Photographer: Patrick T. Fallon / Bloomberg

Photographer: Patrick T. Fallon / Bloomberg

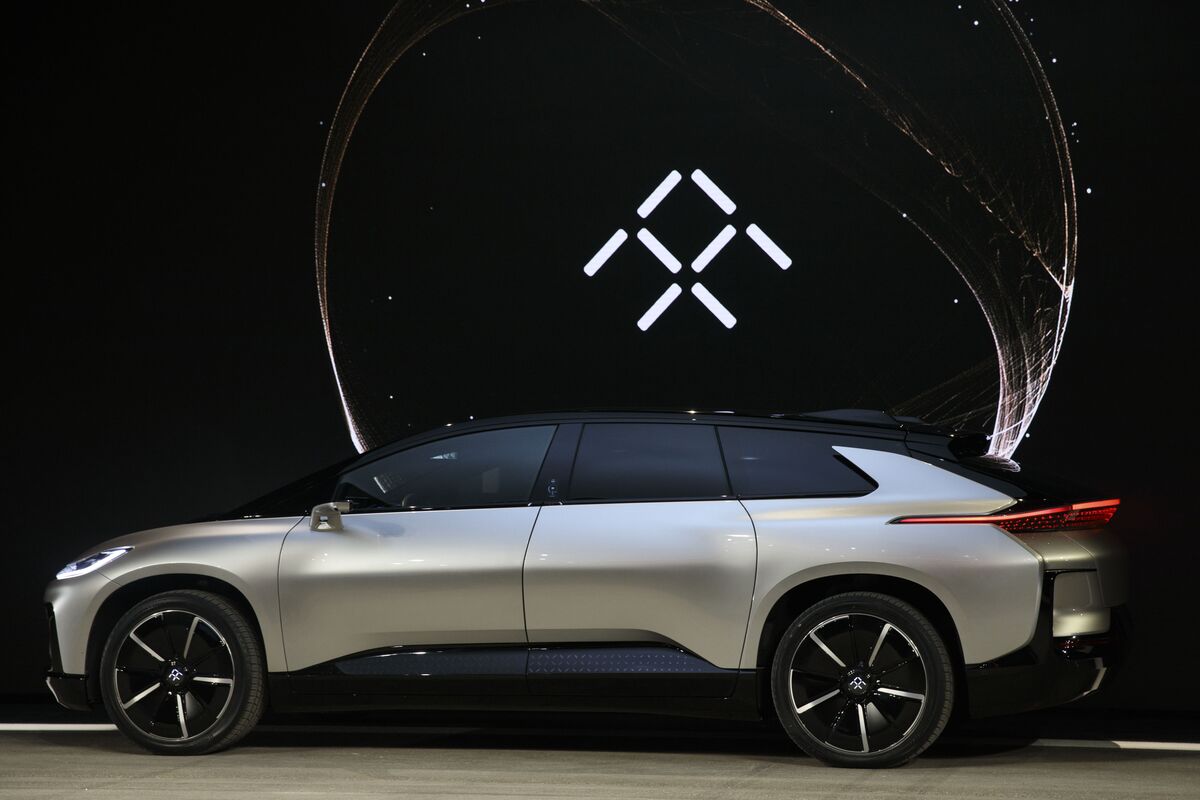

Faraday & Future Inc., an electric vehicle start-up, is in talks to go public through a merger with Property Solutions Acquisition Corp., an empty verification company, according to people with knowledge in this regard.

The special-purpose procurement company is trying to raise more than $ 400 million in equity to support the transaction, which should value the combined entity at about $ 3 billion, people said. As with all transactions that have not been completed, terms may change or discussions may break.

A Faraday spokesman did not respond to several requests for comment. A Property Solutions representative declined to comment.

Faraday of Los Angeles, led by CEO Carsten Breitfeld, was founded by Jia Yueting, an entrepreneur who in October 2019 went bankrupt in the US after accumulating billions of dollars in personal debt. His efforts to build a business empire in China that covers the interests of broadcasting to television have seen him borrow pledged shares, leaving him worth $ 2.3 billion in debt, according to the document.

Jia went bankrupt after setting up a creditors’ trust and transferring all its shares in the electric vehicle company to it, he said in July statement posted on the company’s electric vehicle website. He said that up to 10% of the trust will be given to the compensation of the shareholders of Leshi Internet & Technology Corp., a unit now deregistered from his conglomerate and that he no longer holds any shares in Faraday, but remains employed. The approval of the plan clarified the way for the company to work towards its capital financing objectives, the company said.

This month, Faraday appointed Zvi Glasman, the former chief financial officer of Fox Factory Holdings, as chief financial officer. He said his flagship vehicle, known as the FF 91, would be available for sale about a year after a successful round of financing.

Rows of carmakers wanting to compete with Tesla Inc. In electric vehicles are heavily populated by Chinese startups. Investors have been in a rage for all things electric vehicles in 2020, increase the valuation of the Chinese car company Nio Inc. over those of General Motors Co. and Ford Motor Co. Xpeng Inc. raised $ 2.2 billion from a subsequent share sale in December just months after its $ 1.7 billion IPO and even internet giant Baidu Inc. planned to team up with automaker Geely Automobile Holdings Inc. to produce electric vehicles for the Chinese market.

Read more: Tesla’s dominant position in China could be threatened next year

Property Solutions, led by President and Co-CEO Jordan Vogel, has raised $ 230 million in a July 2020 IPO. to target companies serving the real estate industry, including property technology.

Electric vehicle companies, including Nikola Corp. and Fisker Inc., have become public in recent years by merging with gap verification firms.

(Context updates on Jia and EV in the fifth and seventh paragraphs, respectively.)