With global markets coming together in the hope that the massive economic stimulus will accompany the new administration of President-elect Joe Biden, the Goldman Sachs projection that the S&P 500 will end in 2021 at 4,300 points seems even more realistic.

In ours call of the day, the chief strategist of the US investment bank, David J. Kostin, paved the way for 4,300.

Goldman sees S&P 500 SPX,

increasing by 14% throughout the year, after one of the most watched indices in the world closed at 3,756 by the end of 2020. An additional 7% increase of the index is expected for 2022 – reaching 4,600.

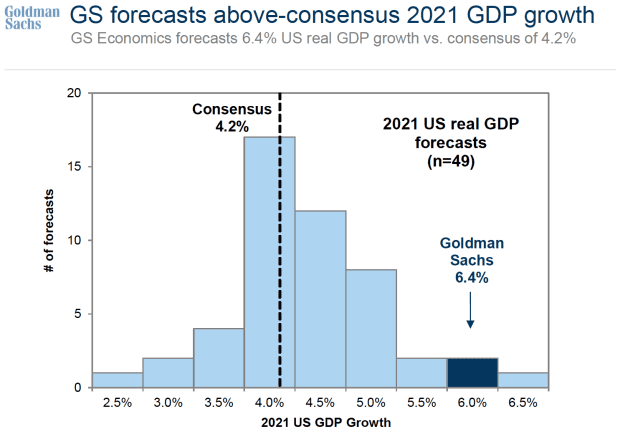

The basis of a double-digit forecast for returns in 2021 is the upward projection of the investment bank on the US economy – 6.4% real growth of gross domestic product compared to the consensus of 4.2%.

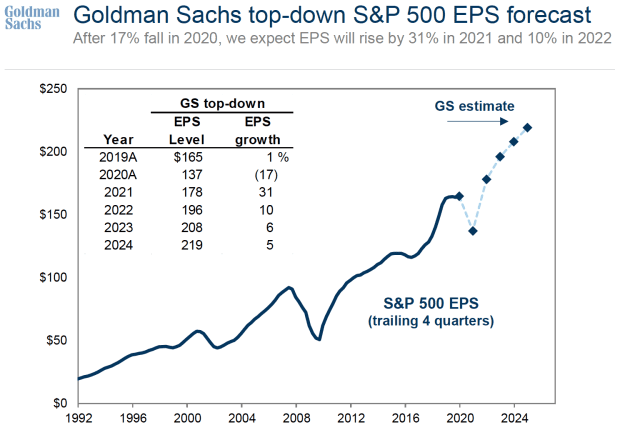

Adding to the economic growth of the shares is added a massive increase in earnings per share (EPS), a recovery from the negative impact that the COVID-19 pandemic had on corporate results. Goldman expects EPS to increase by 31% in 2021, after declining by 17% in 2020.

Along with EPS are projections of a strong return on margins, which Goldman expects to be higher than the bottom-up consensus forecast. An increase in margins is largely due to operational leverage, as well as cost moderation, such as labor.

Leverage stocks with a high level of exploitation exceeded performance in 2020, and Goldman expects this trend to continue until this year, based on strong economic growth.

In many ways, the 18% rally on the S&P 500 in 2020 was helped by its top five stocks: tech giants Facebook FB,

Amazon AMZN,

Apple AAPL,

Microsoft MSFT,

and the GOOGL Alphabet,

These shares returned 56%, compared to an increase of 11% compared to the remaining 495 companies.

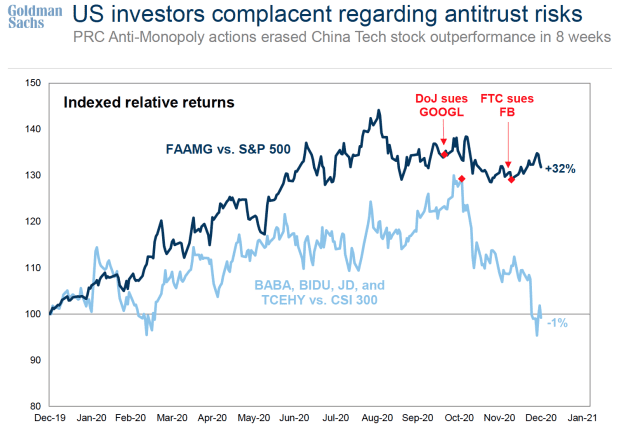

However, Goldman warns that investors are happy with the antitrust risks.

While China’s antitrust actions eliminated the performance of Chinese technology stocks in just eight weeks, the market largely did not react to the Justice Department’s lawsuit against Google and the Federal Trade Commission’s lawsuit against Facebook.

