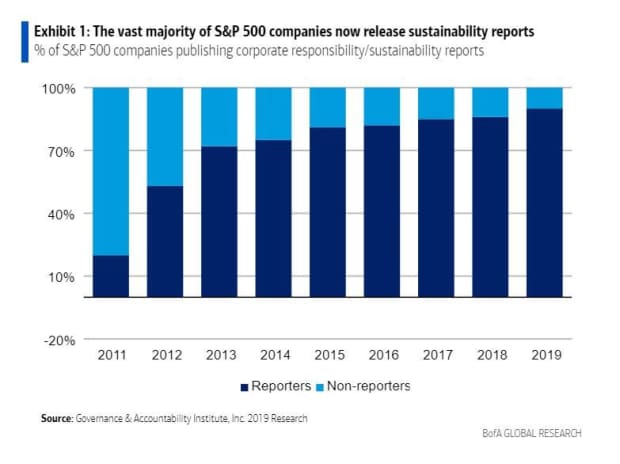

Most companies listed on the S&P 500 are more transparent about their exposure to climate change risk than a decade ago, while investors seem a little wiser in setting the prices of these stocks based on changes expected to come with a warming planet.

For Earth Day, Bank of America’s equity and quantified strategy team, led by Savita Subramanian and Marisa Sullivan, created a punch list that highlights the “surprising greening” of the S&P 500 SPX,

The broad index enjoys an increase of almost 11% this year and has increased by 49% in the last year.

Most of the emissions related to the S&P 500 – 70% – are generated by industries, utilities and energy combined, however these stocks represent less than 15% of the total index.

Read: ESG funds have more energy stocks than you might think

From there, the “green” dissection of the index is more nuanced. Here are some of BofA’s findings in a series of diagrams.

Companies are making voluntary moves – although a push has been needed in many cases from investors, customers and employees – to protect and find opportunities in a global shift towards renewable energy, carbon capture technology, lower dependence on oil CL00 ,

and natural gas NG00,

smarter water use and more. These actions precede what is considered the potential for stricter regulation, which will force companies to discover and report on the risk of climate change in a uniform way.

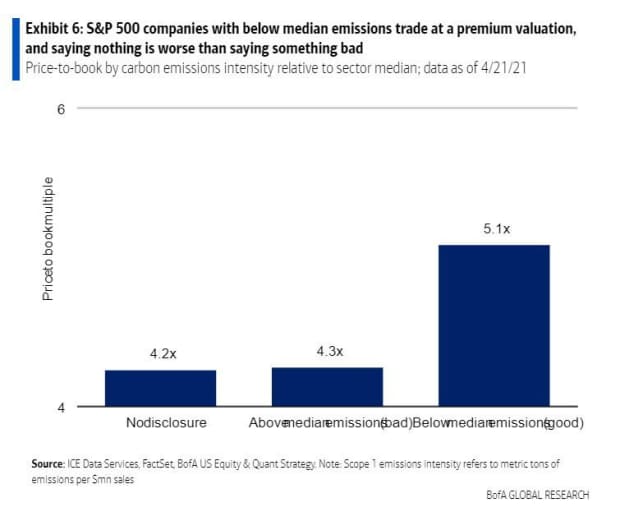

High-emission companies trade at a discount of over 15% for low-emission companies. But saying nothing can be worse than saying something bad: companies that do not disclose emissions data trade with an even deeper cut, analysts said.

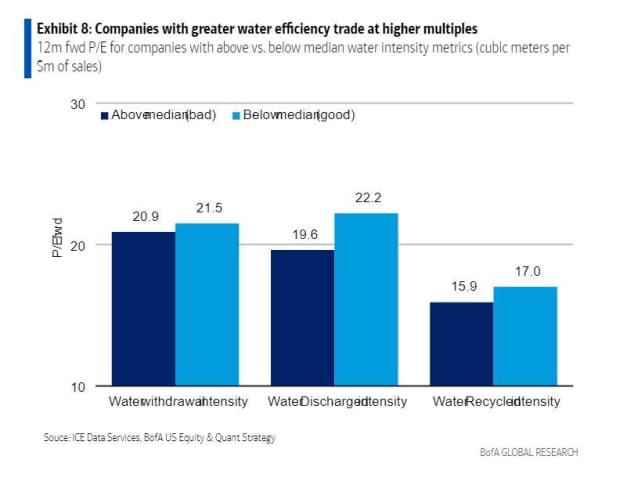

The BofA team tracked higher multiples for S&P 500 stocks related to low emissions, zero net targets and water efficiency.

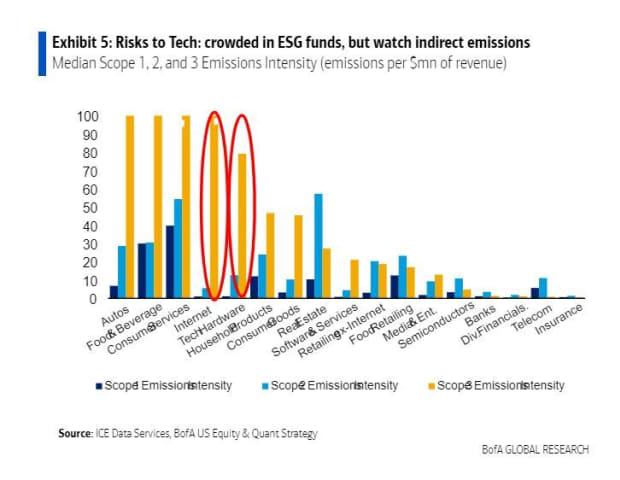

And analysts have found that technology stores XSW,

RYT,

which have been fixed in environmental, social and government funds (ESGs) and ETFs, are not so “green” due to high indirect emissions.

