The initial public offering expected by Coinbase attracted attention on Wednesday, eclipsing results of the banks, which started the earnings season.

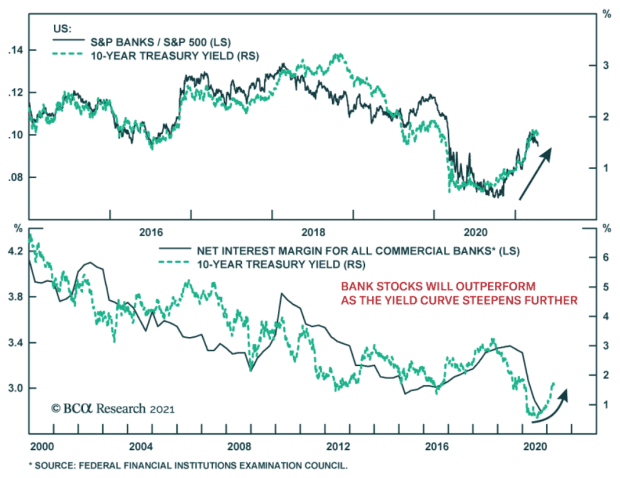

Our call of the day is from the research firm BCA Research, urging investors to favor an overweight allocation to the bank’s shares in their portfolios, as a number of factors support the continued consolidation in the financial field.

First-quarter earnings for banking giants were spurred by large reductions in loss reserves, which were more than double the levels of the pre-COVID-19 pandemic by the end of 2020. As the economic recovery from the pandemic continues, banks will continue to release reserves the need for accommodation for large potential loan losses eases, BCA said.

But going further, banks will need to focus on their ability to expand lending portfolios. Banks’ core profits come from loans from economists at low short-term interest rates and loans at higher long-term rates. The dynamics of US fiscal stimulus have led to increased deposits and reduced lending, but this is expected to change as the economy reopens, BCA said.

Source: BCA Research.

The launch of the vaccine is growing, and a certain level of immunity of the COVID-19 herd by September would reduce restrictions, boost consumer confidence and accelerate a recovery in the labor market, BCA said. All this will encourage spending and another round of recovery, especially as household balance sheets are largely healthy, according to the group.

In fact, this is already happening: the Federal Reserve’s consumer credit survey in February showed that US consumer loans increased by $ 27.6 billion – 7.9% annually – the most since November 2017.

More spending and a reduction in savings should raise U.S. Treasury yields, according to the BCA, with strong growth supporting long-term yields, while short-term bonds face greater resistance to the accommodative political position of the US Treasury. Fed. This will further intensify the yield curve, BCA said, and this is another boost for the banking outlook.

Buzz

ARK Invest acquired $ 246 million worth of Coinbase shares after the cryptocurrency exchange went public on Wednesday, at an “important moment” for encryption. The fund’s headquarters led by Cathie Wood sold $ 178 million worth of Tesla shares to make room for Coinbase COIN,

in three funds, including ARK Innovation ETF ARKK,

It is a day of success on the US economic front, with a wave of data that far exceeds expectations. Initial unemployment claims for the week of April 10 amounted to 576,000, well below the expected 710,000, while in the week of April 3 there were 3.73 million claims for continuous unemployment. while the Empire State Manufacturing Index was reported at 26.3, exceeding the consensus forecast of 20. Industrial production for March rose 1.4%, less than the estimated 2.7%. The index of the National Association of Home Builders for April was reported at 83, just below 84 expected.

TSM of Taiwan Semiconductor Manufacturing Co.,

profits increased by 19% in the first quarter of 2021 compared to the same period a year ago. The digital trends stimulated by the COVID-19 pandemic have led to a rapid increase in chip demand in the last year and have caused a global shortage of semiconductors.

The Data Protection Commission of Ireland has launched an investigation on Facebook FB,

on Wednesday in response to reports that a dataset containing personal information about about 533 million users has been made public. The regulator will investigate whether the social media giant has breached the EU’s data protection rules.

TuSimple, a group of autonomous trucks from California, went public on the Nasdaq. Related to the car manufacturer Volkswagen VOW,

and supported by the UPS logistics company UPS,

TuSimple will compete with the self-driving projects of the electric car manufacturer Tesla TSLA,

and Waymo, a division of Alphabet GOOGL,

A study from the University of Oxford found that blood clots are just as common in COVID-19 vaccines from the drug company Pfizer PFE,

and Modern Biotechnology MRNA,

because they come from the drug company AstraZeneca AZN,

a vaccine produced with the help of the university. The AstraZeneca vaccine has been put under control and its use has been stopped in Denmark due to concerns about blood clots.

markets

American stocks DJIA,

SPX,

COMP,

were higher with the current earnings season and bond yields under control. European actions flirted with new UKX records,

DAX,

PX1,

with the pan-European Stoxx 600 SXXP,

closing in on the all-time high reached last week. Asian stocks NIK,

HSI,

SHCOMP,

they were more mixed.

Chart

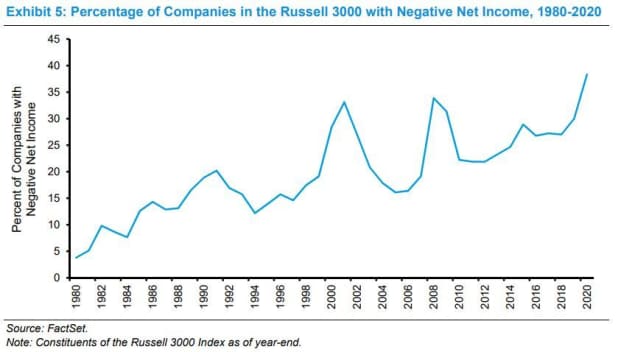

Source: Morgan Stanley.

No, American corporations are not just bleeding money – as you might think from the analysis of the chart of the day, brought to our attention by the blog of Irrelevant Investors. The chart, part of recent research by Morgan Stanley, shows the increase in “intangible investments”, which are not included in a company’s balance sheet, but rather in the profit and loss account. These “expenses”, which include assets such as research and development, make companies seem unprofitable. It’s an accounting thing.

Random readings

A Canadian MP apologized after he accidentally appeared naked in a virtual sitting of the House of Commons.

A missing California hiker was found after a geography enthusiast used a mysterious photo to reveal his location.

You need to know to start early and update up to the opening bell, but sign up here to deliver it once in the inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern time.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron and MarketWatch.