The shares of General Electric Co. they made a new dive on Thursday, putting them on the right track to suffer the biggest decline in more than 11 months, while analysts mixed the industrial conglomerate Analyst Day and the GECAS agreement.

GE stock,

fell 8.8% in afternoon trading, the highest in a day since it fell 11.3% on April 1, after falling 5.4% on Wednesday the trading announcement and the analyst event.

Since the stock closed at a three-year high of $ 13.60 on March 8, it has now fallen 14.6% amid a three-day series of losses.

The extended sale of the stock comes after GE announced a $ 30 billion deal to combine its aircraft leasing business (GECAS) with AerCap Holdings NV AER,

and surprisingly proposed a reverse division of the stock 1-for-8. The company also said that what was left of its GE Capital business, with the agreement of GECAS, will be incorporated into GE Industrial and provided updated financial guidance at its Analyst Day event. Read more about GE’s moves on Wednesday.

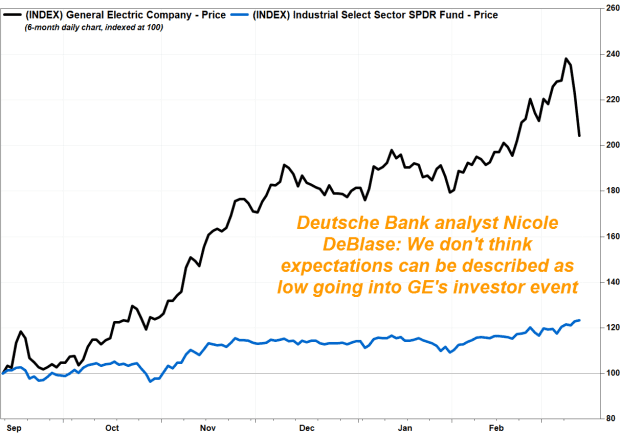

Deutsche Bank analyst Nicole DeBlase raised her stock price target to $ 14 from $ 13 on the back of an improved outlook for free cash flow (FCF) in 2022 and 2023 to match management guidelines. She reiterated the holding rating she had in stock for at least the past two years, citing a lack of increase in her price target.

Although DeBlase “did not find many surprises” in GE’s outlook for this year, she believes that “positioning / expectations were a major component” of the subsequent trading action.

GE has been a long-standing consensus among hedge funds for several months and remains a preferred way to gain exposure to “reopening” trade, given the importance of the aviation business to both [earnings per share] and FCF, ”DeBlase wrote in a note to customers.

After a record 73.4% increase in the fourth quarter, DeBlase said the stock was the best performing of its peer group this year, “so we don’t think expectations can be described as low at the event.”

In addition to the evaluation, she said she heard other “not-so-positive” feedback, including questions about the timing of the GECAS transaction, given that it took place during the cycle, and that the transaction was a way ” tricky ”for scoring GECAS assets.

FactSet, MarketWatch

Oppenheimer analyst Christopher Glynn said the agreement and guidance place GE on a “solid” footing as it improves capital efficiency and meets expectations that a “solid recovery” is underway in aviation.

But Glynn expressed concern about the valuation, as it downgraded GE’s rating after outperforming in November, while eliminating its price target. He said his downgrade is based on valuation, given that the shares exceeded his previous $ 13 price target.

Glynn wrote that “some substantial rotational and cyclical recovery executions” are already “assessed at current levels”, but said that the extended duration of the debt structure and strong liquidity now provide GE with “a background to emerge from the aviation recession in a position of resistance. ”

Meanwhile, JP Morgan bear / skeptic Stephen Tusa reiterated GE’s neutral rating over the past year, but said he still sees a “material disadvantage” to the shares, according to its $ 5 price target, which is 59% below current levels.

Tusa said that while he agrees that a simplified GE following the GECAS agreement is positive, he said the transaction and the financial outlook have just “crystallized” for him the “real bear case” for shares.

As GECAS no longer appears in the picture, Tusa said that there are no more GE Capital assets for Wall Street bulls to claim that there is enough value / capital to support the related debts.

“The bottom line, with the free money from [COVID-19] reserved vaccine transactions, the narrative of GE as a reward gains traction with a V-shape in cash and gains amount to figures that show a sustainably high leverage, well above targets, despite [more than] “70 billion dollars in shares based on the fundamental principles that we would characterize as being mixed with the expectations regarding future revenues that remain too high”, wrote Tusa.

UBS’s Markus Mittermaier was a little more forgiving, though, as he reiterated his buy rating at GE in December 2019 and his $ 15 price target, which means a 24% gain from current levels.

He said that despite the FCF’s short-term “blows”, the simplification following the GECAS agreement is “a clear strategic positive”. He said, for the very near term, that he understands the “negative interpretation” of some of the elements of the transaction and prospects, such as hitting 2021 FCF to further reduce the factoring balance, as well as increasing net debt from GE Capital’s incorporation GE.

That being said, this has not removed the surplus from future factoring, it has further risked the aggregate picture of debt that we believe will make investors increasingly willing to ‘subscribe’ to the new GE that is emerging, which would you have to help multiples, ”Mittermaier wrote. “On balance, we believe [Wednesday] it was an important step in creating a simpler GE, with significantly smaller “old overruns” and improved medium- and long-term strategic option. ”

GE shares have increased by 47.3% in the last 12 months, while the traded fund in the selected industrial sector SPDR XLI,

advanced 46.7% and the S&P 500 SPX index,

rose by 44.0%.