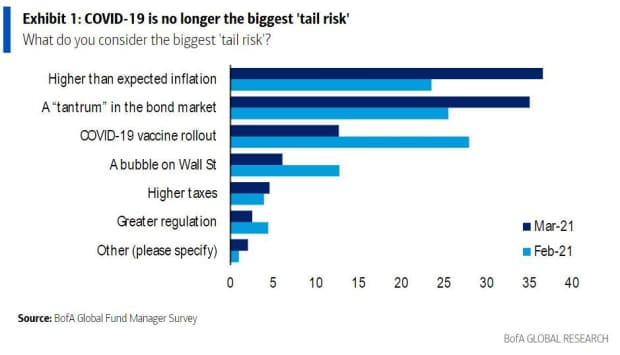

Here is a possible clear signal. COVID-19 is no longer a “tail risk” for investors, for the first time since February 2020, Bank of America says in the latest fund managers’ survey. A tail risk is an unlikely event that could result in excessive losses or gains.

Scroll down for that chart.

Meanwhile, the two-day political meeting of the Federal Reserve begins on Tuesday, and investors will be looking for any clever signal that could get some steam out of the shares. The premarket has a mixed action, although many remain stuck in the idea of a post-pandemic boom, at least in the US as vaccinations unfold.

Read: The value shares return. Don’t be left behind, say these analysts

This has kept records for DJIA Dow Jones Industrial Average,

and S&P 500 SPX,

and actions aimed at recovery. Our call of the day comes from strategies at Bank of America, which offers 17 buy-in shares for the three Rs I see coming – recovery, reflection and requalification.

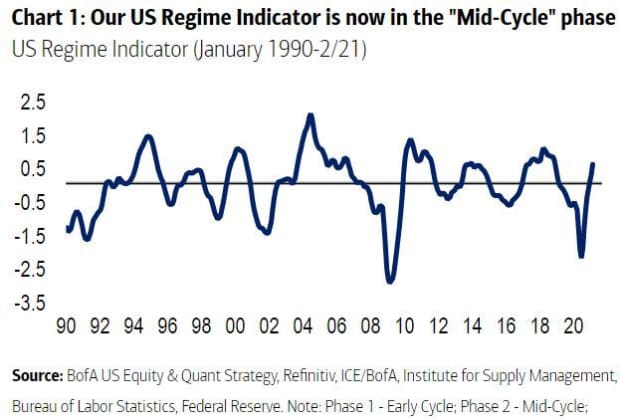

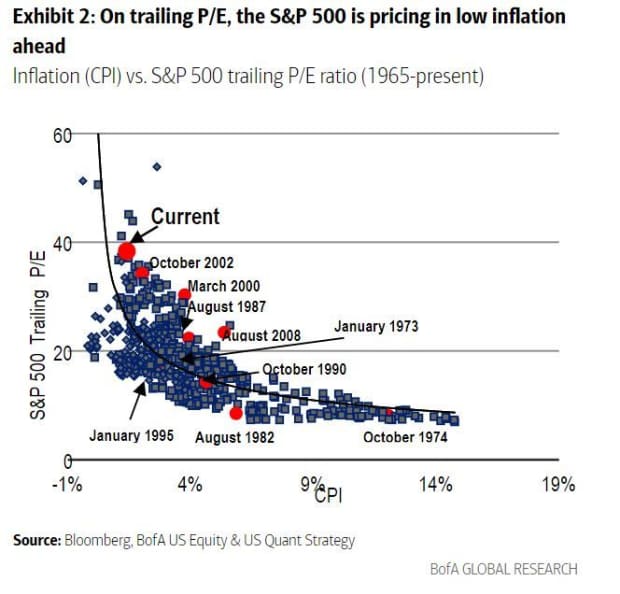

Strategists Jill Carey, Savita Subramanian and Ohsung Kwon say the economy has reached the middle cycle, where inflation is usually strongest. In such previous phases, with the exception of the technology bubble, the small caps exceeded the largest, and the value beat the increase.

