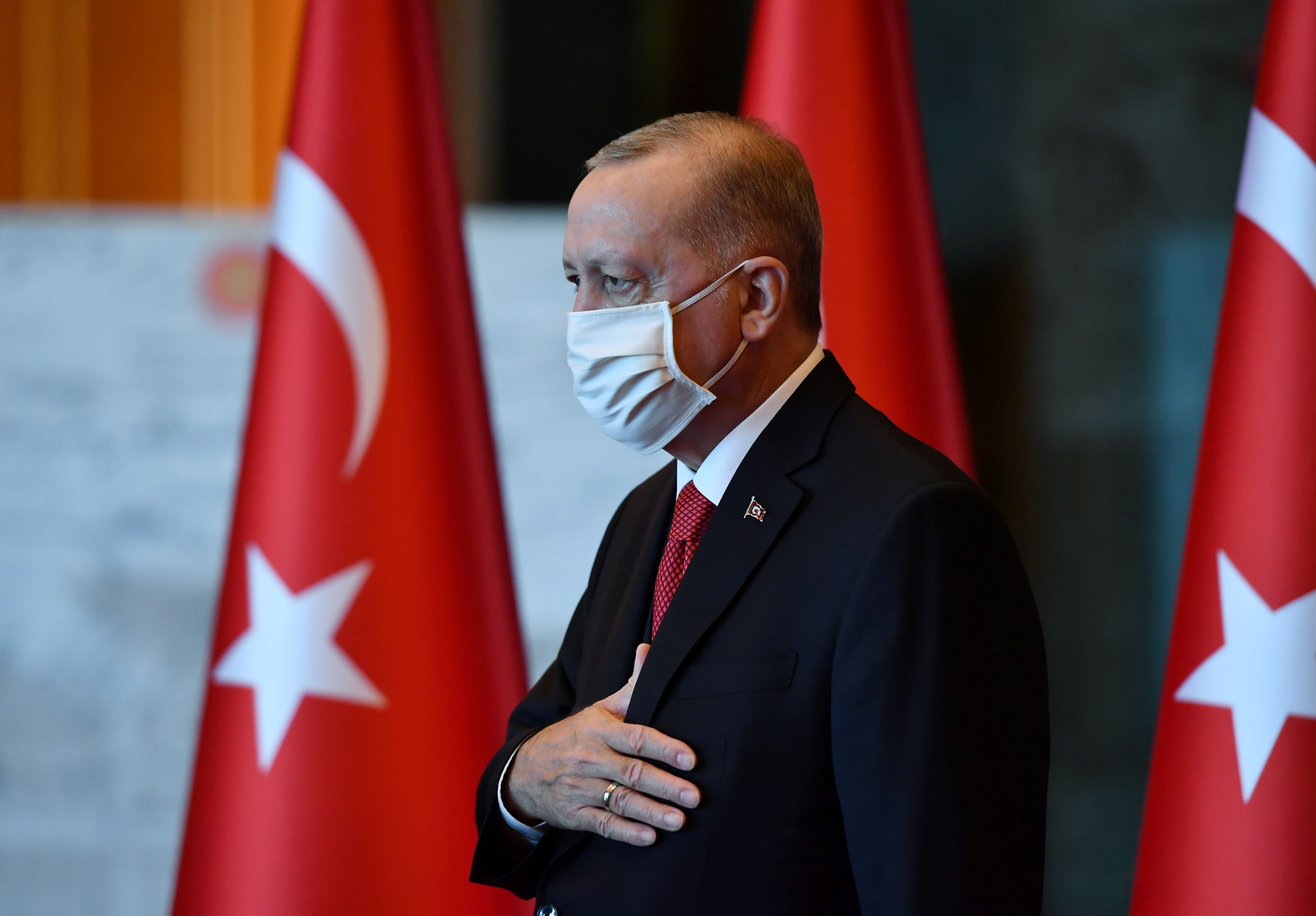

Turkish President Tayyip Erdogan attends a Republic Day ceremony at the Presidential Palace in Ankara, Turkey, on October 29, 2020.

Presidential Press Office Reuters

Inflation, falling currencies and the rapid depletion of foreign exchange reserves: these are among the risks that emerging investors and market economists warn of the dismissal of Turkish President Recep Tayyip Erdogan over his former central bank chief over the weekend.

