Shares of Nvidia Corp. they rose on Monday, but ended at a record high after the chip maker’s annual conference began with a rosy revenue outlook and product announcements.

NVDA Nvidia,

the shares rose to a high of $ 614.10, but closed 5.6% higher at the session at $ 608.36, outside its closing close of $ 613.21 set at February.

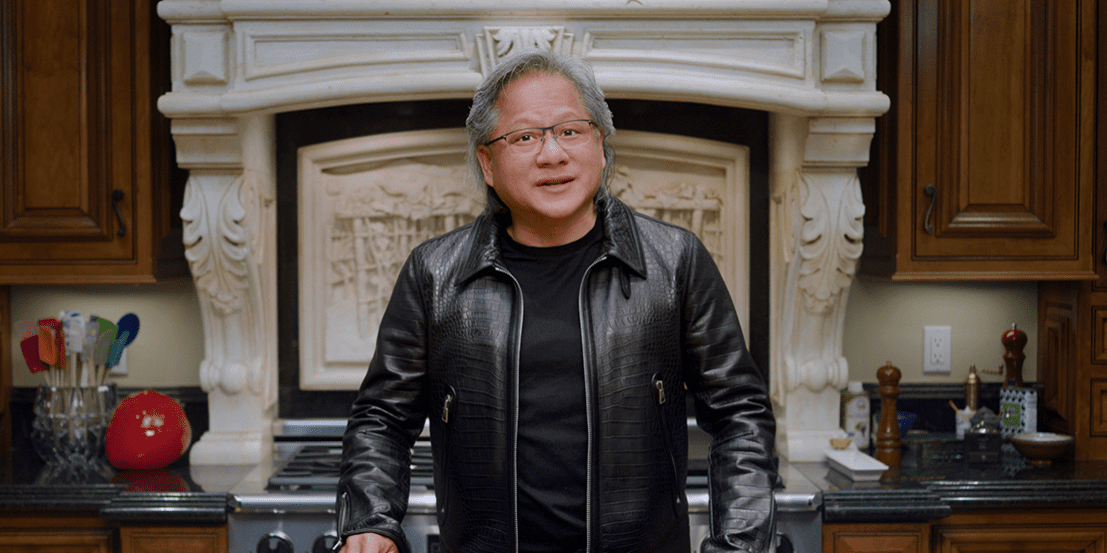

Nvidia shares gained after CEO Jensen Huang announced Monday morning at the annual GTC developers’ conference that the chip maker is launching its first central data center or CPU – unlike its basic graphics or GPU, based on Arm Holdings PLC technology, competing against rivals Intel Corp. INTC,

and Advanced Micro Devices Inc. I HAVE D,

Don’t miss it: Nvidia intensifies competition with Intel and AMD with Arm’s first data center processor

Earnings accelerated later that day, after the company revealed that first-quarter tax revenues exceeded the $ 5.3 billion forecast. At the end of February, Nvidia had forecast revenues of between $ 5.19 billion and $ 5.41 billion. Analysts surveyed by FactSet expect $ 5.32 billion. Colette Kress, Nvidia’s chief financial officer, said the revenue “exceeds the $ 5.30 billion outlook provided during our end-of-year earnings call,” but did not set a new specific target.

“Within the Data Center we have a good visibility and we expect another strong year. Industries are increasingly using AI to improve their products and services, ”Kress said in a statement. “We expect this to lead to increased consumption of our platform through cloud service providers, resulting in more acquisitions as we move through the year. “

Nvidia also said it expects first-quarter revenue of $ 150 million for its cryptocurrency chips, up from the previously expected $ 50 million.

Most of the chip sector traded lower Monday, as the PHLX Semiconductor Index SOX,

down 1.1% as the S&P 500 SPX,

fell below 0.1%. Over the past 12 months, Nvidia’s stock has risen 131%, while the SOX index has risen 103% and the S&P 500 has risen 48%.