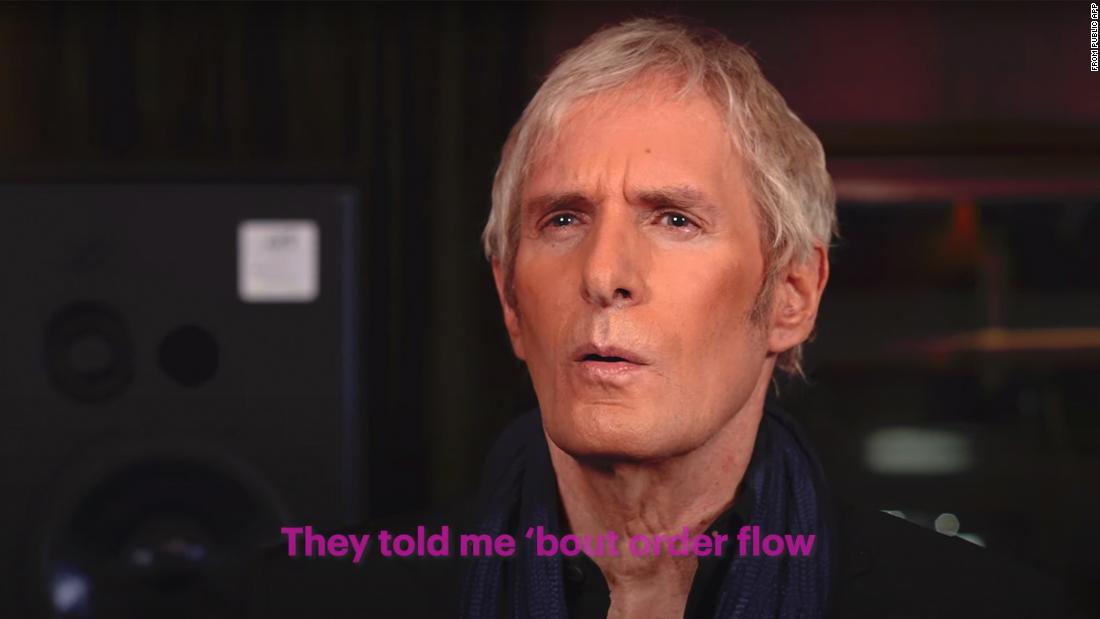

“I couldn’t believe what I saw on Reddit today,” he sang. “I was hoping to get it directly from you. They told me “order flow, so I searched on Google, now I know. I think I need to find someone new. “

Bolton continues, “So tell me all about it. Tell me who you’re selling my trades to.”

Pop culture critics point to the enormous attention paid to the way in which Robinhood and other brokers have adopted business models without commissions. Critics say that trading is not really free and that high-speed trading companies on Wall Street get a better end to the transaction.

During the introduction of his song, Bolton pointed out that Public.com says it does not sell trades to third parties.

“I know a thing or two about breakups. And I’m here to help you,” Bolton said.

Robinhood has consistently defended its use of payment for order flow, which accounts for more than half of the company’s revenue.

In the first half of 2020 alone, Robinhood estimated that its customers received more than $ 1 billion in price improvements – the price they received compared to the best price on a public exchange.

Citadel Securities, the high-speed trading firm to which Robinhood sends much of its orders, similarly defended the practice.

“This is a key reason why retail investors are able to trade free or reduced fees today,” Citadel Securities founder Ken Griffin said at the meeting.