Chris Hondros | News | Getty Images

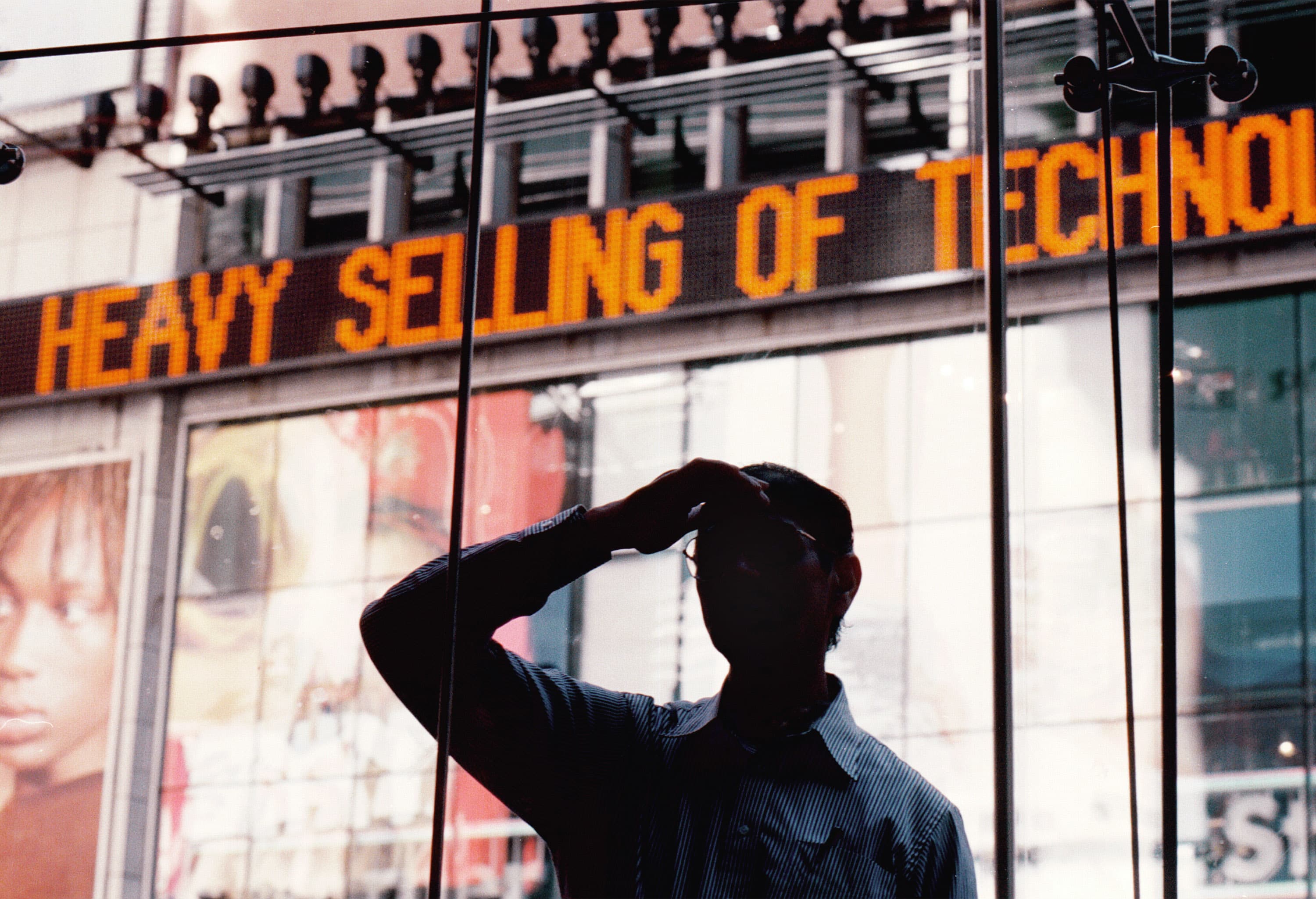

Investors are finally retiring from technology stocks after a decade of superior performance.

For the fourth week in a row, the highly technical Nasdaq Composite watched the Dow Jones industrial average. It is the longest period since April-May 2016, which was also the only year in 2011 that the Dow defeated the Nasdaq.

Market experts have been predicting a technological cooling for years and have consistently been wrong, due to the growing dominance of mega-head companies such as Apple and Amazon, the frenzy surrounding Tesla and the massive shift in spending on cloud computing.

“There have been years of frustration at trying to make this trade fair,” said Jack Ablin, who oversees $ 12.5 billion as director of investment at Cresset.

Ablin said he feels different this time. Starting in the fourth quarter, his company launched a new “quality dividend strategy”, moving customers from technology and industrial, financial, material and energy companies. He bet on a democratic sweep in November, followed by a large package of incentives that would pump money into the economy, leading to inflation and higher interest rates.

President Joe Biden, along with Vice President Kamala Harris (R), talk about the American plan to save the White House rose garden in Washington, DC, on March 12, 2021.

Olivier Douliery | AFP | Getty Images

The 10-year treasury rose to its highest level in more than a year on Friday, reaching 1.642%. Rising rates provide investors with an incentive to shift money to fixed income, while inflation tends to have an oversized impact on growing companies as it lowers expectations for future profits.

Meanwhile, the $ 1.9 trillion coronavirus aid package signed by President Joe Biden on Thursday will send direct payments of $ 1,400 to most Americans and extend the children’s tax credit and provide rental and utility assistance.

“Recharge request”

Add to Biden’s statement that all adults will be eligible for a Covid-19 vaccine by May 1, and the economy appears ready for a significant recovery in 2021.

“There is a retained demand to actually go out and do things, take vacations, go to bars and restaurants,” Ablin said. People will “take all that money aside and spend it,” he said.

Even though Biden and the Democratic Congress are focused on expanding green energy alternatives, the current prospects for travel and return to work are to the benefit of traditional oil and gas companies. In the S&P 500, energy stocks have the best results this year, up 40% as a group. The best performing groups this week were discretionary consumer, real estate and utility stocks.

Dow Industrials rose 4.1% weekly to a record 32,778.64. After three consecutive weeks of declines, the Nasdaq rose 3.1% to 13,319.87. For the year, the Dow rose 7.1%, while the Nasdaq gained 3.4%.

Dow Vs. Nasdaq in 2021

CNBC

Ablin knows it’s too early for a victory round. Even if the technology has a poor performance, there is still a ton of money going into even more speculative assets. Bitcoin has almost doubled in value this year, and on Wednesday a non-fungible token (NFT) by the artist Beeple sold for over 69 million dollars in an auction through Christie’s.

Ablin said he was just asked about NFT by a customer on Thursday. While acknowledging that he does not have a strong view on them, he said that if the beneficiaries of incentive money opt for risky investments instead of traveling and buying consumer goods, the market could look very different in the coming months.

“If it really isn’t spent, but it’s plowed on the market, that would take the carpet out of our thesis,” Ablin said. For example, he said, “If instead of taking a vacation, they buy Tesla shares.”

Tesla shares rose 16% this week. But that was after falling 30% from the previous month.

CLOCK: NFTs see record prices as artists and Silicon Valley buy