Stock markets have been recovering from the worst week on Wall Street since October 2020, recovering losses caused largely by the retail frenzy – but signs indicate more turbulent days ahead.

Last week, investors in the Reddit group WallStreetBets raised the share prices of short-circuited companies, especially GameStop, forcing hedge funds to cover their shorts by selling large long bets. This, in turn, contributed to a sale that led to a decrease in major indices.

But the retail rush is not over yet. WallStreetBets has a new accent: silver SI00,

The precious metal has now grown by more than 11% months since Friday’s close.

In ours call of the dayIpek Ozkardeskaya, a senior analyst at Swissquote Bank, said the dramatic rise in silver could be more rational than some investors would have expected from an online impulse game. But he also warned that silver weather in the sun could be short-lived.

Along with the challenge, the investment thesis supported by the WallStreetBets crowd is that silver is undervalued because it is widely used in high-tech applications, such as solar panels, which are positioned for long-term growth.

Which add: Miners grow as silver futures reach a maximum of eight years on retail interest

Ozkardeskaya said there is some validity to being optimistic about silver prices. The precious metal is often traded in tandem with gold, which enjoyed a spectacular rally to historic highs last year. The silver was largely left behind.

The gold-silver ratio, which describes the relationship between the prices of the two metals, historically converges close to an average of 60 – which means that the price of gold GOLD,

it is often about 60 times larger than silver.

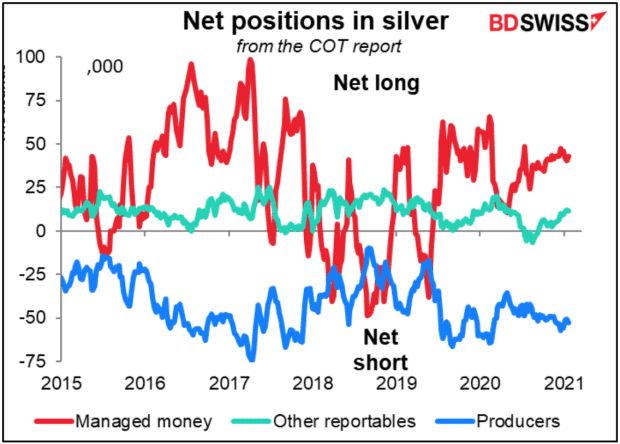

Graphic of the Marshall Gittler the BDSwiss.

Silver is currently trading at just over $ 29 an ounce, but Ozkardeskaya said it “could have consolidated well in the $ 30-32 band,” given that gold prices remained at nearly $ 1,800. per ounce.

“Therefore, the growth of silver does not seem to be widespread yet,” she said.

Read also: After 10 years of poor performance, goods are booming. Here’s how to play the rally.

“So far, it’s not exactly the GameStop anomaly, but it’s an indication that retailers who have just discovered the power of their unit are there, looking for new – and seemingly bigger, targets,” added the Swissquote Bank analyst.

“For silver, the rally could be short-lived,” Ozkardeskaya said, noting that there are divisions between posters on WallStreetBets, with some recommending that you do not bet on the rally. With the brief press on GameStop, there was almost unanimous support for this trade and overwhelming solidarity on the forum.

“One important thing to remember in this game is that if you lose full support and momentum, it’s over,” Ozkardeskaya said. “Speculative rush is a prosperous but dangerous game.”

Buzz

The trading frenzy is expected to continue on the GameStop GME video game retailer,

and other very short-circuited WallStreetBets preferences, such as the AMC AMC movie-theater chain,

BlackBerry BB software group,

and retailer Naked NAKD,

– which all jumped into premarket trading.

The Robinhood trading application imposed buy limits on the shares of all these companies, although otherwise it shortened its list of restricted shares.

Melvin Capital, one of WallStreetBets’ main short-term hedge funds, lost 53% in January. It seems that he has now “massively risked” his portfolio.

On the US economic front, the Markit Manufacturing Purchasing Managers’ Index for January is the first to fall on the pipeline at 9:45 a.m. Eastern, followed by the manufacturing ISM PMI. Construction spending for December and car sales for January are also due.

Exxon Mobil XOM Directors,

and Chevron CVX,

discussed the merger of the two companies last year, The Wall Street Journal reported on Sunday. Shares in both oil supermajors increased by almost 2% in the premarket.

The Australian Prime Minister has suggested that the software giant MSFT Microsoft,

Bing could replace Google search if it leaves the country. Google, owned by Alphabet GOOGL,

has threatened to make its search engine unavailable in Australia because of a proposed law that would make technology companies pay to broadcast news content.

Outside the markets, people are waking up to the news of a coup in Myanmar, where Prime Minister Aung San Suu Kyi and other politicians have been detained. The military has said it will take control of the country for a year.

The markets

It looks like a positive day in the future as markets recalibrate after last week’s frenzy. In the long run, the stock market is YM00 higher,

ES00,

NQ00,

ready for a strong opening, with the Dow future showing more than 200 points after a weak previous week. Asian markets gathered NIK,

HSI,

SHCOMP,

while European markets have marked higher SXXP,

UKX,

DAX,

PX1,

Chart

Graphic of the Marshall Gittler the BDSwiss.

Our chart of the day, from Marshall Gittler to BDSwiss, only shows who has a short circuit – and doesn’t really know who WallStreetBets is targeting. Silver producers are the ones who are short on the futures market, the analyst said, but it is normal for them to be short, because they sell their production ahead to block prices.

Random readings

Empty mole rats have unique dialects and are “incredibly xenophobic,” according to a study.

Research shows that singing in some languages could spread the coronavirus that causes COVID-19 more easily than others.

You need to know to start early and update up to the opening bell, but sign up here to deliver it once in the inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from writers Barron and MarketWatch.