The movement, which represented its third resignation in two years, brought the value of the Turkish lira sunk – but Erdogan says the economy is fine, telling members of his AK party on Wednesday in a speech that this week’s market volatility does not reflect Turkey’s economic reality, according to a Reuters translation.

However, in the same speech, he urged Turks to sell their foreign exchange assets and gold and buy pound-based financial instruments in an effort to stabilize the besieged currency, which lost 10% of its value on Friday.

“Return to Volatility,” reads the headline of an analyst note from Barclays on Monday. “The risk of a currency crisis is increasing,” wrote the London-based company Capital Economics. He described how former central bank governor Naci Agbal, who had set out to tackle Turkey’s double-digit inflation by raising the key interest rate by 875 basis points since taking office in November, trusted investors.

But Erdogan has long held the unorthodox view that higher interest rates cause inflation and are “bad.” Analysts say it was only a matter of time before Agbal was replaced by someone more malleable to Erdogan’s views, prompting investors’ fears about the central bank’s lack of autonomy and a future inflation and currency crisis.

Agbal’s replacement, Sahap Kavcioglu, many experts in Turkey say, has no experience in the field and has a critical history of rising interest rates, raising concerns about uncontrolled inflation.

“It seems that the central bank’s efforts to combat inflation in the country could come to an end, and a disorderly balance of payments crisis has become (once again) a real possibility,” wrote Jason Tuvey, a senior economist in emerging markets. at Capital Economics. Turkey’s inflation is 15%, youth unemployment is 25%, and the dollar has risen by more than 10% against the pound since the start.

“Agbal’s brief dismissal is one of the most counterproductive government actions in Turkey’s recent history,” Erik Meyersson, a senior economist at Handelsbanken Macro Research in Stockholm, told CNBC. “It will instantly erode any credibility gained during Agbal, increase the risk premium on Turkish financial assets and force the remaining decision-makers to go on an even harder brake line in the future.”

The Turkish presidency’s office did not respond to a request for comment from CNBC.

Impact on other markets?

When the pound fell sharply due to similar fears about Turkey’s monetary policy in May 2018, the impact shook many Spanish and French banks, which had significant exposure to Turkish assets. Now, this is less of a problem, says Can Selcuki, CEO of Istanbul Economics Research.

“I doubt this will lead to non-performing loans that could pose a risk to foreign banks,” he told CNBC. “The pound level is not unprecedented, so the business is used to it,” and those who became insolvent did so during the previous currency decline, he added.

Spain’s banking sector is leading in terms of exposure to the Turkish public sector, with Turkish assets of $ 14.7 billion, including government bonds, down from $ 20.82 billion in the spring of 2018, followed by France with $ 6.4 billion, down from $ 7.1 billion in 2018, according to S&P Global.

And for emerging markets, analysts also consider a limited risk of dispersion.

“You may see a limited amount of risk, but I don’t think it will be a contagion,” Divya Devesh of Standard Chartered said on Monday, adding that there could be some risks from retail investors holding Turkish lira. especially in Japan.

“I don’t think this has the potential to lead to a wider market contagion – in the last two years I think markets have come to see Turkey as a very idiosyncratic case of EM (emerging market) risk,” he said.

I run out of reserves

So the rest of the world may be safer than it used to be, but Turkey seems ready for a rocky path, especially if the new head of the central bank keeps its prospects corrupt.

“The pressure on the TRY (Turkish lira) is likely to increase,” Goldman Sachs analysts wrote on Monday. The Turkish central bank’s previous strategy of consolidating the pound was to buy more of the currency in dollars, thus burning through its foreign exchange reserves.

“A restart of FX interventions similar to 2020 may be the initial response, but the buffers are relatively low,” Goldman warned. Turkey’s gross foreign exchange reserves are estimated at $ 35.7 billion – “not large enough to support continued interventions, in our view.”

Erdogan’s central bank move could be the last break for many, says Tim Ash, a senior strategist in emerging markets at Bluebay Asset Management.

“It’s hard to see these people ever coming back – damaging Turkey’s reputation among investors enormously,” he wrote in an email note on Tuesday. “Those who trusted Agbal and the story of Turkey are penalized.”