Investors who expect the shares of GameStop Inc. get a boost as the latest government stimulus payments hit bank accounts are likely to be disappointed, according to BofA Securities analyst Curtis Nagle.

Nagle wrote in a research note on Friday that, in collaboration with the BofA predictive analytics group, it analyzed the potential impact on the GME GameStop stock,

of the $ 1,400 incentive payments currently being made.

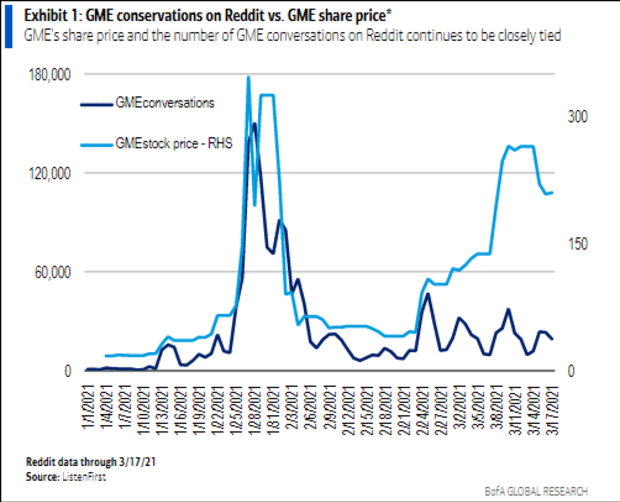

Looking at online forums like Reddit, Nagle said that previous sharp increases in the number of conversations involving stimulus and GameStop (GME) seem to coincide with large increases in stock prices. But before, Nagle, who is bearish on GameStop shares, said he believes any positive effect from “stimmies” has already been played.

“[W]I think the future impact may be limited given two factors, “Nagle wrote in a note to clients.

• “Conversations [sic] the incentives involved seem to have peaked, and GME stocks have fallen in recent days. ”

• “The number of recent conversations, including both GME and stimulus, is low.”

BofA Global Research, ListenFirst

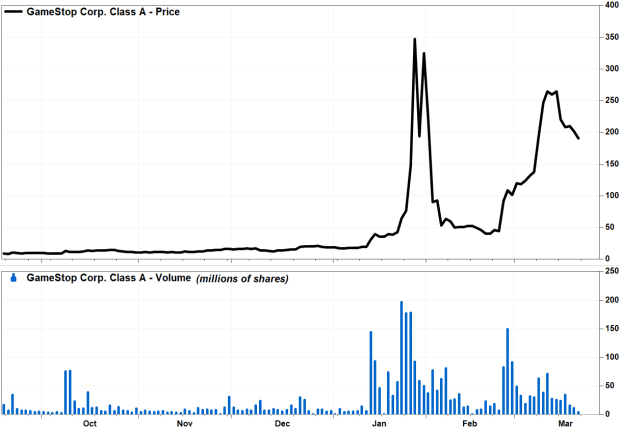

Nagle also pointed out that GME trading volumes had also fallen steadily and short-term interest rates had fallen “materially”. Nagle reiterated its underperformance rating per share and its target price of $ 10.

Trading volume averaged 34.5 million shares per day from March to Thursday, after an average of 43.6 million shares per day in February and 66.4 million shares in January, according to a MarketWatch analysis of FactSet data .

FactSet, MarketWatch

And the latest available exchange data showed that the short interest rate as a percentage of public float was 26.1%, compared to over 100% when the frenzy of Reddit-induced trading began in mid-January.

GameStop shares fell 6.7% in morning trades and fell 29.1% this week. It puts the stock market on the right track to achieve a three-week winning streak, down 551.6%, followed by a three-week losing streak, down 87.5%.

Do not miss: Robinhood business model on fire at GameStop hearing in Congress.

Read also: The most frequently asked questions by Robinhood traders reveal “a new type of uninformed participant in the equity market”.

Instead of buying shares, it seems more and more likely that the current $ 1,400 incentive payments and other disposable money will be spent elsewhere.

Read more: Student loans, charity bills and pet bills – here’s what readers will do with $ 1,400 incentive checks.

“Although we did not ask consumers how much they intend to invest in the stock market in the future, in our latest home survey, respondents intend to increase spending the most in the next 12 months for activities restricted by COVID-19, holidays, restaurants and travel, as well as investments and home furnishings, ”Nagle wrote.

Despite the week’s decline, GameStop shares continued to rise 1,105.0% over the past three months, while the S&P 500 SPX index,

increased by 5.4%.