Not long ago, Wall Street looked at crypto with a mixture of suspicion and contempt. The space created by Bitcoin has been largely ridiculed by the main financial world. It’s just a fad, isn’t it? A balloon that was about to end in tears for all involved and a refuge for criminal activities.

This view is certainly no longer the case. As the trend refused to die and the ecosystem flourished, Wall Street slowly came to the idea that the crypto is here to stay.

The scale of the transformation from the financially bad boy to the possible future of global payments has received a real justification recently with the public listing of Coinbase (CURRENCY). The cryptocurrency exchange made a brilliant entry last week, with a NASDAQ listing of $ 75.9 billion. So is all the hoopla worth it?

Sean Horgan, Rosenblatt Securities, believes this.

“We are on the rise in the long-term growth of the currency, as it benefits from the growing adoption and acceptance of cryptocurrencies, while our short-term vision is more cautious, as stocks face negative risks following a price reduction crypto, ”said the analyst. “Long-term sustainable growth is less uncertain, in our view, and our expectations are potentially conservative, given the increased risk of institutional adoption and increased subscription revenues.”

And Coinbase is definitely growing. In 2020, the company generated revenues of about $ 1.3 billion, up 144% year-on-year. However, in the first quarter of the year alone, the company’s revenue reached $ 1.8 billion.

Although, as Horgan notes above, Coinbase is to some extent at the mercy of the cryptographic cycle, which is currently going through one of its boom phases. However, the withdrawals are notorious and the markets are long.

That being said, crypto has reached a “turning point on its path to legitimacy,” and Horgan considers it a “disruptive long-term trend that is just beginning.”

There is evidence to support the claim. Institutions have moved and are now collecting Bitcoin to store as the digital equivalent of gold. And, as evidenced by the recent launch of crypto trading on Venmo – PayPal’s mobile payment service, the effect of the network will create additional demand, and businesses “will likely see the value of offering an encryption option at the point of sale.”

“As this ecosystem evolves and becomes more valuable, COIN is a way to capture the advantage,” the analyst summed up. “Net / net, we are buyers of COIN as a leader in long-term categories and stock of pure cryptocurrencies.”

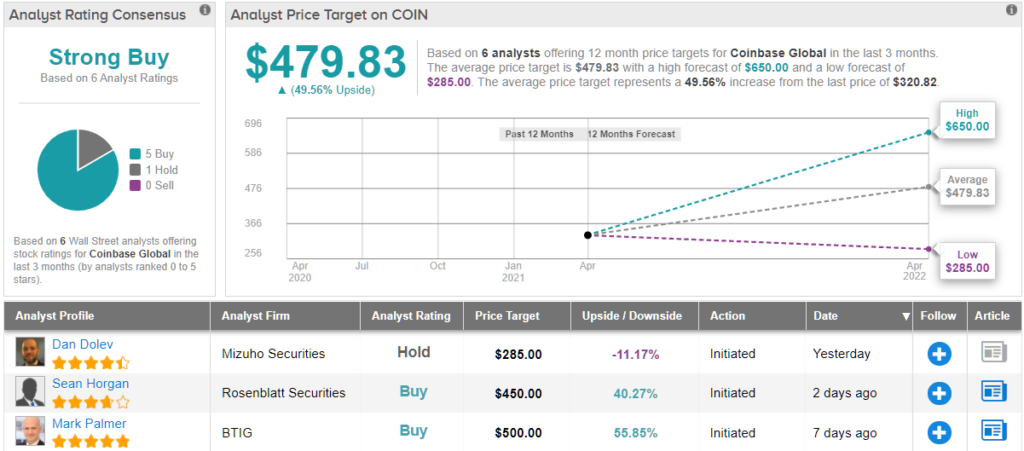

As a result, Horgan initiated COIN coverage with a purchase rating and a target price of $ 450. The implication for investors? Up 44%. (To follow Horgan’s record, click here)

Horgan’s colleagues agree. Based on Shopping only – 5 in total – the stock has a strong buy rating. The average target price is also a high one, and at 479.83 USD, it suggests an increase of ~ 50% in the next 12 months. (See coin stock analysis on TipRanks)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that brings together all the information about TipRanks stocks.

Disclaimer: The opinions expressed in this article are only those of the analyst presented. The content is intended for informational purposes only. It is very important to do your own analysis before making any investment.