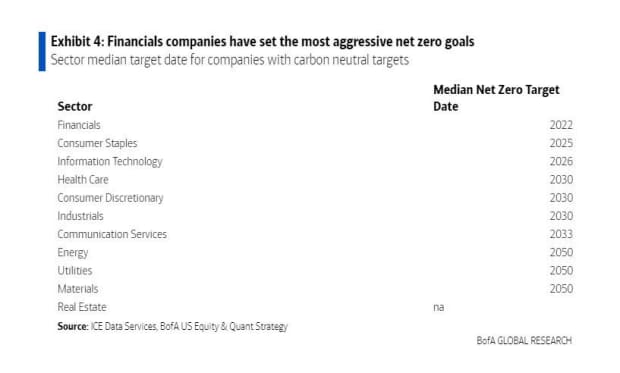

Among companies with carbon-neutral targets, financial companies have set the fastest median target date, 2022. This is followed by consumer core companies, which have a median target date of 2025.

However, financial firms have faced new scrutiny over the fact that, despite emission commitments for their operations, banks continue to finance traditional energy sectors whose emissions pollute.

Read: Major banks freshly commit $ 1 billion in climate change spending, but remain under scrutiny for oil patch funding

And: Banks are much more exposed to climate change than they reveal

Read: Invest in batteries for electric vehicles, water technology and cryptographic applications to go green, says UBS

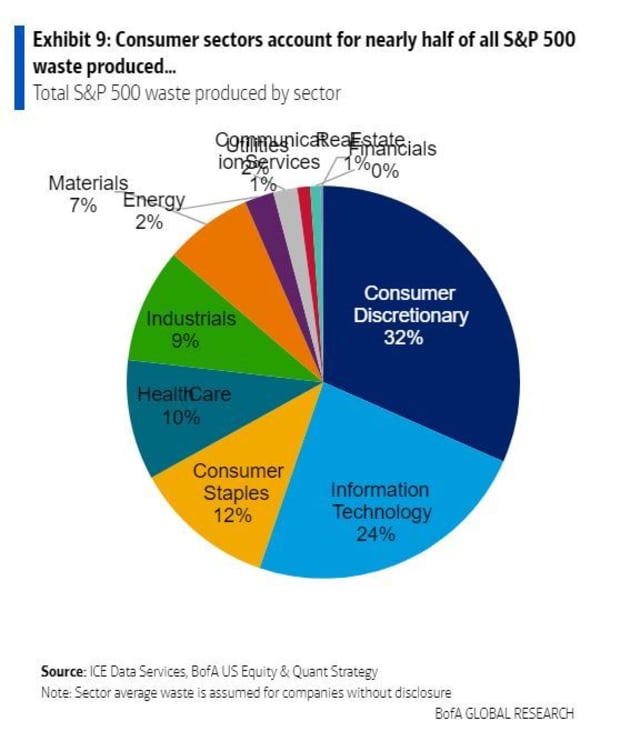

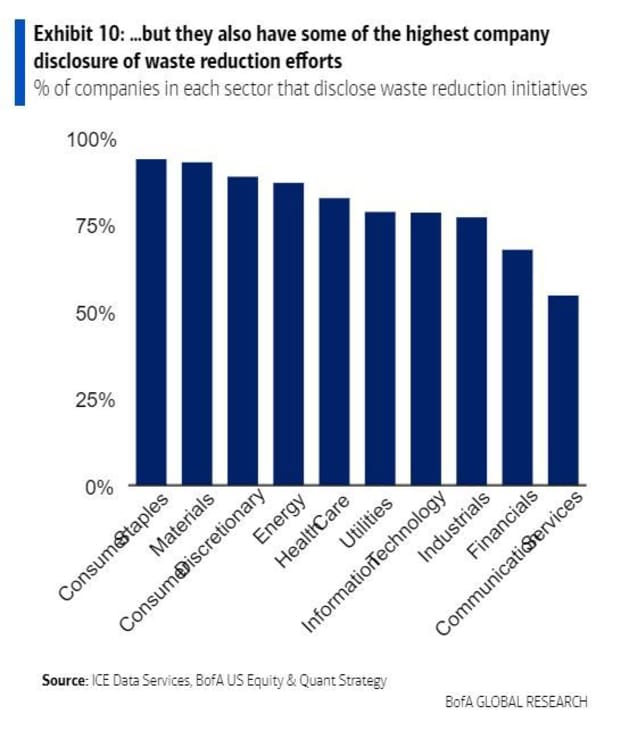

Consumer sectors account for half of all S&P 500 waste, while technology ranks second. So far, core consumers and discretionary sectors are among the highest percentage of companies with waste reduction initiatives, according to the BofA analysis.

With a broader perspective on stock market indices, Arabesque, a technology company with sustainable financing, found that companies in 14 of the world’s largest stock market indices generally remain in efforts to meet the climate change targets set by major corporate bodies. lead.

Using data between 2015 and 2019 and its Temperature Score technology, the company included FTSE 100 UKX,

S&P 100 OEX,

DAX DAX,

and Nikkei NIK,

in his research. It found that just under 25% of companies listed on all 14 indices are aligned to meet the 1.5-degree warming target, a key point of the UN COP26 and Joe Biden-led climate summit. from this week.