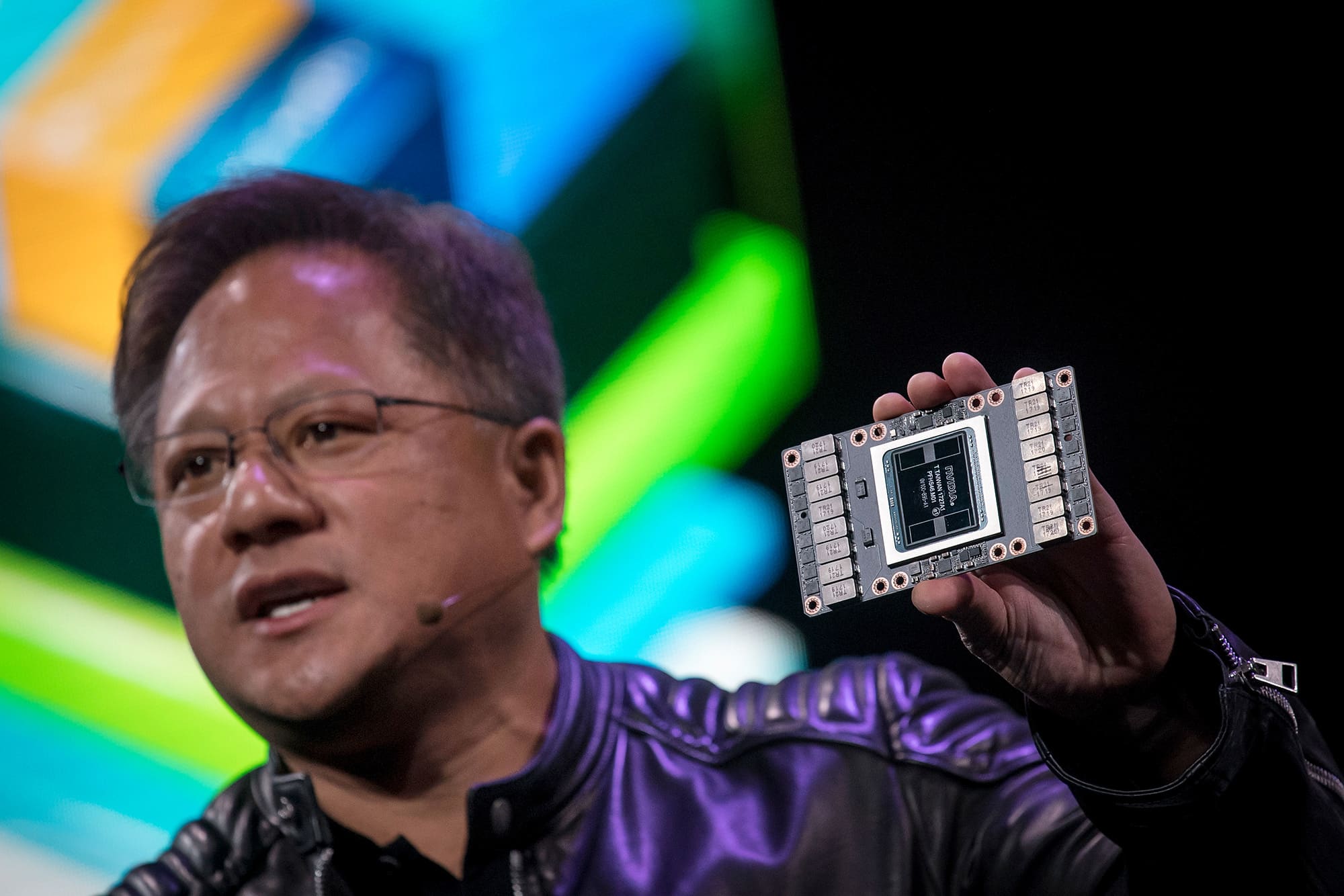

Nvidia CEO Jensen Huang told CNBC on Thursday that he is confident in the company’s growth story, even if his potential blockbuster acquisition of British chip designer Arm will not happen.

“Nvidia will be huge no matter what,” Huang told Mad Money in response to a question from the show’s host, Jim Cramer. Cramer asked the executive how investors should think about Nvidia in the long run, while its $ 40 billion transaction for the purchase of Arm owned by Softbank remained pending.

Many companies in the technology landscape, including Californian chip maker Qualcomm and Microsoft, have said they are worried that the Nvidia-Arm deal could affect competition. The FTC, the US antitrust regulator, has opened a “thorough investigation” into the acquisition, Bloomberg reported earlier this month.

Nvidia, which is known for its graphics gaming chips, first announced the deal in September. Shortly after it was covered in the media, Cramer told “Money Money” viewers that if “Nvidia can close on Arm Holdings, the stock will be unstoppable even after its magnificent multi-year run.”

Nvidia shares have advanced 103% in the last 12 months, compared to a gain of 22.4% for the S&P 500. In the last five years, the chip maker’s shares have increased by almost 1,600%.

Huang said Thursday that Nvidia chips remain essential to many disruptive technologies, keeping its secular winds in check. A day earlier, the company reported quarterly sales of $ 5 billion, an annual increase of 61%. Both revenues and revenues exceeded Wall Street expectations.

“The growth opportunity ahead of us for artificial intelligence, autonomous vehicles, production, industrial robotics, 5G edge, these applications will make us a very big company,” said Huang, who founded Nvidia in California in 1993. “I think our trajectory Growth is very interesting … We expect it to be an excellent year of growth for the data center and all of this is independent of Arm, ”Huang added.

At the same time, Huang sought to defend Nvidia’s desire to buy Arm, which is known for designing the chip architecture used in most mobile phones in the world.

“We will be able to inject so much engineering scale and so interesting into the Arm to accelerate their roadmap, which the ecosystem will love,” he said, adding: “We will achieve this agreement. I’m very confident in that. ”

Last year, Nvidia completed a $ 7 billion acquisition of chip maker Mellanox Technologies. It took more than 13 months for Chinese regulators to review the transaction.

Shares of Nvidia closed above 8% on Thursday, which proved to be a difficult session for many technology companies, while investors digested rising bond yields.

Disclosure: The Cramer charity holds shares in Nvidia.