising commodity costs, adding to concerns about rising global inflation as the pandemic recedes.

The producer price index rose 4.4% from a year earlier, after gaining 1.7% in February The National Bureau of Statistics said on Friday it was higher than the average estimate of 3.6% in a Bloomberg survey of economists. The consumer price index rose by 0.4% after falling for two consecutive months.

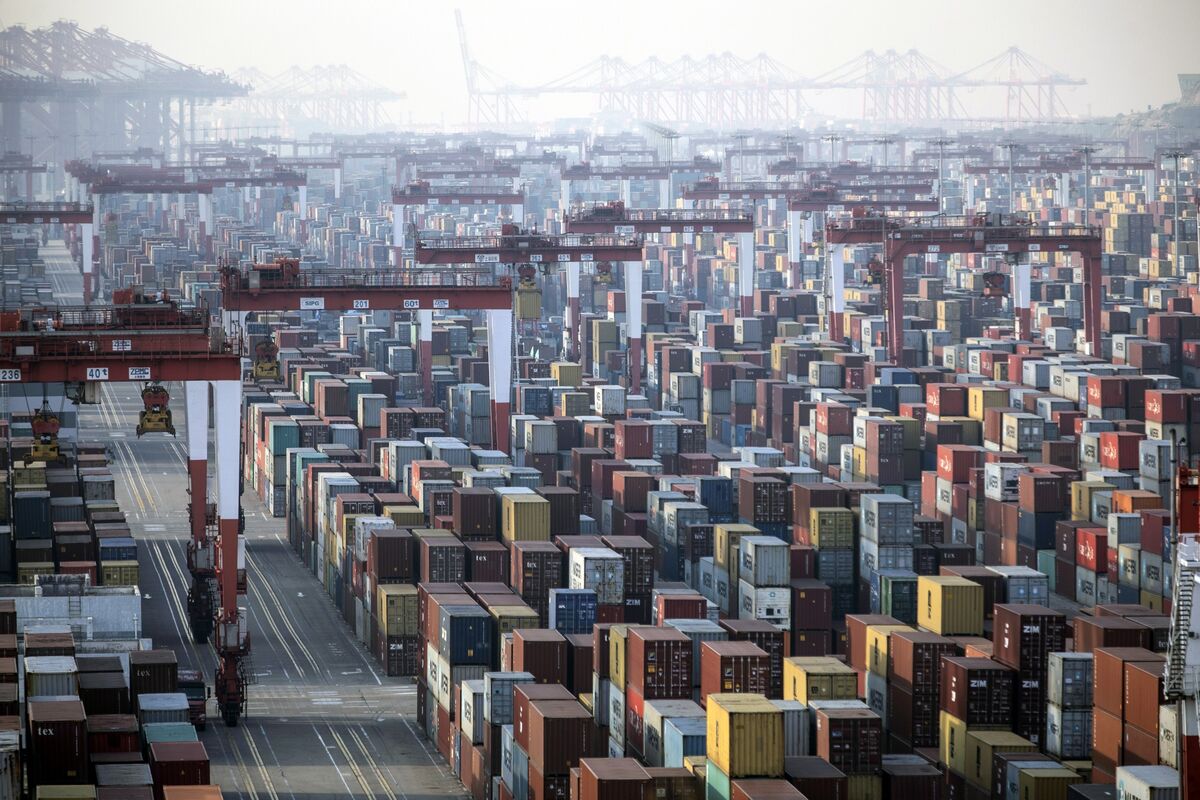

After months of deflation, producer prices have started to rise sharply this year as the costs of oil, copper and agricultural products rise. As the world’s largest exporter, rising prices in China threaten to cause inflation worldwide, increasing volatility in financial markets. Inflation risks are already rising due to a stronger recovery in the world economy, a massive fiscal stimulus in the US and rising transport costs.

“Our research has found that the PPI in China has a high positive correlation with the CPI in the US,” said Raymond Yeung, chief economist for Greater China in Australia and New Zealand Banking Group Ltd. the judgment had an impact on inflation pressure in the US and globally, and this impact should not be underestimated. “

The CSI 300 index has fallen 1.5% since 14:55 in Shanghai. Shanghai futures prices fell, while construction steel fell.

What Bloomberg Economics says …

Under China’s rising inflation in March there was a significant divergence – commodity prices were major factors, while household demand was relatively stable. There are two implications – industrial firms have to gain from higher prices, and consumers are not standing up again.

– David Qu, economist

Click here to read the full report

Growing profits

Rising commodity prices have gained the attention of China’s most important decision-makers, with the Financial Stability and Development Committee – chaired by Deputy Prime Minister Liu He – calling for price stabilization efforts this week. Authorities should “closely monitor commodity prices,” the committee said in a statement on Thursday evening.

Inflation data shows that consumption remains low, giving the central bank reasons not to tighten monetary policy soon, according to ANZ’s Yeung.

“If inflationary pressures start to show up in consumer prices, the policy could start to tighten,” he said.

Consumer price deflation in recent months has been driven mainly by falling prices for pork, a key component of China’s CPI basket. Although prices are likely to rise, the slow recovery in household spending means that inflation is likely to remain moderate. Basic consumer prices, which exclude volatile energy and food costs, rose 0.3% in March from a year earlier, while food prices fell 0.7%.

“The recovery of the manufacturing industry is fast, but the rate of return to consumption is slower than ideal,” said Zhou Hao, a senior economist in emerging markets at Commerzbank AG in Singapore. “The recovery of the services sector is not ideal either, but production is exceptionally good, which means that production will continue to drive growth in the future, while services will be an obstacle.”

PPI growth could reach over 7% in the next two to three months, he added.

For Chinese enterprises, rising factory prices mean higher profits and a greater ability to repay debts industrial profits increase in the first two months of the year in the same period in 2020, recent data show. However, purchase prices for industrial companies rose even faster in March than the price of finished goods, which could reduce profits if it continues.

– With the assistance of John Liu, Yinan Zhao, Yujing Liu, Lianting Tu and Jason Rogers

(Update paragraphs 1 and 3.)