The economy provided a lot of indicators that claimed to show when growing economies were approaching a kind of speed limit. But increasingly, inflation is the only one taken seriously.

A sustained rise in prices would probably convince policy makers that it is time to put a stop to the expansionary measures taken in the pandemic, such as high public spending or low borrowing costs. That’s why Tuesday’s US consumer price data will be so closely watched – though it will take more than a month to change its mind.

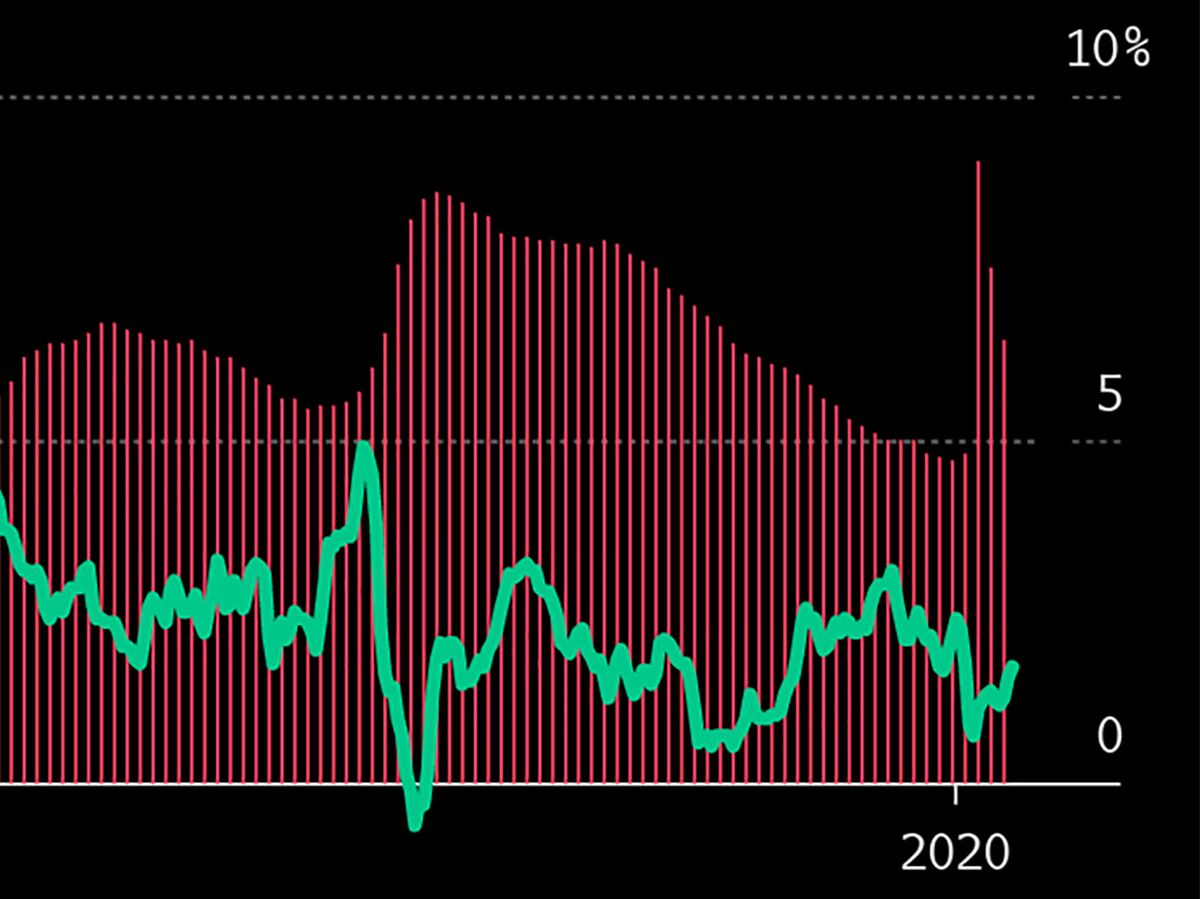

Yesterday’s problem – Or tomorrow’s?

Decades have passed since inflation was a pressing issue in the rich world

Source: Organization for Economic Co-operation and Development

Meanwhile – as part of a profound shift in economic thinking, which has picked up pace over the past year – a whole range of other indicators that were once based to mark future problems are at a disadvantage.

Budget deficits and public debt were thought to cast a warning at certain levels – until many countries exceeded these limits, especially in the last year, without collapsing. Estimates for full employment or most jobs that could create an economy without overheating have proved wrong.

The measures of the so-called “output gap” should capture how close an economy has reached its maximum capacity – but many analysts have concluded that it relies too much on the recent past to be a useful guide.

The pivot of humility

Abandoning or minimizing all these criteria means that officials are less likely to take preventive action that has stifled expansions in the past.

