Shares of Affirm Holdings Inc. they are up about 90% on Wednesday afternoon trading after the financial technology company made its public debut.

Actions of Affirm AFRM,

opened at $ 90.90 on Wednesday after listing on the Nasdaq, with the first transaction coming at 12:20 ET. The company priced its initial public offering at $ 49 per share late Tuesday, above an already high range of $ 41 to $ 44 per share.

The company raised at least $ 1.2 billion through the bid. Underwriters have access to a global batch of 3.7 million shares beyond the initial 24.6 million shares that Affirm sold through IPOs. It appears that Affirm has delayed its IPO since late last year, given the large first-day stock moves for Airbnb Inc. ABNB,

and DoorDash Inc. DASH,

Affirm, led by PayPal Holdings Inc. PYPL,

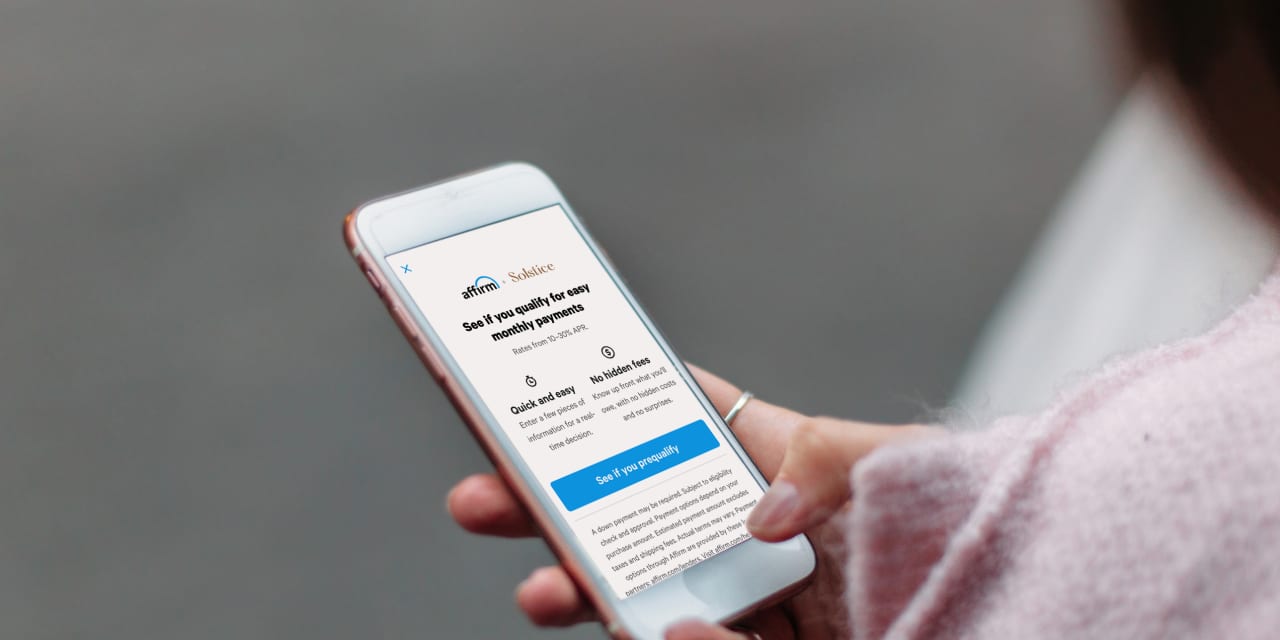

co-founder Max Levchin, offers payment options that allow people to make online purchases in installments. The company receives compensation from merchants when customers opt for one of the company’s loan options. Affirm has an interest-free “0% APR” offer, as well as a “simple interest” loan product which is also paid to the consumer at the end of a transaction.

Say IPO: 5 things to know about the fintech company that shakes credit online

The company’s largest customer is Peloton Interactive Inc. PTON,

which accounted for about 28% of Affirm’s revenue in its last fiscal year, which ended in June. Affirm reported revenue of $ 509.5 million in its last fiscal year, up from $ 264.4 million a year earlier. The company posted a net loss of $ 112.6 million, compared to a loss of $ 120.5 million in the previous period.

“The pandemic has created a favorable environment as more value-conscious shoppers are looking for ways to finance online purchases in a uniform manner,” MKM Partners analyst Rohit Kulkarni wrote in a pre-IPO note to customers.

Affirm works with banking partners who have originated many of the company’s loans.

The offer comes as IPO Renaissance IPO ETF,

gained 22% in the last three months and as S&P 500 SPX,

increased by 8.5% over the same period.