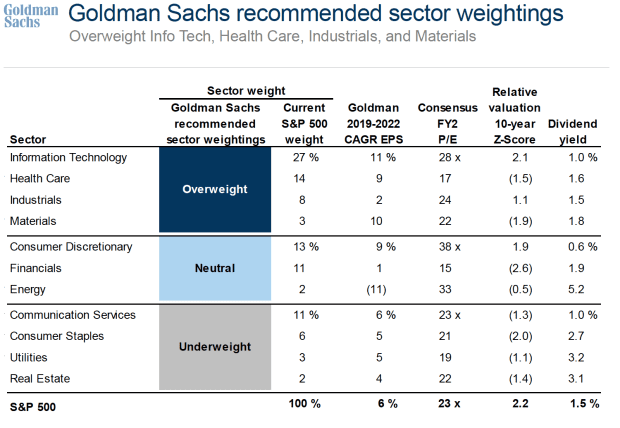

Closing the roadmap at 4,300 is the sector weightings recommended by Goldman Sachs. The investment bank has information technology, healthcare, industry and materials classified as overweight, while communications services, consumer commodities, utilities and real estate are underweight.

Buzz

A day after Donald Trump became the first president to be indicted twice, Biden is to propose a $ 2 trillion increase in tax spending to help the US economy get through the COVID-19 pandemic, according to a report by CNN.

Alibaba 9988,

and Tencent 700,

shares rose in Hong Kong and Baidu rose in the Nasdaq premarket, after reporting that, after all, US investors will not be banned from investing in Chinese internet giants.

It is an important day for data, with initial and ongoing requests from the unemployed. Approximately 800,000 initial unemployment claims are expected to be reported – up from 787,000 last week. But Federal Reserve Chairman Jerome Powell’s speech at 12:30 pm EST on the economy will likely be the star of the economic show.

The National Road Safety Administration has asked the electric car manufacturer Tesla TSLA,

to voluntarily recall 158,000 Model S and Model X cars, after it was provisionally concluded that a possible defect on the vehicle screen could affect safety.

Read also: He started buying Tesla for just $ 7.50, and now retires at age 39 for $ 12 million – still refuses to sell a single share

Did you run out of crypto? According to Cointelegraph, the eToro exchange platform is struggling to keep up with “unprecedented demand”, warning cryptocurrency traders with limited liquidity, which means that there may be limitations on purchase orders.

Which add: Bitcoin and the “funny business” should be regulated globally, says the head of the European Central Bank

SPCE of Spaceflight Virgin Galactic,

the stock rose nearly 12% in the New York premarket after ARK Investment Management filed with the Securities and Exchange Commission to launch a publicly traded fund to explore the space.

markets

Looks like a positive day ahead. YM00 stock futures,

ES00,

NQ00,

are oriented higher, set for a strong opening, with the Dow pointing upwards by over 100 points. Asian markets NIK,

HSI,

SHCOMP,

gathered in general, while the European SXXP indexes,

UKX,

DAX,

PX1,

they are constantly in the green.

Market optimism comes as investors look at a possible $ 2 trillion stimulus proposal from Biden. The sentiment is also supported by the rare shift in tensions between the US and China, as it looks like US investors will not be blocked from investing in some Chinese internet giants.

Chart

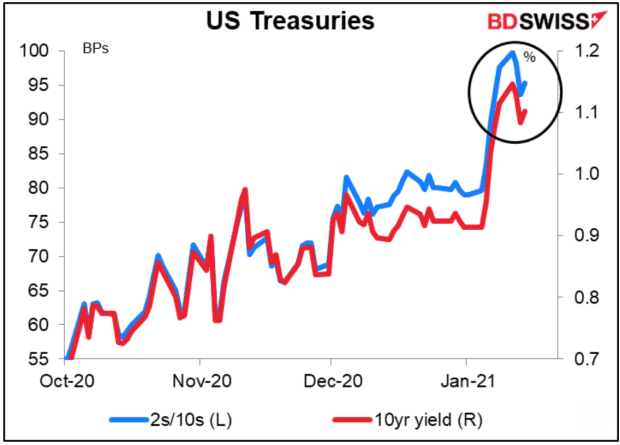

US Treasuries are the center of attention in the chart of the day from Marshall Gittler to BDSwiss.

Yields on the 10-year treasury note TMUBMUSD10Y,

initially fell on Wednesday, pushed down by strong 30-year bond demand in a $ 24 billion auction. But the fall was reversed late the day after the report on Biden’s stimulus plans.

Random readings

Looking for: bison rangers from Great Britain, no previous experience expected.

The mayor of a Houston suburb was elected by drawing a name from a hat.

You need to know to start early and update up to the opening bell, but sign up here to deliver it once in the inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron and MarketWatch.