Change also rises to a pivot to humility, in a profession that is not famous for it. Economists were accustomed to giving their predictions as the basis of policy. They need to recognize that the future is full of things they just don’t know.

“The influence of long-term projections has evaporated and it’s a very good thing,” says James Galbraith, a professor of economics at the University of Texas. “Develop policies to deal with the problems you have. If they have consequences later, you will address them later “.

This philosophy underlies the Federal Reserve’s new interest rate framework. Over the last decade, the central bank has begun to raise borrowing costs, even though inflation has fallen and unemployment has remained at around 5% since the financial crisis.

Now, Fed officials actually acknowledge that it was a mistake, because lower unemployment did not trigger a rise in prices. And now they say they will base politics on what actually happened in the economy, rather than on what is expected to come next.

Room to run

The decade before Covid-19 showed that the US economy could continue to create jobs without triggering inflation

Source: Bureau of Labor Statistics

Three times in one In a speech last month, Federal Reserve Governor Lael Brainard contrasted the “results” with the “prospects” – and said Fed policy would be based on the former, not the latter.

In fiscal policy, too, speed limits have been rethought.

The budget deficit and national debt, as part of the economy, have been commonplace for measurements. The European Union has imposed deficit limits of 3%. Economists Carmen Reinhart and Ken Rogoff, in an influential study a decade ago, argued that debt to 90% of GDP was a dangerous tipping point.

This type of thinking led to austerity policies after the initial shock of the 2008 financial crisis – and the result was a weak recovery. But budget forecasts tended to be too pessimistic because they did not anticipate that interest rates would remain low.

Wrong piece

OBC has consistently overestimated the costs of government borrowing

Source: Congress Budget Office

In the pandemic, governments have been more willing to spend, especially in the US President Joe Biden is pushing measures worth more than $ 5 trillion in his first year – fuel for what already appears to be a faster recovery of the economy.

How hot?

In some respects, the new approach aligns with the school of thought called Modern Monetary Theory. The MMT says governments have room to revitalize their savings with fiscal spending and argues that inflation – rather than the level of deficit or debt – is the metric that budgetary authorities need to pursue.

“One thing the mainstream has caught on is is to allow the economy to work a little harder,” says Scott Fullwiler, an MMT economist and associate professor at the University of Missouri-Kansas City. “That’s the thing I’ve been hitting for decades.”

Unfortunately, says Fullwiler, economists have not paid enough attention to the question of what would be a safe maximum rate – and have focused too much on central banks, even if fiscal policy is now leading to recoveries.

“The economist profession, in general, has a capacity large enough to realize how hot the economy can work,” he says. It would have better answers right now “if economists had worked on fiscal policy frameworks to stabilize the economy and keep inflation low, instead of an optimal monetary policy, which is virtually irrelevant.”

“Meaningless exit gaps”

In the US, opponents of Biden’s spending have called for the “production gap” – the difference between the goods and services that an economy actually produces and the maximum that it could sustainably manage.

Remember the Gap

The US economy has grown largely below its 1980 potential

Source: CBO Economic Outlook, February 2021

Former Treasury Secretary Larry Summers and the Committee on Responsible Federal Budget, for example, argued that last month’s stimulus bill was much larger than was needed to close the shortfall and risked triggering inflation as a result. .

But many analysts are skeptical about the measure. Robin Brooks, chief economist at the Institute of International Finance, has been running a campaign against “meaningless production shortages” for years.

The production gap is “an extremely important concept” that underlies all major political appeals, he says. “No one has any idea how to measure it.”

Production gaps are based on estimates of the potential of an economy. A small shortcoming means that production is considered to be close to its speed limits, and trying to make it go faster could trigger inflation.

But Brooks says the potential is often calculated simply by looking at what has happened in the recent past. He says that when a country has been performing poorly for a long time, like Italy, in recent decades, the result is that its potential is also degraded – effectively putting the ability to get the right things.

Rather?

Production gap in Q4 2020 as a share of potential GDP

Source: Goldman Sachs Economics Research

In a February report, Goldman Sachs economists tried an alternative way of measuring it and concluded that the output gaps in Italy’s major economies to the US were probably larger at the end of last year than official estimates suggested – meaning that there was “more weakness,” a lower risk of inflation and a stronger case for expansionary policy.

Since then, the US recovery has picked up pace, surprising many analysts.

Read more: US jobs return, surprising employers and economist

Galbraith, who was director of Congress’ s Joint Economic Committee during the recession in the early 1980s, says emergencies are not the right time for policymakers to try any kind of precision prediction.

“Don’t try to calculate these things,” he says. “You throw away as much as you need and much more. And then, if it turns out you’re doing too much – which is unlikely – you’re resizing it. “