The shares of General Electric Co. fell on Wednesday after the industrial conglomerate confirmed a $ 30 billion deal with AerCap Holdings NV, while also surprisingly proposing a reverse split of 1-for-8 shares.

GE, which hosted a meeting of analysts early Wednesday, also provided financial guidance in 2021, in which the range for adjusted earnings was somewhat discouraged, but the ranges for revenue and free cash flow were in line with expectations. .

GE stock,

Swing fell 6.0% in morning trades, setting it on its biggest one-day decline since September 21, 2020, when it fell 7.7%. The decline comes after shares rose 11.6% in March through Tuesday, including a 3-year close of $ 14.17 on Monday, while the S&P 500 SPX index,

gained 1.7% at the same time.

The reverse split could surprise investors, as they are usually reserved for the companies concerned that their share price could or would fall below the thresholds that could cause mutual fund investors to avoid shares or cause stock exchanges to issue write-off notifications. Read more about reverse stock splitting.

In GE’s case, the company said its board of directors recommends splitting the reserve, which will be voted on by shareholders at its May annual meeting, given the company’s “significant transformation” in recent years.

“The reverse division of shares would reduce the number of outstanding shares to a number more typical of companies with comparable market capitalization,” GE said in a statement.

FactSet, MarketWatch

GE had a market cap of $ 122.75 billion at Tuesday’s closing price and had $ 8.77 billion in stock as of Jan. 31. In comparison, Lowes Companies Inc. LOW,

with a market cap of $ 121.34 billion, it has about 734 million shares outstanding, while Starbucks Corp. SBUX,

with a market capitalization of $ 125.44 billion, it has 1.18 billion shares outstanding.

The reverse split proposed by GE would effectively multiply the share price by eight, while reducing the number of outstanding shares to around 1.1 billion. If the shareholders approve the division, the division will take effect at the discretion of GE’s board of directors, at any time before the first anniversary of the annual meeting on May 4, 2021.

GE confirms AerCap agreement

GE on Wednesday confirmed an agreement to combine its GE Capital Aviation Services (GECAS) aircraft leasing business with AerCap, in a transaction that creates more than $ 30 billion for GE shareholders.

The Wall Street Journal reported earlier this week that an agreement was imminent.

Under the agreement, GE will receive $ 24 billion in cash and 111.5 million common shares, with a market value of approximately $ 6 billion and a 46% stake in the combined company.

GE has stated that it intends to use the proceeds of the agreement to further reduce debt, which will lead to a total debt reduction by the end of 2018 to over $ 70 billion.

The agreement is part of a multi-year effort by GE to reduce risk to GE Capital, which is expected to have assets estimated at $ 21 billion after the conclusion of the agreement, down from $ 68 billion by the end of 2020. close in nine to 12 months. And after the transaction is completed, those remaining assets will become part of the consolidated industrial balance sheet.

“Today marks GE’s transformation into a more focused, simpler and more powerful industrial company,” said Larry Culp, CEO.

“AerCap is the right partner for our exceptional GECAS team,” Culp said. “We create an industry-leading aviation locator with expertise, scope and coverage to better serve customers around the world, while GE earns both cash and a significant stake in a stronger, more flexible combined generate money as the aviation industry recovers. ”

GE Financial Guidelines

As part of its analysis day, GE provided details on its financial guidance for 2021.

The company expects year-round adjusted earnings per share of 15 cents to 25 cents, compared to the FactSet consensus of 25 cents.

In terms of revenue, GE expects a “single-digit” percentage increase, while the current $ 80.4 billion FactSet consensus implies a 1.0% increase.

Free cash flow is expected to be $ 2.5 billion to $ 4.5 billion this year, surrounding the $ 3.6 billion FactSet consensus.

GE said its guidelines are based on the assumption that the aviation market will begin to recover in the second half of the year. GE is taking on the growth of the renewable energy market, an accelerated change in electricity and sees an “attractive” healthcare market, with scans back to pre-COVID levels.

“We are on a positive trajectory in 2021 as the momentum grows in our businesses and we become a more focused, simpler and stronger industrial company,” said CEO Culp. “We are excited to focus more on offense, investing in advanced technologies to meet the needs of our customers and the world – for more sustainable, reliable and affordable energy; more integrated and personalized medical assistance; and a smarter and more efficient flight. ”

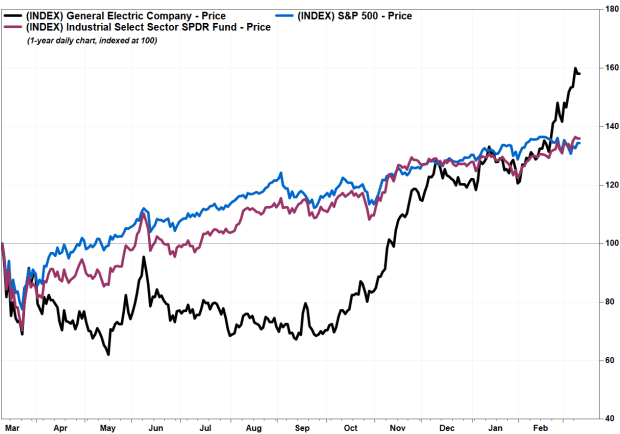

GE shares have now increased by 16.2% in the last three months and increased by 48.6% in the last 12 months. In comparison, the fund traded on the SPDR Industrial Select Sector XLI,

has advanced 36.6% in the last year, and the S&P 500 has risen 34.9%.