With the conclusion of the Brexit trade agreement and the rapid launch of the COVID-19 vaccine, UK stockpiles could be the “trade of the decade”.

This is the opinion of Research Affiliates founder Rob Arnott, who said that the end of the COVID-19 threat is now in sight in the UK, potentially creating a “real tailwind” for the economy and capital market.

A combination of factors, including uncertainty surrounding Brexit and the devastating impact of the pandemic, pushed UK stocks to “incredibly cheap levels” by the end of 2020, Arnott said, and they remain “remarkably low”.

The country has become an early leader in the implementation of vaccination, with 17.9 million people – about a third of the population – already receiving at least one dose. The government hopes to vaccinate every adult by the end of July. He also set a roadmap outside the blockade, aiming to lift all restrictions by June 21.

The post-Brexit trade agreement, agreed in December, has also eliminated many concerns, although some areas, such as financial services, remain unresolved.

“Worldwide, the value is trading at extremely high growth rates. No matter how we measure valuation, the value reductions for growth are broader than 95% of the history of that country or region – with the exception of Australia, ”said analysts led by Arnott.

“Brexit’s backwinds and rapid COVID vaccination make the UK’s low assessment attractive,” they added.

Read: If you think it’s time to move on to valuable stocks, here are your Wall Street favorites

In January 2016, research affiliates named emerging market value stocks (EMs) as the trade of the decade. Analysts said they still like EM stocks, but that the British capital market, and especially stocks, are now even cheaper.

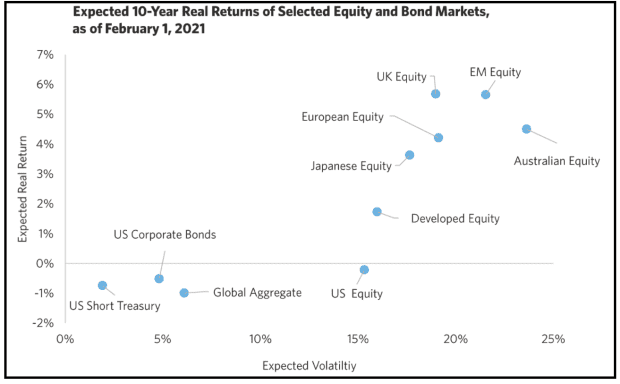

Source: Affiliate research using data from CRSP / Compost and Worldscope / Datastream

“UK stocks are notable for offering one of the most attractive risk-return trade-offs, at prices to return with a higher notch than EM stocks with significantly lower volatility,” said Arnott. “Both UK and EM securities could be the transactions of the decade,” he added.

The UK has one of the highest COVID-19 deaths – 121,305, according to government data – behind only the US, Brazil, Mexico and India. The economic impact of the pandemic on the United Kingdom has also been severe, with most of the country currently in a third stalemate.

Gross domestic product fell by 9.9% last year, the worst annual drop since the “Great Freeze of 1709.” Along with the pandemic, negotiations on a post-Brexit trade deal have surfaced, with a deal finally concluded on Christmas Eve. More generally, Brexit has had an impact on assessments in the UK since the country voted to leave the EU in June 2016, affiliated researchers said.

Corporate revenues in the UK fell by 88% in 2020, much stronger than the 17% drop in the US and the 50% drop in Europe. When it comes to stock market performance, UK stock stocks fell 15% last year, while growth stocks rose 4%, affiliated researchers said, citing Russell data.

The result has been that UK stocks currently trade in the cheapest quintile of their historical norms – based on both the average price-to-book and price-to-five-year cash flow ratio.

Read: Mining stocks have risen in a struggling British market

Instead, Arnott said the US capital market was more expensive than its current valuation, based on the book-price ratio, a sixth of the time in the last 60 years and only 8% of the time based on the price-average ratio of cash flow at five years.

Cheap valuations can mean either buying opportunities or a value trap in which British companies continue to fall, Arnott noted, before concluding in this case that it was the first.

“Neither Brexit nor the COVID-19 pandemic will have an impact as large as in 2026 as in 2020-21. Therefore, the market shocks induced by these events represent opportunities now, “he said.