It’s been a bad week for tech stocks. The Nasdaq was down 2.7% on Wednesday, and the slide appears to continue on Thursday.

So buy the decline before technology stocks rise by at least 25% more this year, says veteran technology analyst Daniel Ives of investment firm Wedbush in call of the day.

“The risk-off trade for technology has been a painful one for technology investors this week, as concerns about high valuations, bubble fears, turnover transactions, rising yields and a focus on reopening plays are central.” said Ives.

But, according to Ives, the digital transformation is just beginning and will last for several years among companies in the cloud, cybersecurity, e-commerce and 5G. These subsectors are the lifeblood of the technology party, with consumer and business demand catalyzing a “multi-year growth boom,” the analyst said.

Although collaboration software companies such as Zoom ZM,

Teams, Slack WORK,

and Citrix CTXS,

will see “growth moderation” by 2022, many CEOs told Wedbush that 30% to 40% of employees could remain working remotely in some form. This will cause companies to “break Band-Aid and become aggressive” with transformations in the cloud, Ives said.

See: Analysts say Zoom can continue to thrive in a vaccinated world

Investors should use the current market weakness to ensure that Apple AAPL,

Microsoft MSFT,

DocuSign DOCU,

Zscaler ZS,

Palo Alto PANW,

SailPoint SAIL,

and Nuance NUAN,

are included in their portfolios, Ives recommended.

Across the sector, Wedbush predicts that technology stocks will move up at least 25% next year. This will be led by big name Facebook FB,

Amazon AMZN,

Apple, Netflix NFLX,

and Google parent Alphabet GOOG,

GOOGL,

as well as stocks in the cloud and cybersecurity, despite recent sales, Ives said.

More generally, Ives said that Uber UBER,

and Lyft LYFT,

– ‘disruptive names of technological recovery’ – remain Wedbush’s preferred ‘reopened plays’, with profitability on the horizon and a massive increase in food supply.

Do not miss: Lyft shares rise at highest prices in 2019, after best week for pandemic rides

And while technology regulation is a long-term risk, “it remains a Goldilocks environment for technology stocks with the Biden administration,” according to Wedbush. Ives sees President Joe Biden as likely to reduce tensions in the “Cold War” between the US and China, as well as encourage cybersecurity initiatives.

Market bears will come out of hibernation to warn investors that the technology boom and the bull rally are over, Ives said. Wedbush believes this is “a golden opportunity to hold the winners of the secular technology for the next 12 to 18 months at convincing evaluations, given some of these sales.”

Buzz

The House of Representatives ended the week after police discovered a QAnon-linked militia plot to attack the Chapter, but that did not stop the major legislation late Wednesday. House Democrats have submitted to the Senate the largest revision of the US election law in at least a generation, along with a bill to revise the police, named after George Floyd, who was killed during an arrest in May 2020.

Economically, the initial unemployment claims launched at 8:30 am in the morning will be the main figure. 750,000 Americans are expected to have claimed unemployment last week, a slight increase from 730,000 the previous week. The ongoing complaints for the unemployed and factory orders for January are also due this morning, before Federal Reserve Chairman Jerome Powell speaks at the Wall Street Journal Jobs Summit at noon.

The SpaceX spacecraft – a prototype for a future mission to Mars – looked as if it had landed to be proud of founder Elon Musk. But just minutes after the touchdown was declared successful, it exploded with such force that it went back to heaven. And there’s a video.

The general manager of the Texas power grid has been fired. The network suffered a fatal breakdown in a freezing February that left millions without heat or electricity for days in one of the worst disruptions in US history.

The European Medicines Agency, the European Medicines Regulatory Authority, has begun a review of the Sputnik V COVID-19 vaccine developed in Russia.

The Competition and Markets Authority, the UK’s competition regulator, is investigating Apple’s terms and conditions governing developers’ access to the App Store.

Indian online retailer Flipkart, owned mainly by Walmart WMT,

is considering a listing in the US by merging with a special purpose procurement company or SPAC, according to a Bloomberg report that said the company could request a valuation of at least $ 35 billion.

markets

Dow futures YM00,

are down about 120 points, in line with other futures contracts on the ES00 stock market,

NQ00,

set to continue yesterday’s slide. The Dow DJIA,

it slipped more than 120 points on Wednesday along with other indices. European stocks UKX,

DAX,

PX1,

fell after three consecutive days of gains, while NIK major Asian indices,

HSI,

SHCOMP,

all fell by more than 2%.

Chart

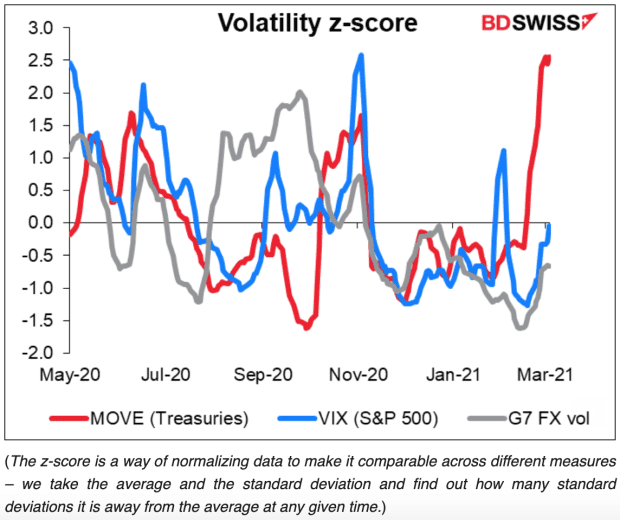

If you think the bonds were heavier than usual … you would be right. Our chart of the day, from Marshall Gittler to BDSwiss, shows how volatile the Treasury market is at the moment. Gittler charts the MOVE index, which is like the stock market version of the VIX stock index. Stock volatility is almost normal, while currencies are slightly calmer than usual.

Random readings

A woman from Tahltan in northern Canada bakes a head of elk, which looks fierce, tastes phenomenal and feeds a family.

A passenger flight returned to Sudan when a clandestine cat attacked the pilot.

You need to know to start early and update up to the opening bell, but sign up here to deliver it once in the inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron and MarketWatch.