Uncredited

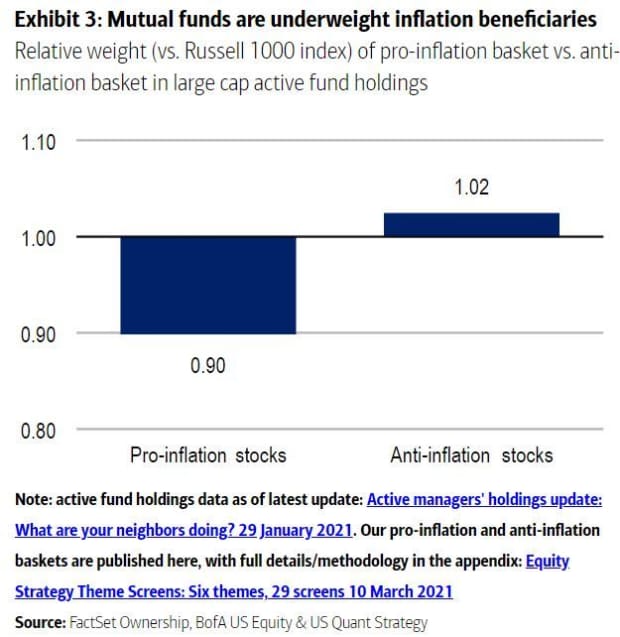

The Bank of America team says there are two reasons why they like these actions: many of the companies they point to are not yet expensive, and active funds are not positioned to raise inflation, with higher mega exposure than lower ceilings.

Uncredited

Uncredited

On stocks (almost half are small to medium companies) …

Alcoa AA,

– BofA has a target price of $ 37 per miner. Aluminum prices could go both ways, but rising global demand is a plus for Alcoa.

Axalta Coating Systems AXTA,

– The share price is GBP 37 for the global hedging group. The pace of car recovery will be key and a stronger dollar and lower raw material costs could be a boost.

Broadcom AVGO,

– The share price is 550 USD. Risks for the semiconductor company include sensitivity to US-China trade relations and competition in networks, smartphones and other markets.

Hess HES,

– The share price is $ 95. The risks of the energy company include oil and gas prices, as well as the slowdown in drilling.

Marriott International MAR,

– Action price target 150 USD. Weaker economies and lower-than-expected spending by businesses and consumers are among the risks for the hospitality company.

Walt Disney DIS,

– $ 223 price target for the entertainment giant that has the “best assets in the class.” Disadvantages include the slowdown in ESPN growth for people who choose not to keep a cable TV subscription, weaker consumer confidence, and reduced attendance at theme parks. Also watch out for potential movie flops

Otherwise, they like CNH Industrial CNHI,

Comcast CMCSA,

Emerson Electric EMR,

Herc Holdings HRI,

Knight-Swift Transportation KNX,

Occidental Petroleum OXY,

Parker Hannifin PH,

Main financial PFG,

Robert Half International RHI,

Union Pacific UNP,

and World Fuel Services INT,

Chart

Here is the “queue risk” chart from the most recent monthly BofA fund managers’ survey. The higher risks are higher-than-expected inflation and a “tantrum” in the bond market.

Uncredited

markets

YM00 futures,

ES00,

NQ00,

shakes a little, but European stocks are SXXP higher,

It was also a high day for Asian markets. Elsewhere, oil CL.1,

and the DXY dollar,

are softer and bitcoin BTCUSD,

returns beyond the $ 60,000 success of the weekend.

Buzz

Retail sales and import prices are due before the market opens, followed by industrial production and an index of the National Association of Home Builders. In addition to launching the Fed meeting, investors will also follow the outcome of a 20-year treasury bond auction.

Ray Dalio, founder of Bridgewater, the world’s largest hedge fund, says bond investments are “stupid” and investors should stick to a “well-diversified portfolio”.

AstraZeneca AZN,

AZN,

shares are higher after Jefferies upgraded the drug company to buy from the hold. AstraZeneca was in the hot seat, while several European countries are suspending their COVID-19 fires due to reports of blood clots from inoculation.

Finnish telecommunications group Nokia NOKIA,

SUFFICIENT,

reduces up to 10,000 jobs to save $ 716 million over two years.

A team from the US government’s road safety agency is heading to Detroit to investigate a “violent” accident following a Tesla TSLA,

the vehicle drove under a semi-trailer, leaving two people seriously injured.

Random readings

Office Nostalgia – Redditers trade colleagues for hell.

When a hacker receives all the texts for 16 USD.

The need to know starts early and updates up to the opening bell, but sign up here to deliver it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron’s and MarketWatch.