Aena airports ended 2020 in losses after seven years of increased traffic and profits. The red numbers mark 126.8 million in the year of the pandemic, a figure that contrasts with the 1,442 million earned in 2019. In the critical state of the accounts, the company improves the estimate of losses expected by analysts consulted by Bloomberg of 190 million (average range between 155 and 230 million).

The impact of the health crisis on income was 2,262.9 million. The fall compared to 2019 is 50.2%, to 2,242 million. Ebitda, of 714 million, shows a contraction of 74.2% compared to 2,766 million a year ago. The latter magnitude includes the 22.7 million contributed by London-Luton and the remaining 66.8 million by Aena Brasil after updating the value of concessions in that country, where the balance of contracts in the face of the traffic disaster is sought. The Spanish concession of Murcia airport, in turn, receives a depreciation of 45.3 million.

Despite the impact, Aena’s EBITDA also improves on the 679 million expected by analysts’ consensus.

The company declares 2,065 million in cash, to which it can add 845 million available in its promissory note program.

The 72.4% decrease in passenger traffic in the Spanish airport network, to 76.1 million, led to regulated income from the aeronautical activity to a decrease of 67.1%, marking 986 million. The number of passengers has dropped by up to 99% in the weeks of detention worldwide.

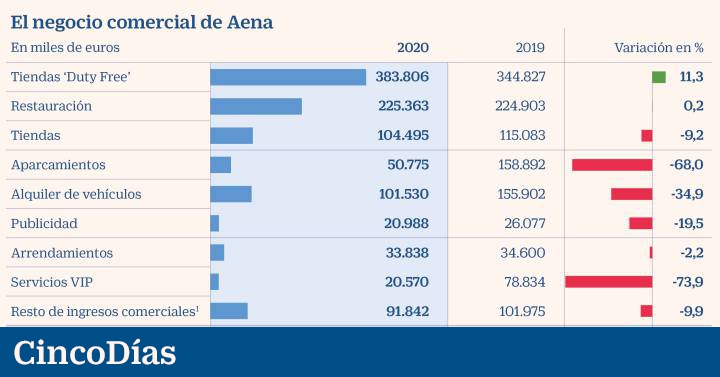

commercial business, based essentially on the rental of space in terminals, decreased by 16.4% of turnover to 1,046 million, but included on December 31 a post of 635 million euros in the concept of guaranteed minimum annual income (RMGA).

The company collects this last accounting record in accordance with the requirements of IFRS 16 (leasing), but acknowledges that it has not collected. Of the 635 million, 198 million come from the first state of alarm (from March 15 to June 20, 2020), for which Aena has proposed a 100% exemption for its RMGA tenants.

Aena declares 2,065 million in cash, to which it can add 845 million available in its promissory note program

In terms of rent collection, Aena maintains a momentum with some of its largest tenants for the amount of rents in the midst of the collapse of the business. The manager of the airport network proposed the aforementioned reduction of 100% in the months of the first state of alarm and of 50% between June 21 and September 8 this year. An offer to which is added the 100% discount for traders affected by the complete closure of the terminals. Aena claimed that, with this aid, it goes beyond what is established in the Royal Decree-Law to support the tourism, hospitality and trade sectors (RDL 35/2020) and that it complements saving measures of around 800 million for its tenants between 2020 and 2021 regarding the minimum rent they should have paid under normal conditions.

So far, the company has revealed this morning that 56.2% of commercial customers, holders of 72 contracts and weighing 13.2% of RMGA, have joined the proposal. However, those with the most weight remain for Aena. Until a few days ago, among those who rejected the bills were Dufry, Areas and SSP. During negotiations to rebalance the concession contracts of traders, restaurateurs, financial institutions and other businesses installed in Spanish terminals, many of them called for a reduction in rent comparable to the decrease in air traffic.

“For illustrative purposes, if this proposal had been accepted by all commercial operators, the pending RMGA amount invoiced in the affected activities would go from the current 620.3 million euros to 179.5 million euros. The impact on cash would take place in 2021. In terms of revenue, the difference between the two amounts (EUR 440.7 million) would be adjusted as a lower linear income from the date of the agreements and for the duration of each of the affected contracts. ” explained Aena in its presentation to CNMV.

Discounts to airlines

In a bid to revive traffic ahead of the summer season, which begins on April 1, the Aena board has approved an extraordinary incentive for airlines based on the recovery of operations until October 31.

The company rewards the percentage of recovery from the minimum thresholds for production in 2019: for the first three months (April, May and June) an initial level of 30% is set and, in the last four months, 45 %% recovery. Flights from these activity recovery percentages compared to the same months in 2019, regardless of the number of passengers, will see the landing rate reduced by the same percentage as that of its reactivation.

Under normal circumstances, this rate is close to 20%, In the tariff burden borne by airlines, but with the lower current load factor of aircraft, this component of the overall tariff has increased its weighting in the costs of any airline. Last year, the Airlines Association (ALA) demanded that the incentive focus on lowering the passenger rate, but Aena maintains a reduction in the landing rate to reactivate operations regardless of the passage.

The new reduction takes place simultaneously with the application of the planned tariff freeze starting in March. Aena has relied on a forecast of 137 million passengers for this year, still affected by flight restrictions. The figure represents an 80% jump compared to 2020 traffic.

The company chaired by Maurici Lucena highlighted this morning the savings of 405 million euros between April and December last year. A reduction resulting from capacity adjustment and other austerity measures, in order to keep cash, while it was decided to keep the workforce at 100%.

The incentives last during the summer season

Aena has already lifted the landing rate reduction mechanism launched in June in October last year. The aid granted to airlines was opened until March 31, 2021 and sought to reduce the cost of additional traffic, from pre-established thresholds, by reducing the landing rate.

In the October supplement, Aena reduced all operations in the same proportion as production recovered from a very low level of 20% compared to flights in the previous winter season (2019/2020).

The pattern is maintained, but the thresholds increase to 30% from April 1 to June 30 and to 45% in July, August, September and October.