A retreat for the Dow Jones industrial average and the S&P 500 index on Tuesday stopped the longest series of earnings per share in recent months, but a major concern for investors remains: Is there a major correction approaching?

Even some bullish investors have called for a reduction in shares as a kind of catharsis for the next bigger stage and a relaxation of some of the frantic, retail-inspired bets that have repeatedly sent shares to new records amid recovery. COVID-19.

A brief retreat that began in late January, linked to the commercial fervor surrounding GameStop Corp. GME,

and AMC Entertainment Holdings AMC,

We have seen markets test a few short-term downtrend lines, but recently the markets have managed to turn back to produce unsatisfactory returns at the beginning of a year full of uncertainties.

Dow Jones Industrial Average DJIA,

is up 2.5% so far, S&P 500 SPX,

enjoys a more pronounced gain of over 4%, while Nasdaq Composite COMP,

and Russell 2000 RUT,

The index on Tuesday set the 10th record so far in 2021.

The gains recorded so far in the high-capacity Nasdaq, up 8.7%, and in Russell 2000, up 16.4%, reflect a strange convergence of investor betting: those betting on additional prosperity in growth stocks COVID’s large-cap pandemic that ran in the wake of the US pandemic in March, along with bets on a significant return to the economically sensitive, low-capitalized stocks represented in Russell.

In both cases, cautious investors and those worried that the good times may not last forever are preparing for the next major drop in equities and ruminating on how it might turn out.

Earlier this week, Morgan Stanley’s Michael Wilson told CNBC in an interview that “It was short, so if you blinked you missed it,” referring to the stock withdrawal at the end of January.

“That seems to have been the case so far, and I mean the markets are pretty strong right now and they have been,” Wilson said.

“There is an extraordinary liquidity, there is a very good story and very easy to understand behind the scenes. That is, we have a strong economic recovery, visible to everyone. The earnings season has been good so far … and people have gotten involved in it, ”said analyst Morgan Stanley.

He warned, however, that the market remains in a “slightly fragile state” and warned that the lever that spins in the system could bring withdrawals by 3% or 5% more than the rules.

Wilson said, however, that the resurgence of individual investors in the financial markets would be a force to be reckoned with and that they now represent the marginal buyer on Wall Street, maintaining the prices of sustained assets.

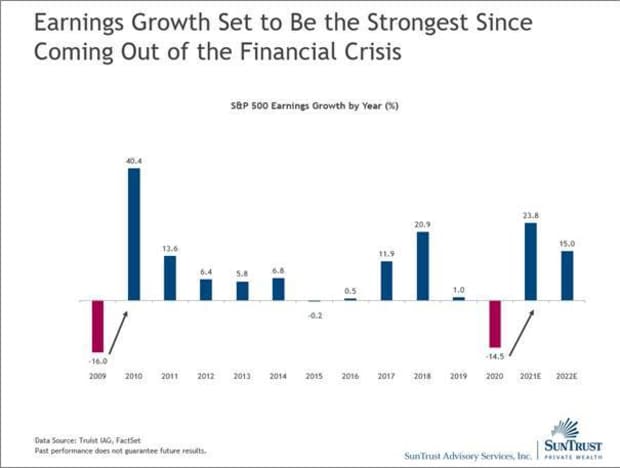

Keith Lerner, chief market strategist at Truist Advisory Services, said worries about a stock bubble are exaggerated and not supported by the current batch of fourth-quarter earnings results, which his firm estimates will be the best to the financial crisis of 2008.

Truist Advisory Services Inc./SunTrust Advisory Services Inc.

“Although there are foamy segments of the market that are detached from the fundamentals, we do not see wider bubble conditions,” Lerner wrote in a research report on Tuesday.

“Instead, we see a stock market trading at a better value than historical valuations – partly justified by low rates, a shift in sectoral composition towards higher value growth sectors, a supportive monetary and fiscal policy, and and lower market access (ie the secular decrease in commissions and fund fees), “Truist analysts added, noting that a lower barrier to entry for individual investors also provided support for stock values.

Meanwhile, Daniel Pinto, co-chair of JPMorgan Chase & Co., told CNBC in a question and answer that he expects the stock market to slip further.

“I think the market will gradually die during the year,” he told the news network. “I do not see a correction soon, unless the situation changes dramatically,” he said, describing possible recessions as mini-corrections that will not necessarily change the general upward trend.

What could change things?

Naeem Aslam, chief market analyst at AvaTrade, in a report on Tuesday, said that optimism in the US market is driven by three actors: Monetary and fiscal policy support, progress in COVID vaccinations and solid quarterly results.

“Basically, it looks like the stars are queuing up and there are strong odds stacked in favor of another bull rally,” Aslam wrote.

“In other words, we need major changes in the current catalyst to change the market narrative among traders that can trigger a minor pullback – not to mention a serious correction,” he added.

William Watts of MarketWatch writes that some experts point to the 2009 stock market as the closest parallel to the current stock configuration. Quoting Tony Dwyer, chief market strategist at Canaccord Genuity, Watts noted that 2021 could play more like the post-crisis scenario seen in 2010, which would point the way to a “solid year” for the market, but with a rough ride. thanks to “several corrections in the first half. ”

Part of the bumpiness could emanate from the bond market, with TMUBMUSD10Y for 10 years,

and Treasurys for 30 years TMUBMUSD30Y,

testing recent yield highs and putting some pressure on stocks.

The so-called inflation trade, in which yields are rising and investors are gravitating towards investments that could thrive in better economic times, has so far offered a series of false dawns for investors.